401k Plan Purchase House Key Takeaways You can use 401 k funds to buy a house by either taking a loan from or withdrawing money from the account You can withdraw all your 401 k funds but you will likely have to

Before diving into whether you should use your 401 k to buy a house it s important to have a firm grasp on how a 401 k retirement account works Your 401 k is an earmarked savings account created specifically to help you prepare for retirement 401 k holders can claim a tax deduction and will see their contributions to the account accrue tax free interest over time The 401 k Loan 401 k loans let employees borrow money from their 401 k balances and pay that money back at an interest rate determined by the plan administrator Withdrawals are typically limited to 50 of the account s total value with a 50 000 limit Loans must be repaid within 5 years and until the loan is paid in full buyers

401k Plan Purchase House

401k Plan Purchase House

https://gold-ira-plan.com/wp-content/uploads/2015/10/401k-chalkboard-piggybank.jpg

What Is 401k Plan

https://wealthbooking.com/wp-content/uploads/2021/06/Copy-of-How-to-access-cPanel-in-Namecheap-without-credientials-2-1.jpg

Small Business 401k Plans How To Set Up A 401k Plan And Be Compliant

https://venturehowmediafiles.s3.us-west-2.amazonaws.com/wp-content/uploads/2018/09/02125222/save-2340273_1280-1024x1024.png

Getty A 401 k is an employer sponsored retirement savings plan Commonly offered as part of a job benefits package employees may save a portion of their salary in a 401 k account subject to Key Takeaways You can withdraw funds or borrow from your 401 k to use as a down payment on a home Choosing either route has major drawbacks such as an early withdrawal penalty and losing out

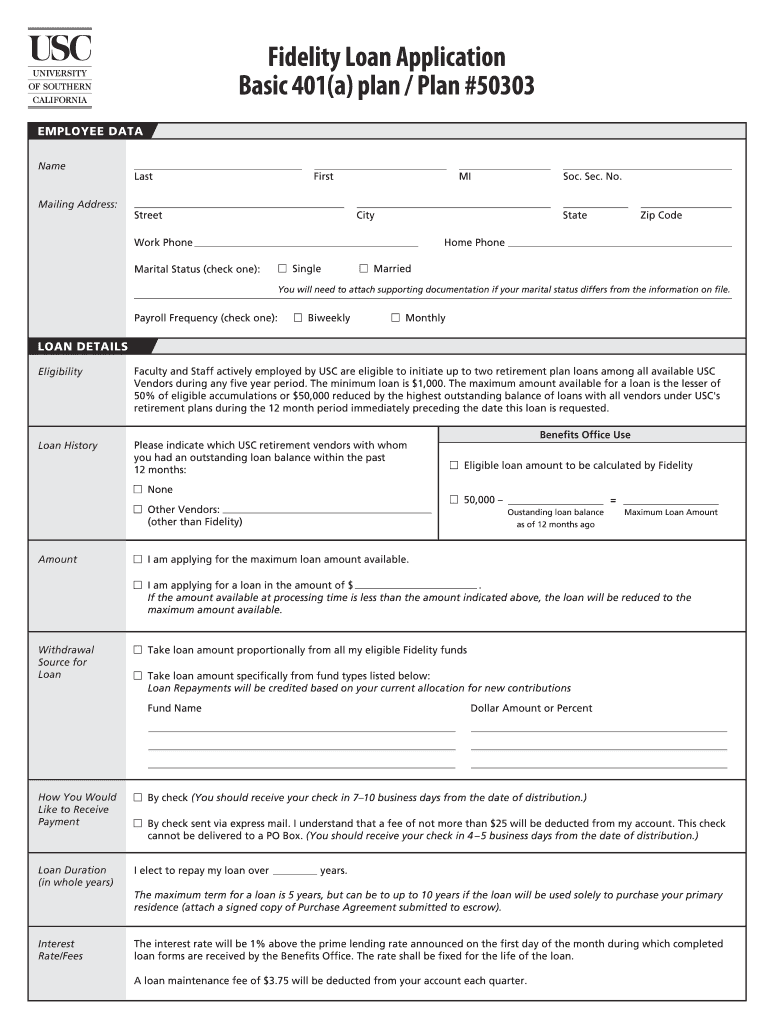

Amounts withdrawn from your 401 k plan and used toward the purchase of your home will be subject to income tax and a 10 early distribution penalty if you re under the age of 59 Even though To borrow from your 401k loan to finance a down payment you ll need to talk to your employer s benefits office or HR department or with your 401k plan provider You can also consult your plan document to find out if your plan permits borrowing from your 401k to purchase a home You ll want to find out how much you re able to borrow

More picture related to 401k Plan Purchase House

What Happens If I Stop Adding To My 401 k Insurance Neighbor

https://www.insuranceneighbor.com/wp-content/uploads/sites/2939/2019/09/401k-Plan.jpg

401k Plan Explained What You Need To Know Inflation Protection

https://i.ytimg.com/vi/yvu40_U0zOY/maxresdefault.jpg

Salesforce 401k Plan Retirement Options

https://www.myretirementpaycheck.org/wp-content/uploads/2023/05/salesforce-401k-plan-1024x576.jpg

Find out how much you can borrow if your plan does The Internal Revenue Service IRS limits 401 k loans of 10 000 or 50 of your vested account balance or 50 000 whichever is less The maximum amount you d be able to borrow is 25 000 assuming you re fully vested if your account balance is 50 000 A 401 k loan must be repaid within Key points You can use your 401 k to buy a home through a loan or withdrawal You can borrow up to 50 of your vested balance or 50 000 whichever is less tax free The more money you take

That initial 30 000 would have compounded into 345 184 56 in your 401 k by the time you retire at 65 assuming no additional contributions were made However if you re 55 and you have 30 000 to invest in a home or 401 k the same conservative 7 compounding interest rate over 10 years doesn t equal nearly as much You d have a Take a 401 k distribution If you are at least 59 5 years old you re at retirement age and can take money out of your 401 k without the 10 fee that applies to early withdrawals The money is considered a distribution rather than a withdrawal but you ll still have to pay income tax on it

Roth 401k Vs 401k Which One Should You Choose Roth 401k 401k Plan

https://i.pinimg.com/originals/ed/0e/02/ed0e026a88cb3edaad943b123c8b9037.jpg

401k Plan financialterms YouTube

https://i.ytimg.com/vi/K7GHQ1H1jwY/maxresdefault.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYDyBlKGUwDw==&rs=AOn4CLBhwTEj3G7AlZ80y3Z5iWuPdBUb1g

https://www.investopedia.com/ask/answers/081815/can-i-take-my-401k-buy-house.asp

Key Takeaways You can use 401 k funds to buy a house by either taking a loan from or withdrawing money from the account You can withdraw all your 401 k funds but you will likely have to

https://www.rocketmortgage.com/learn/use-401k-to-buy-house

Before diving into whether you should use your 401 k to buy a house it s important to have a firm grasp on how a 401 k retirement account works Your 401 k is an earmarked savings account created specifically to help you prepare for retirement 401 k holders can claim a tax deduction and will see their contributions to the account accrue tax free interest over time

What Are The Benefits Of 401 k Plans 724Credit

Roth 401k Vs 401k Which One Should You Choose Roth 401k 401k Plan

9 Ways To Grow Your 401k

The End Of The 401k Plan As We Know It ACM 401K

How Many Investment Options Are In The Typical Large 401k Plan 401K Specialist

Do Not Use Your 401k To Purchase A Home Without Watching This First Inflation Protection

Do Not Use Your 401k To Purchase A Home Without Watching This First Inflation Protection

A 401k Plan Does Not Need To Be Kept When You Retire 401k investing investingtips

Yes Virginia It Still Makes Sense To Save For Retirement Through A 401 k Plan Wealth And

USC Fidelity Loan Application Basic 401 a Plan Plan 50303 Fill And Sign Printable Template

401k Plan Purchase House - To borrow from your 401k loan to finance a down payment you ll need to talk to your employer s benefits office or HR department or with your 401k plan provider You can also consult your plan document to find out if your plan permits borrowing from your 401k to purchase a home You ll want to find out how much you re able to borrow