529 Plan Rental House College Features Using 529 Plan Funds to Pay Rent Even if your child lives off campus at college he can cover room and board costs with money from a 529 plan By Kimberly Lankford published

A 529 plan does include off campus rent as long as you re going to college half time for that semester but it only includes rent and utilities up to the amount specified by the college as a room and board allowance July 27 2023 Room and board costs make up a large portion of a student s total college bill second only to tuition You can use a 529 plan to pay for room and board but only if certain requirements are met Room and board include the cost of housing and the cost of a meal plan

529 Plan Rental House

529 Plan Rental House

https://access-wealth.com/wp-content/uploads/2020/05/529-m.jpeg

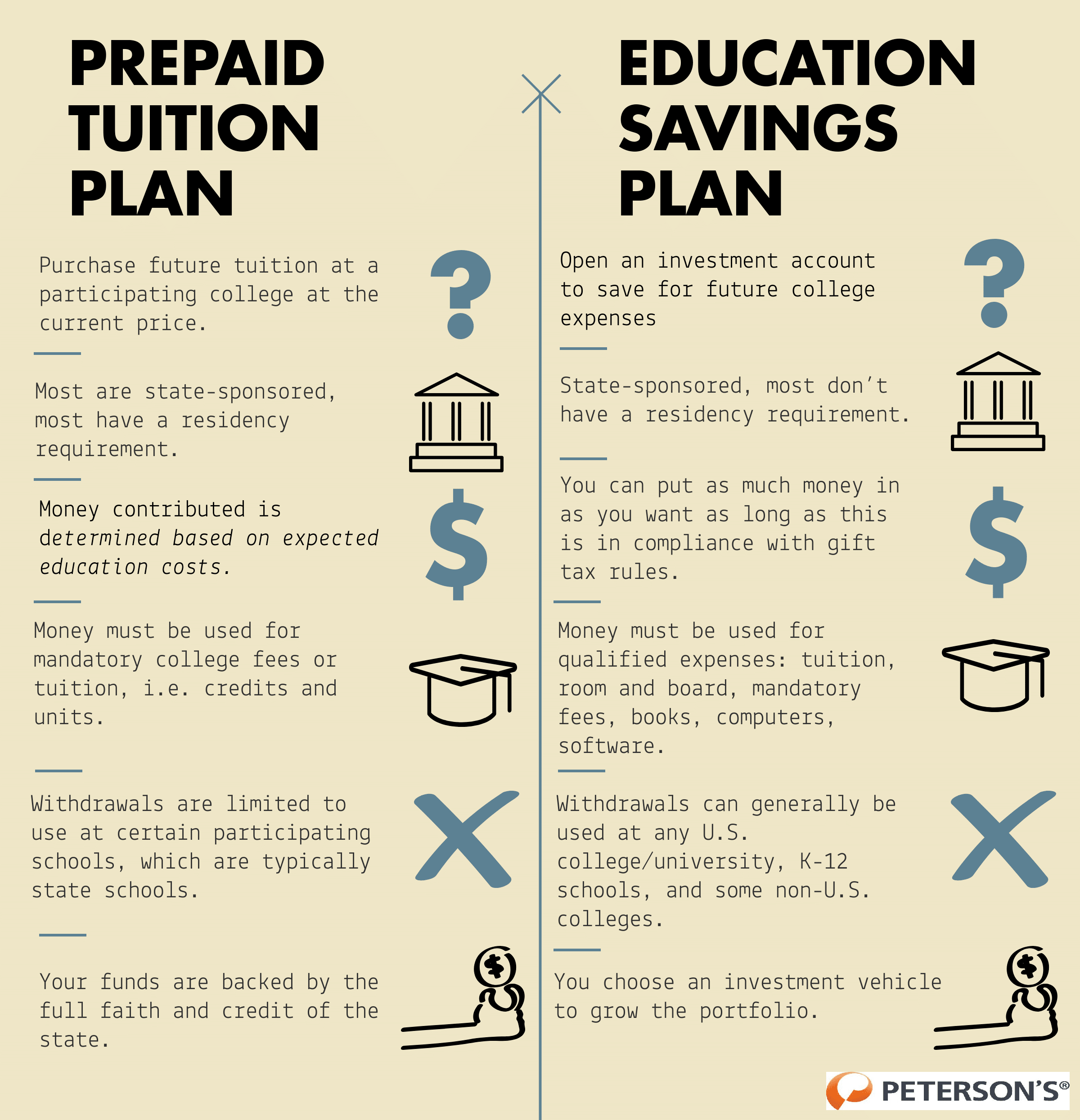

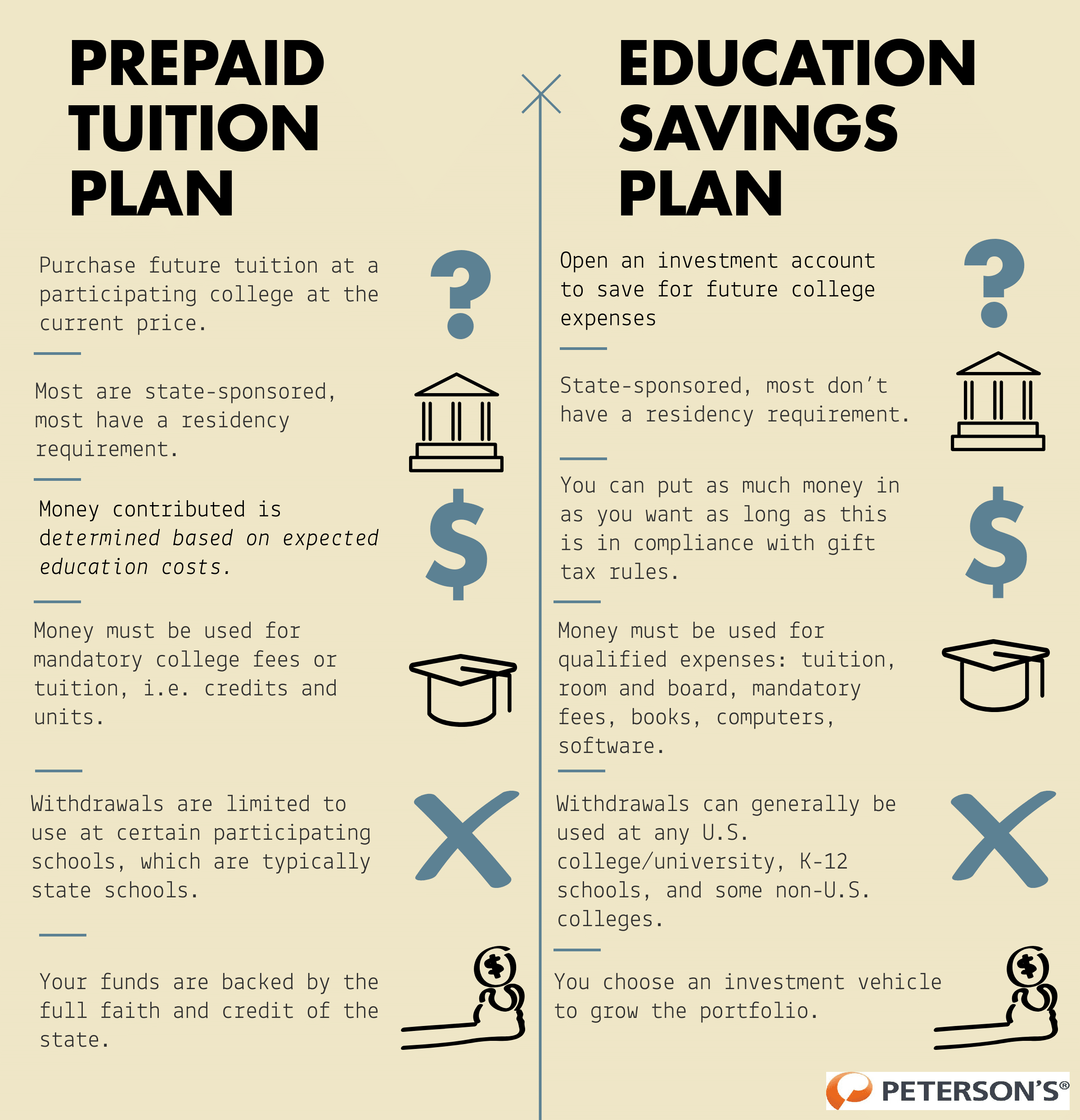

529 Plan Comparison Chart

https://wp-media.petersons.com/blog/wp-content/uploads/2018/08/10123950/piktochartlogo.png

Can 529 Be Used For Rent A Student s Guide ApartmentGuide

https://www.apartmentguide.com/blog/wp-content/uploads/2021/10/what-is-a-529.jpg

Paying for Off Campus Housing with a 529 Plan Your student s room and board could be covered tax free for an entire 12 month lease even if he or she only takes classes for nine months of the This is necessary not just to use the student s 529 plan money to pay the rent but also for the parent to deduct rental expenses from the rental income There are complicated tax rules that apply when the taxpayer rents property to relatives

The qualified amount is limited to the greater of either A the school determined allowance for room and board based on the student s living arrangement or B the actual amount charged if the student is residing in housing owned or operated by the school joe naf 2018 02 27 22 36 01 UTC Yes purchase a rental home and then charge your child rent Rent is a qualifying tax free expense under a 529 plan Thus you can take tax free withdrawals from the plan and use these funds to pay your child s monthly housing expense If you were to

More picture related to 529 Plan Rental House

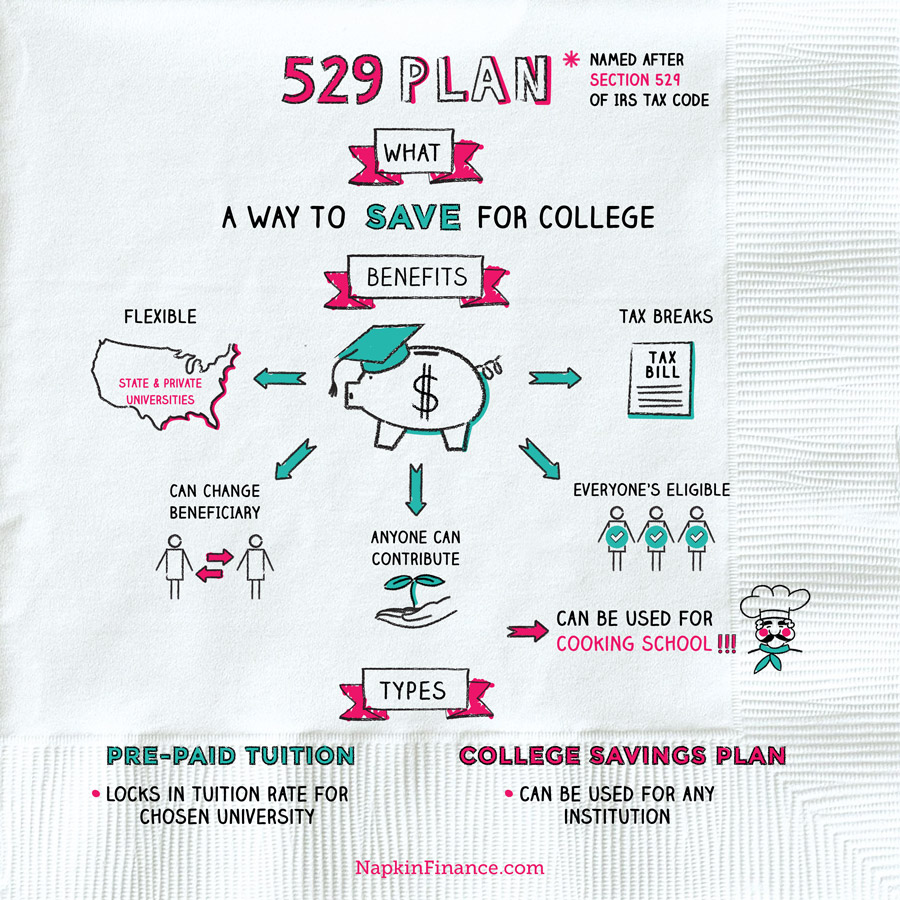

529 Plan Napkin Finance

https://napkinfinance.com/wp-content/uploads/2018/07/529Plan-Napkin-v02.jpg

What Is A 529 Plan And What You Need To Know About It Westface College Planning

https://westfacecollegeplanning.com/wp-content/uploads/65400391_l-2048x1365.jpg

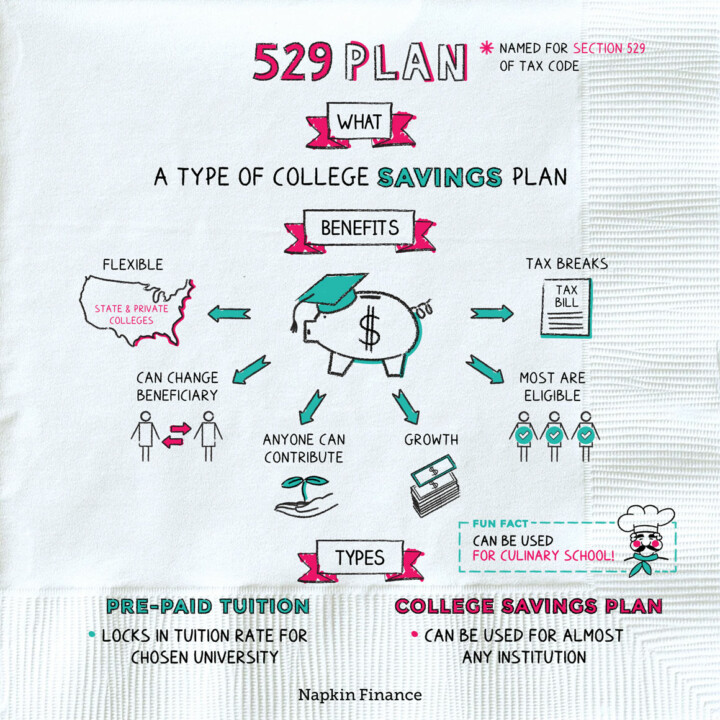

What Is A 529 Plan Napkin Finance

https://napkinfinance.com/wp-content/uploads/2018/07/NapkinFinance-529Plan-Napkin-02-26-19-v05-1-720x720.jpg

A 529 plan is a powerful tool that parents and family members can use to save for a child s education Contributing to a 529 plan offers tax advantages when the money in the account is used for qualified education expenses However there are many 529 plan rules specifically for 529 qualified expenses 529 Plan Qualified Expenses Using the 529 to Pay Off Campus Rent A 529 Plan is an ideal way to save for higher education costs But can you use funds from your 529 plan to pay your off campus rent We tapped into an advisor from the accounting firm of Baker Tilly for some guidance on 529 plan qualified expenses

A 529 plan is a tax advantaged account that can be used to pay for qualified education costs including college K 12 and apprenticeship programs Starting in 2024 a specified amount of There is however a lifetime limit of 10 000 in student loan payments that can be made penalty free with 529 funds The SECURE Act s expansion of qualified expenses to include student loans has

529 Plans A Simple Honest Guide All Questions Answered

https://freedomsprout.com/wp-content/uploads/2019/02/529-plan-total-investment.jpg

Are You Taking Full Advantage Of Your 529 Plan

https://static.wixstatic.com/media/265f73_a239e6d04de64ed8a7d9c71461a7a7d3~mv2.png/v1/fill/w_1000,h_669,al_c,usm_0.66_1.00_0.01/265f73_a239e6d04de64ed8a7d9c71461a7a7d3~mv2.png

https://www.kiplinger.com/article/college/t002-c001-s001-using-529-plan-funds-to-pay-rent.html

College Features Using 529 Plan Funds to Pay Rent Even if your child lives off campus at college he can cover room and board costs with money from a 529 plan By Kimberly Lankford published

https://www.forrent.com/blog/off-campus-living/529-plan-for-off-campus-housing/

A 529 plan does include off campus rent as long as you re going to college half time for that semester but it only includes rent and utilities up to the amount specified by the college as a room and board allowance

The Basics Of A 529 Plan Blog Student Loan Management 529 Plan How To Plan Saving For

529 Plans A Simple Honest Guide All Questions Answered

All About 529 Plans Infographic Presentational ly

529 Plans 29 Thoughts For 5 29 Lazy Man And Money

Pennsylvania 529 Plan Review

Best 529 Plans College Savings Plans For Kids RealWealth

Best 529 Plans College Savings Plans For Kids RealWealth

The 529 Savings Plan The New Dispatch

Backer Review Making Your 529 Plan Accessible 529 College Savings Plan Saving For College

529 Plan Millennial Boss

529 Plan Rental House - This is necessary not just to use the student s 529 plan money to pay the rent but also for the parent to deduct rental expenses from the rental income There are complicated tax rules that apply when the taxpayer rents property to relatives