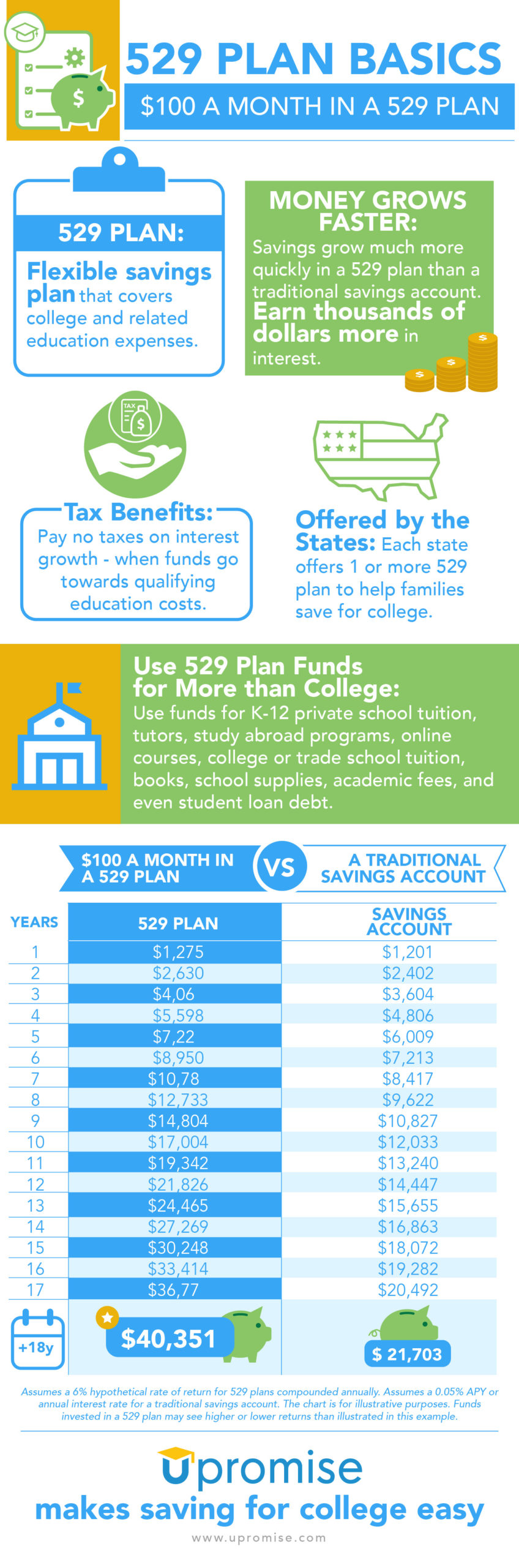

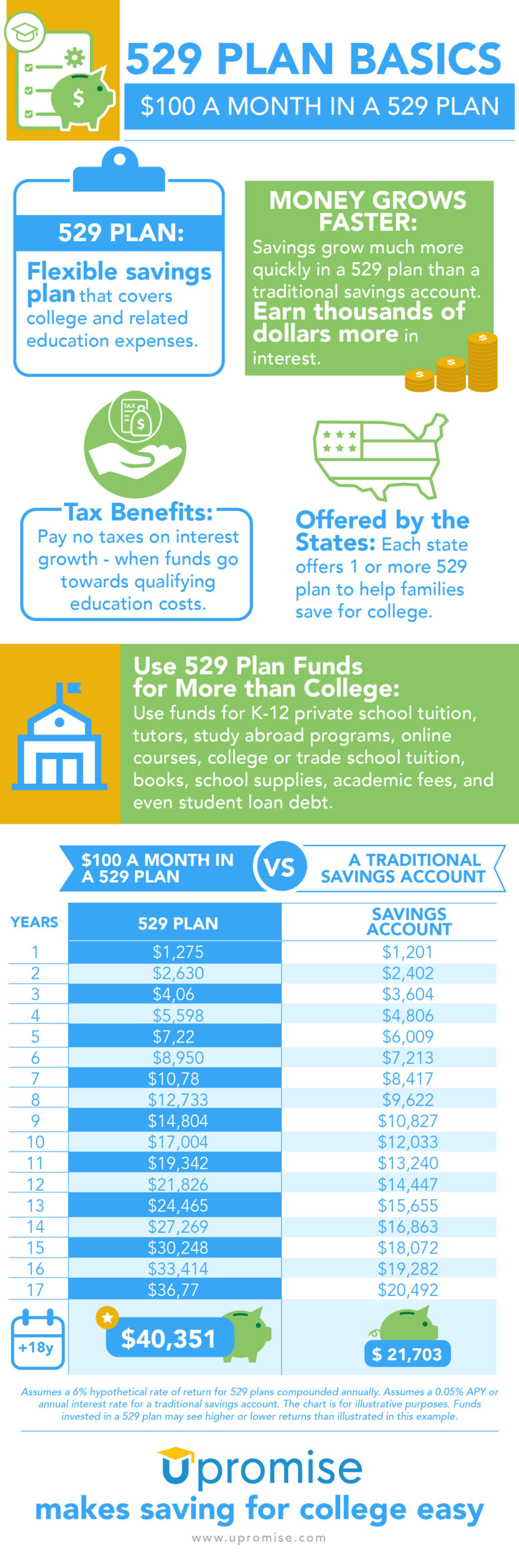

529 Plan Housing Expenses The definition of qualified higher education expenses for 529 plan purposes also includes up to 10 000 per year in tuition for K 12 schools and up to 10 000 in student loan repayments You can use a 529 plan to pay for qualified room and board expenses like rent other housing costs and meal plans This applies to on campus and off

Student Loan Payments Most assume they can only use the money in a 529 to pay for current college related expenses But since the SECURE Act of 2019 you can put up to 10 000 from your 529 529 savings plans aren t just for college You can spend up to 10 000 from a 529 plan on tuition expenses for elementary middle or high school Year after year you and your child have been saving for college through a 529 savings account Now college is closer and it s time to think about spending the money you ve put aside

529 Plan Housing Expenses

529 Plan Housing Expenses

https://www.upromise.com/articles/wp-content/uploads/sites/3/2021/06/529-Plan-Infographic-How-529-Plan-Works-Infographic-Upromise-Rewards-Upromise-makes-saving-for-college-easy-2-scaled.jpg

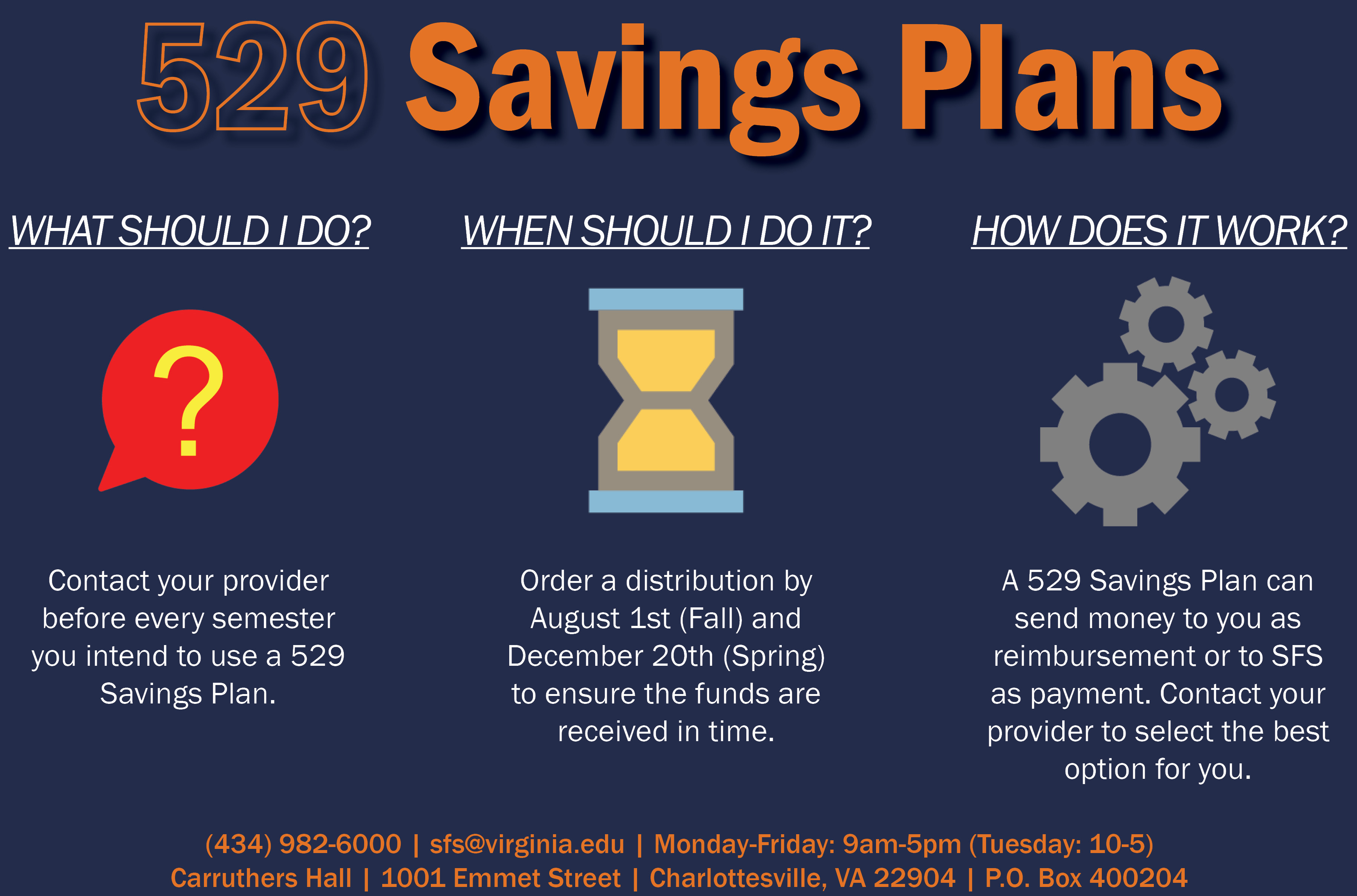

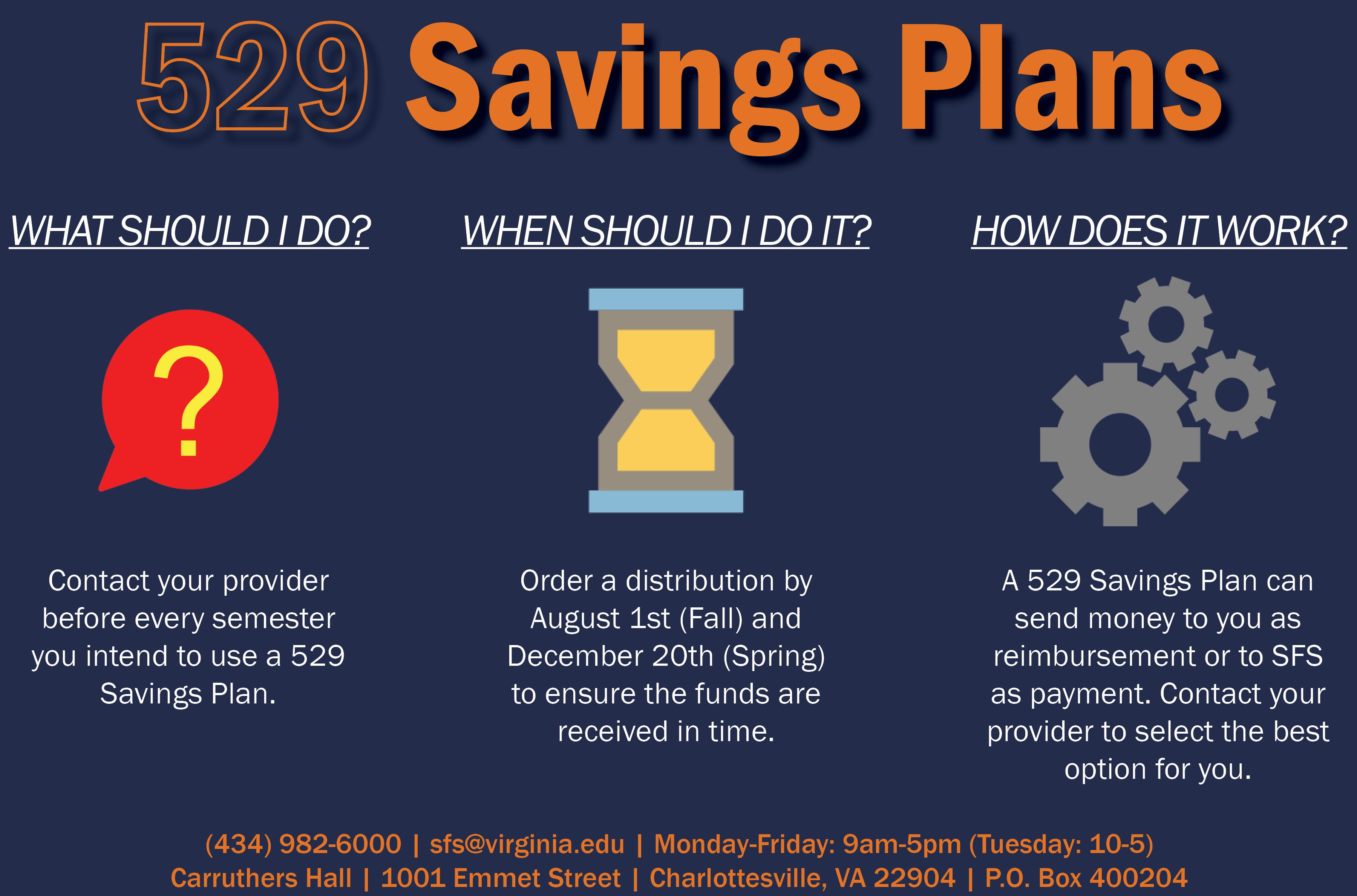

529 College Savings State Prepaid Tuition Programs Student Financial Services

https://sfs.virginia.edu/sites/sfs/files/529 Savings.jpg

Why A 529 College Savings Plan T Rowe Price

https://www.troweprice.com/content/iinvestor/en/products-and-services/college-savings-plans/why-a-529-college-savings-plan/_jcr_content/parsys-main/image.img.jpg/1553580219886.jpg

A 529 plan covers all of the room lodging and housing costs for both vocational and college It does not cover K 12 Sometimes this can be listed as room and board costs when submitting the application for a 529 withdrawal If you use a 529 plan for non qualified expenses you are then subject to all of the tax that would be required Paying for Off Campus Housing with a 529 Plan Your student s room and board could be covered tax free for an entire 12 month lease even if he or she only takes classes for nine months of the

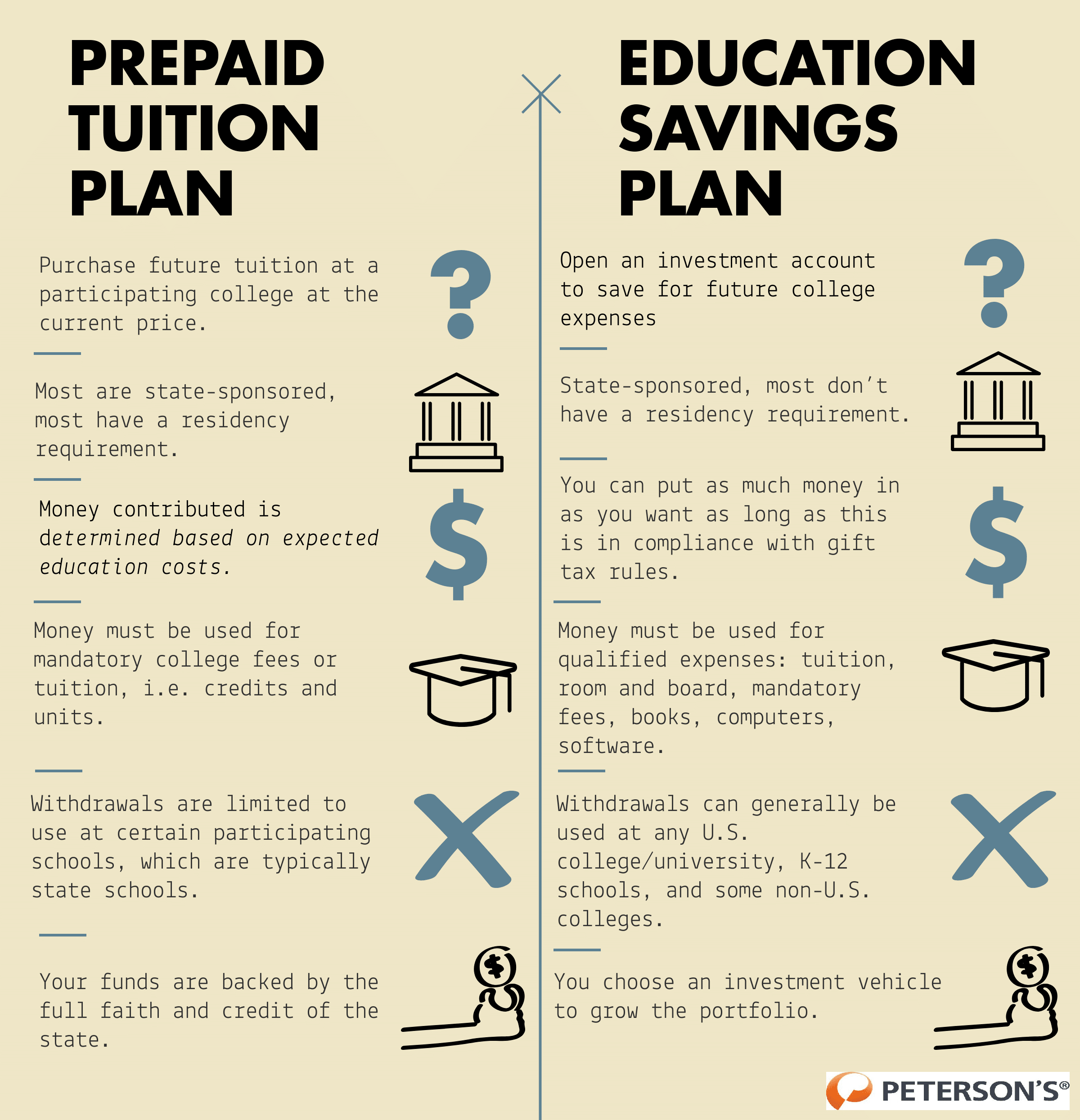

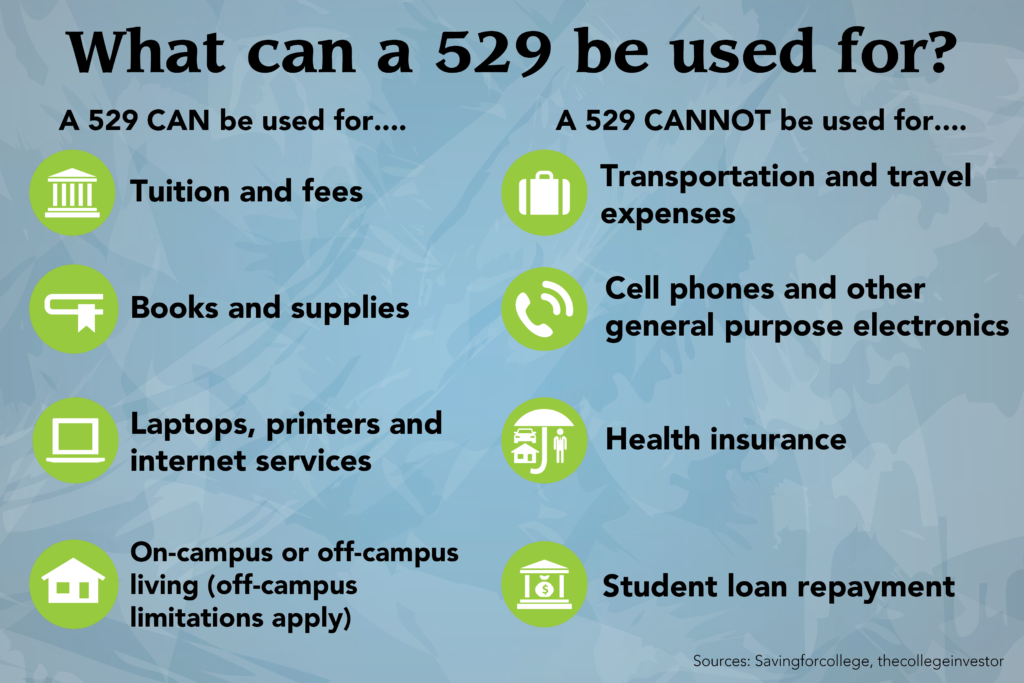

Parents can pay for 529 qualified expenses but not all college costs are covered You can pay for room and board with a 529 housing costs meal plan things like that Lee says Off However 529 plans can only be used for qualified education expenses If you use the money for noneligible expenses such as travel during spring break or a gaming laptop you could incur income taxes and penalties on the withdrawals Learn about 529 qualified expenses to avoid those penalties 529 qualified expenses Non qualified expenses

More picture related to 529 Plan Housing Expenses

529 Plan Comparison Chart

https://wp-media.petersons.com/blog/wp-content/uploads/2018/08/10123950/piktochartlogo.png

529 Plan Benefits You May Not Know About Mercer Advisors

https://www.merceradvisors.com/wp-content/uploads/2021/01/529-Questions_Web.jpg

What You Need To Know About 529 Plans CNBconnect

https://blog.centralnational.com/wp-content/uploads/2019/09/529-Infographic-1024x683.png

Funds from 529 plans can pay for on campus housing but off campus housing may not always be an eligible expense As long as the student is enrolled at least half time the IRS will approve room Qualified expenses for a 529 plan include College graduate or vocational school tuition and fees Off campus housing Campus food and meal plans Computers internet and software used for

The short answer is Yes room and board expenses for off campus housing including a parent s home may be reimbursed through a 529 plan but not necessarily the full cost The reimbursable amount depends largely on the maximum amount the college permits for off campus living costs based on its published cost of attendance COA used 529 plans cover more than just tuition Qualified education expenses include tuition mandatory fees computers books supplies and room and board must be enrolled half time or more Off campus housing also counts as a qualified expense You can use your 529 plan to cover rent utilities and grocery bills up to the college s allowance for

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg)

529 Plan Contribution Limits In 2023

https://www.investopedia.com/thmb/GepQiraogYwUTtMhxzD48_BlGPk=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg

Why A 529 Savings Plan Is The Best Way To Save For College

https://www.moneypeach.com/wp-content/uploads/2020/03/529-Plan-Pinterest.png

https://www.savingforcollege.com/article/what-you-can-pay-for-with-a-529-plan

The definition of qualified higher education expenses for 529 plan purposes also includes up to 10 000 per year in tuition for K 12 schools and up to 10 000 in student loan repayments You can use a 529 plan to pay for qualified room and board expenses like rent other housing costs and meal plans This applies to on campus and off

https://www.forbes.com/advisor/student-loans/qualified-expenses-529-plan/

Student Loan Payments Most assume they can only use the money in a 529 to pay for current college related expenses But since the SECURE Act of 2019 you can put up to 10 000 from your 529

Understanding 529 Plan Qualified Expenses For Off Campus Housing House Plans

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg)

529 Plan Contribution Limits In 2023

The Complete Guide To Virginia 529 Plans For 2024

529 Plan Rules And Uses Of 529 Plan Advantages And Disadvantages

529 College Savings Plan Unused White Oaks Wealth Advisors

Tax Smart 529 Education Savings Plans Eco Tax Inc

Tax Smart 529 Education Savings Plans Eco Tax Inc

The 529 Savings Plan The New Dispatch

Backer Review Making Your 529 Plan Accessible 529 College Savings Plan Saving For College

The Basics Of A 529 Plan Blog Student Loan Management 529 Plan How To Plan Saving For

529 Plan Housing Expenses - Parents can pay for 529 qualified expenses but not all college costs are covered You can pay for room and board with a 529 housing costs meal plan things like that Lee says Off