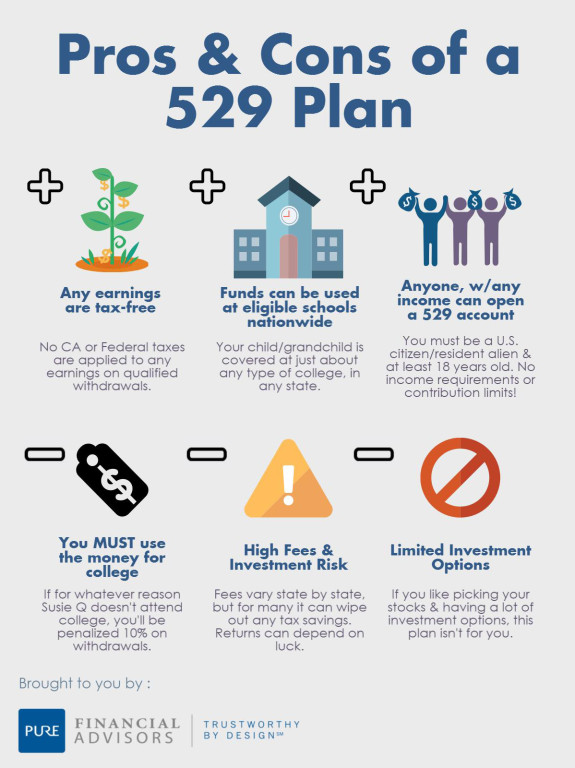

529 College Savings Plan Housing Costs A 529 plan is a powerful tool that parents and family members can use to save for a child s education Contributing to a 529 plan offers tax advantages when the money in the account is used for qualified education expenses However there are many 529 plan rules specifically for 529 qualified expenses

The purpose of a 529 plan is straightforward at first glance to provide families with a tax advantaged account for future education expenses But not all education costs are eligible How A tax advantaged 529 college savings plan can be used to pay for college but not all expenses qualify Withdrawals from 529 plans are called distributions and they must be used

529 College Savings Plan Housing Costs

529 College Savings Plan Housing Costs

https://www.troweprice.com/content/iinvestor/en/products-and-services/college-savings-plans/why-a-529-college-savings-plan/_jcr_content/parsys-main/image.img.jpg/1553580219886.jpg

529 College Savings Plan Tips And Tricks 529 College Savings Plan College Costs Saving For

https://i.pinimg.com/originals/71/ff/e3/71ffe316ea27cb1164cbccee978fcd89.jpg

The Benefits Of and How To Open 529 Plans For College Savings

https://images.angelpub.com/2016/25/38524/529-savings.jpg

Paying for Off Campus Housing with a 529 Plan Your student s room and board could be covered tax free for an entire 12 month lease even if he or she only takes classes for nine months of the 529 savings plans aren t just for college You can spend up to 10 000 from a 529 plan on tuition expenses for elementary middle or high school Year after year you and your child have been saving for college through a 529 savings account Now college is closer and it s time to think about spending the money you ve put aside

According to Sallie Mae s How America Pays for College 2022 report about one third of families used a college savings fund or 529 plan to pay for some of their college costs However 529 plans can only be used for qualified education expenses If you use the money for noneligible expenses such as travel during spring break or a gaming The amount varies by institution and by year For the 2017 2018 school year nationwide the average annual room and board cost for public colleges was 10 000 for private colleges it was 12 000 For more details including a housing cost calculator for 529 plans in your state click here During COVID 19 family members all have busy meeting

More picture related to 529 College Savings Plan Housing Costs

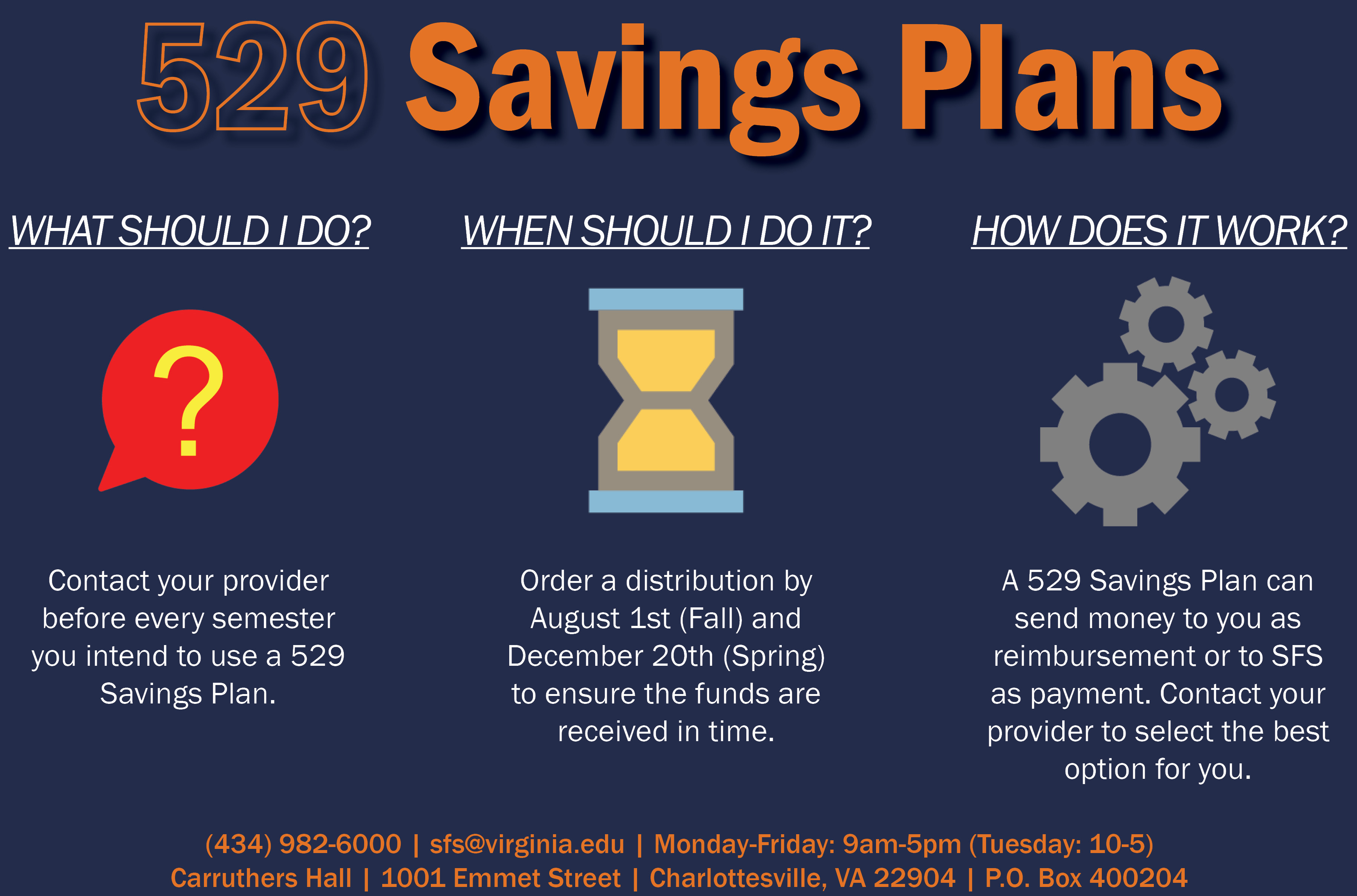

529 College Savings State Prepaid Tuition Programs Student Financial Services

https://sfs.virginia.edu/sites/sfs/files/529 Savings.jpg

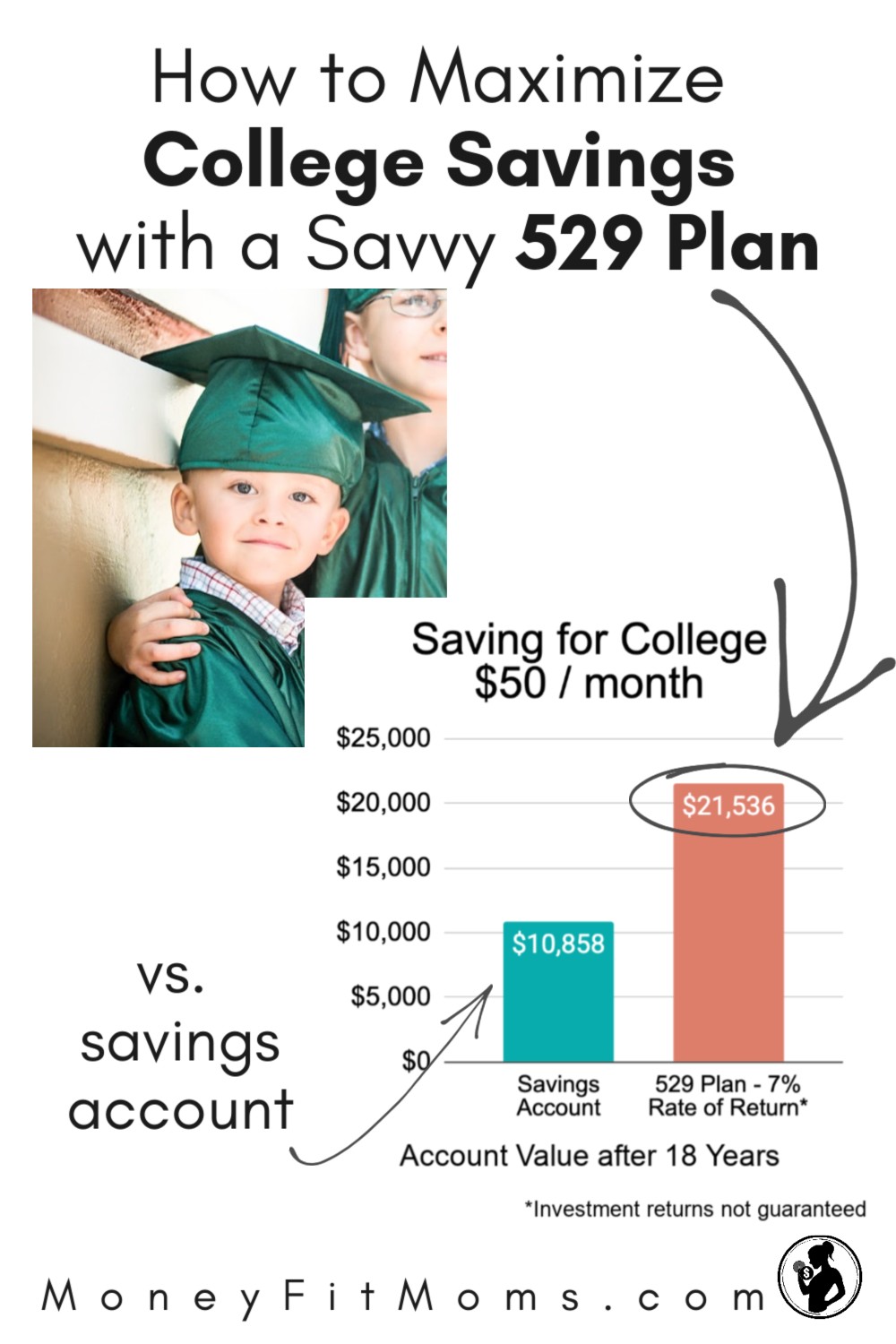

How To Maximize College Savings With A Savvy 529 Plan

https://moneyfitmoms.com/wp-content/uploads/2021/05/529-Plan-Saving-for-College-2.jpg

529 College Savings Plan

https://thedailycpa.com/wp-content/uploads/2017/07/65400464_l.jpg

How a 529 college savings plan works The cost of higher education continues to rise For the 2021 2022 academic year total tuition and fees at public institutions for first time full time A 529 plan is a tax advantaged account that can be used to pay for qualified education costs including college K 12 and apprenticeship programs Starting in 2024 a specified amount of

A 529 plan only covers expenses that are related to education see below for using a 529 plan for elementary education However there are rules Most qualified expenses cannot exceed the cost estimates made by the school that the 529 beneficiary will be attending The short answer is Yes room and board expenses for off campus housing including a parent s home may be reimbursed through a 529 plan but not necessarily the full cost

529 College Savings Plan Unused White Oaks Wealth Advisors

https://www.whiteoakswealth.com/wp-content/uploads/529-Plan.jpg

College Gifting Program 529 Savings Plan Fidelity Saving For College 529 College Savings

https://i.pinimg.com/originals/a1/a8/61/a1a8617c103c3e43980add7f6157945f.png

https://www.savingforcollege.com/article/what-you-can-pay-for-with-a-529-plan

A 529 plan is a powerful tool that parents and family members can use to save for a child s education Contributing to a 529 plan offers tax advantages when the money in the account is used for qualified education expenses However there are many 529 plan rules specifically for 529 qualified expenses

https://www.forbes.com/advisor/student-loans/qualified-expenses-529-plan/

The purpose of a 529 plan is straightforward at first glance to provide families with a tax advantaged account for future education expenses But not all education costs are eligible How

529 College Savings Plan Internal Revenue Code Simplified

529 College Savings Plan Unused White Oaks Wealth Advisors

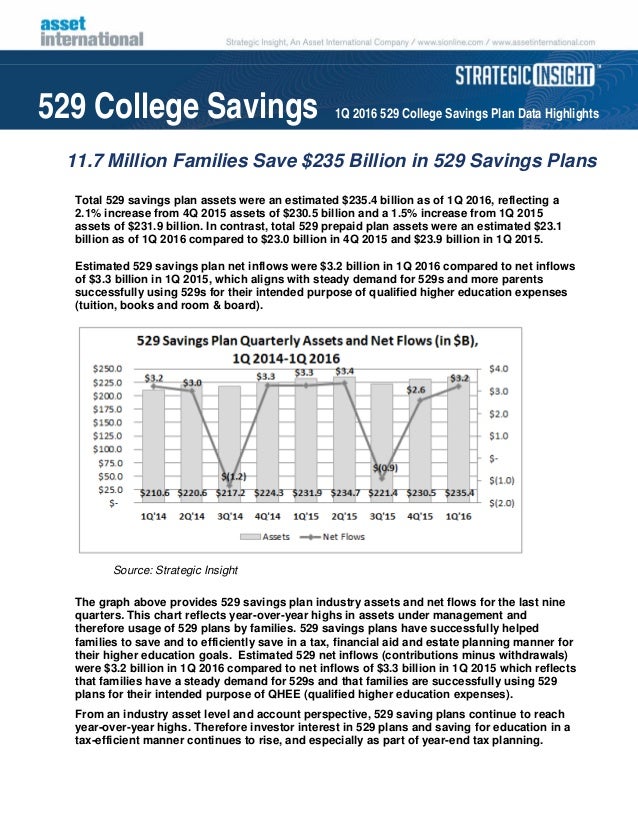

1Q 2016 529 Savings Prepaid Plan Quarterly Highlights

Should You Or Your Parents Open A 529 College Savings Plan Accolade Financial

529 College Savings Plan Fully Explained Beginner s Guide To 529s In 2020 YouTube

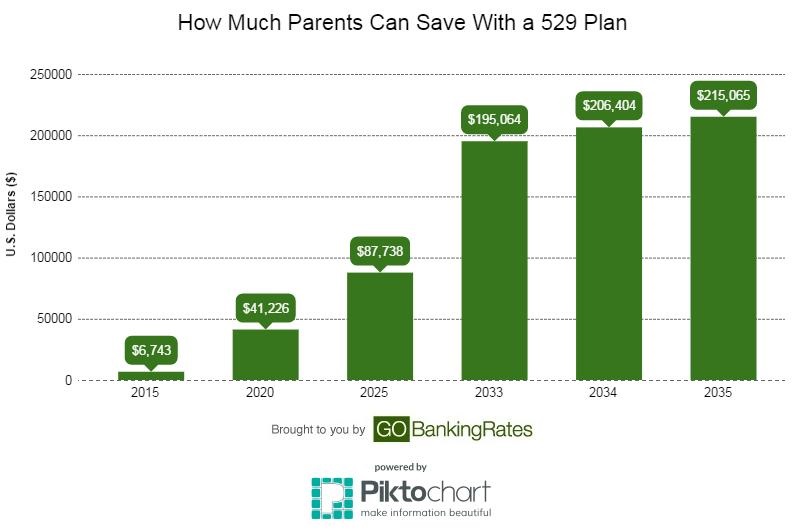

5 Reasons A 529 College Savings Plan Is The Best Baby Shower Gift GOBankingRates

5 Reasons A 529 College Savings Plan Is The Best Baby Shower Gift GOBankingRates

A Financial Aid Counseling And Literacy What Is A 529 Savings Plan

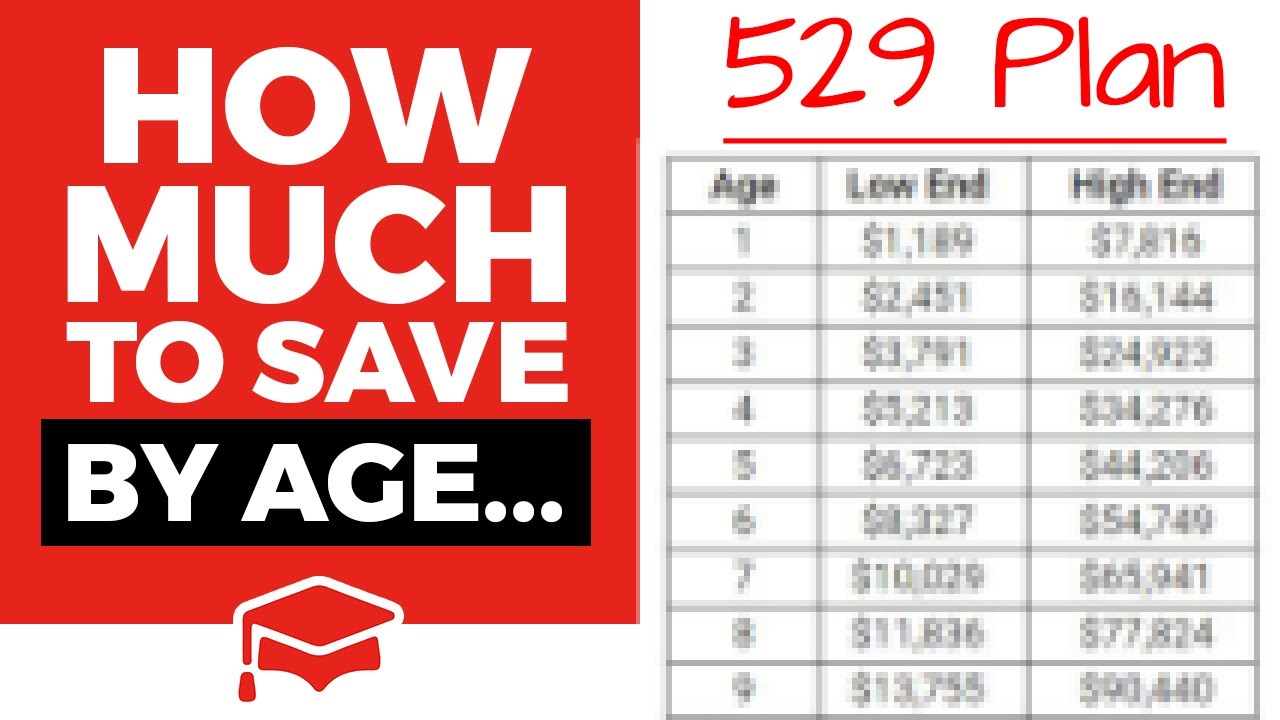

How Much Should You Have Saved In A 529 College Savings Plan By Age YouTube

What You Should Know About The 529 College Savings Plan

529 College Savings Plan Housing Costs - Fact checked by Suzanne Kvilhaug What Is a 529 Plan A 529 plan is a tax advantaged savings plan designed to help pay for education Originally limited to post secondary education