529 Plan Rules Housing 4

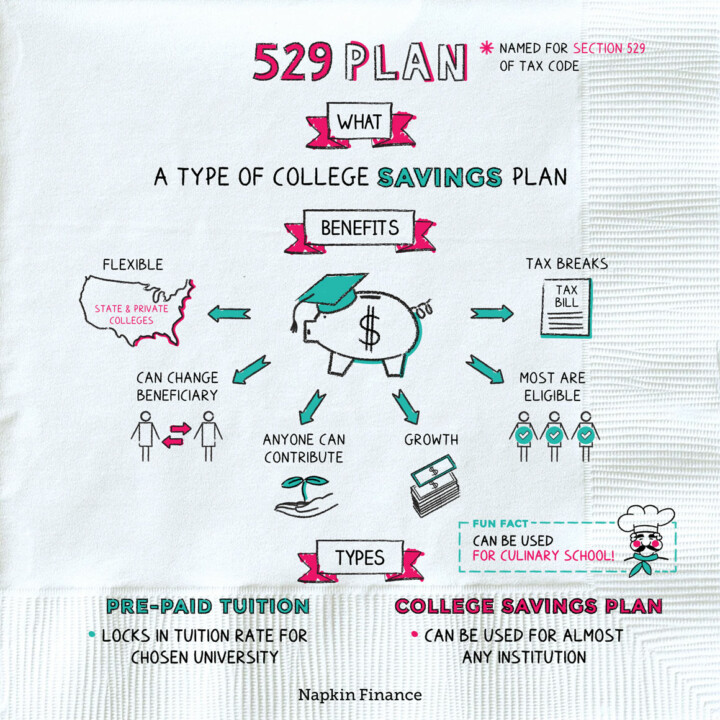

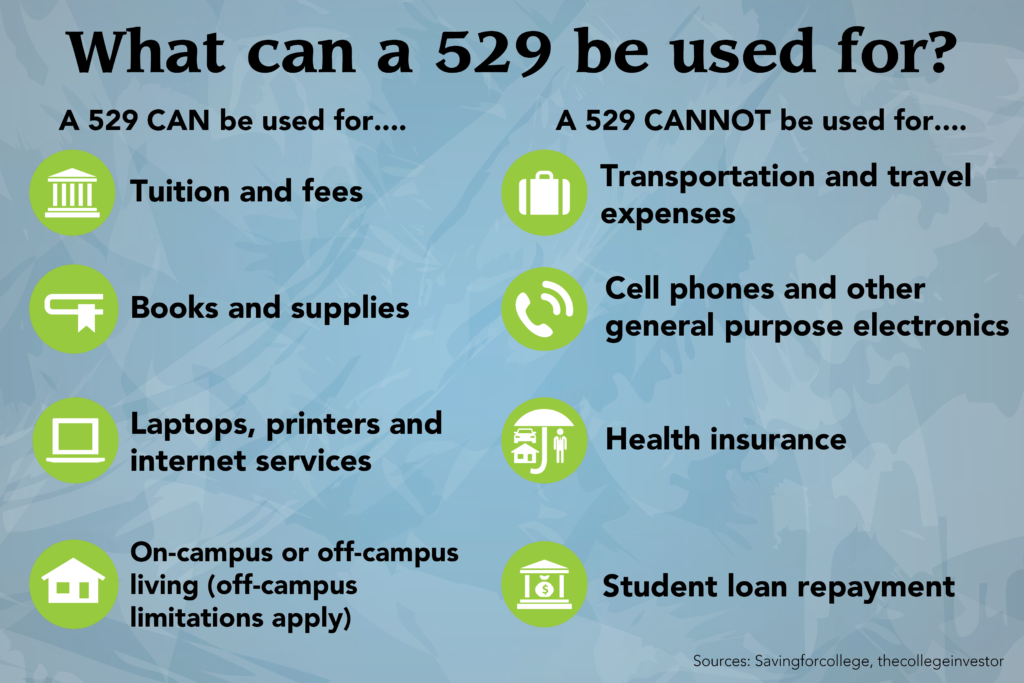

Paying for Off Campus Housing with a 529 Plan Your student s room and board could be covered tax free for an entire 12 month lease even if he or she only takes classes for nine months of the July 27 2023 A 529 plan is a powerful tool that parents and family members can use to save for a child s education Contributing to a 529 plan offers tax advantages when the money in the account is used for qualified education expenses However there are many 529 plan rules specifically for 529 qualified expenses

529 Plan Rules Housing

529 Plan Rules Housing

https://napkinfinance.com/wp-content/uploads/2018/07/NapkinFinance-529Plan-Napkin-02-26-19-v05-1-720x720.jpg

infographic The History Of The 529 Plan How To Plan 529 Plan Saving For College

https://i.pinimg.com/736x/48/c3/9e/48c39e6caefa7acd90e02a9649b9fa51---plan-college-savings.jpg

529 College Savings Plan Tips And Tricks 529 College Savings Plan College Costs Saving For

https://i.pinimg.com/originals/71/ff/e3/71ffe316ea27cb1164cbccee978fcd89.jpg

A Student s Guide A 529 plan can help parents and students save for future education expenses 529 plans can be used for rent but there are restrictions to how much students can spend There are many tax benefits and advantages to opening a 529 plan Alex Heinz October 18 2021 5 Minute Read Share 529 Plan Rules and Contribution Limits 529 plans provide tax free investment growth and withdrawals for qualified education expenses By Arielle O Shea Updated Aug 21 2023 Edited by

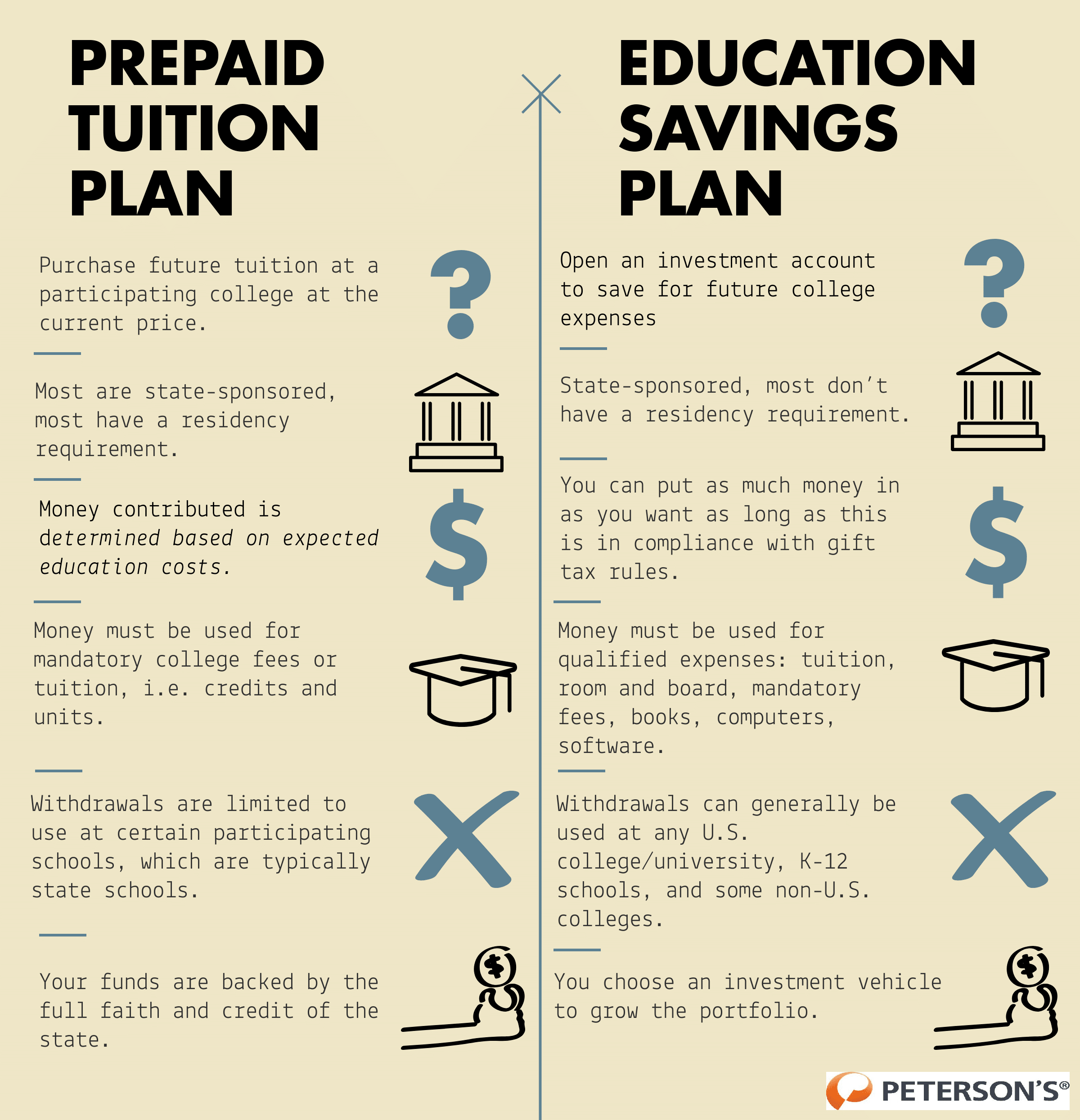

529 savings plans aren t just for college You can spend up to 10 000 from a 529 plan on tuition expenses for elementary middle or high school Year after year you and your child have been saving for college through a 529 savings account Now college is closer and it s time to think about spending the money you ve put aside Suzanne Kvilhaug What Is a 529 Plan A 529 plan is a tax advantaged savings plan designed to help pay for education Originally limited to post secondary education costs it was expanded

More picture related to 529 Plan Rules Housing

May 29 Is 529 Plan Day Access Wealth

https://access-wealth.com/wp-content/uploads/2020/05/529-m.jpeg

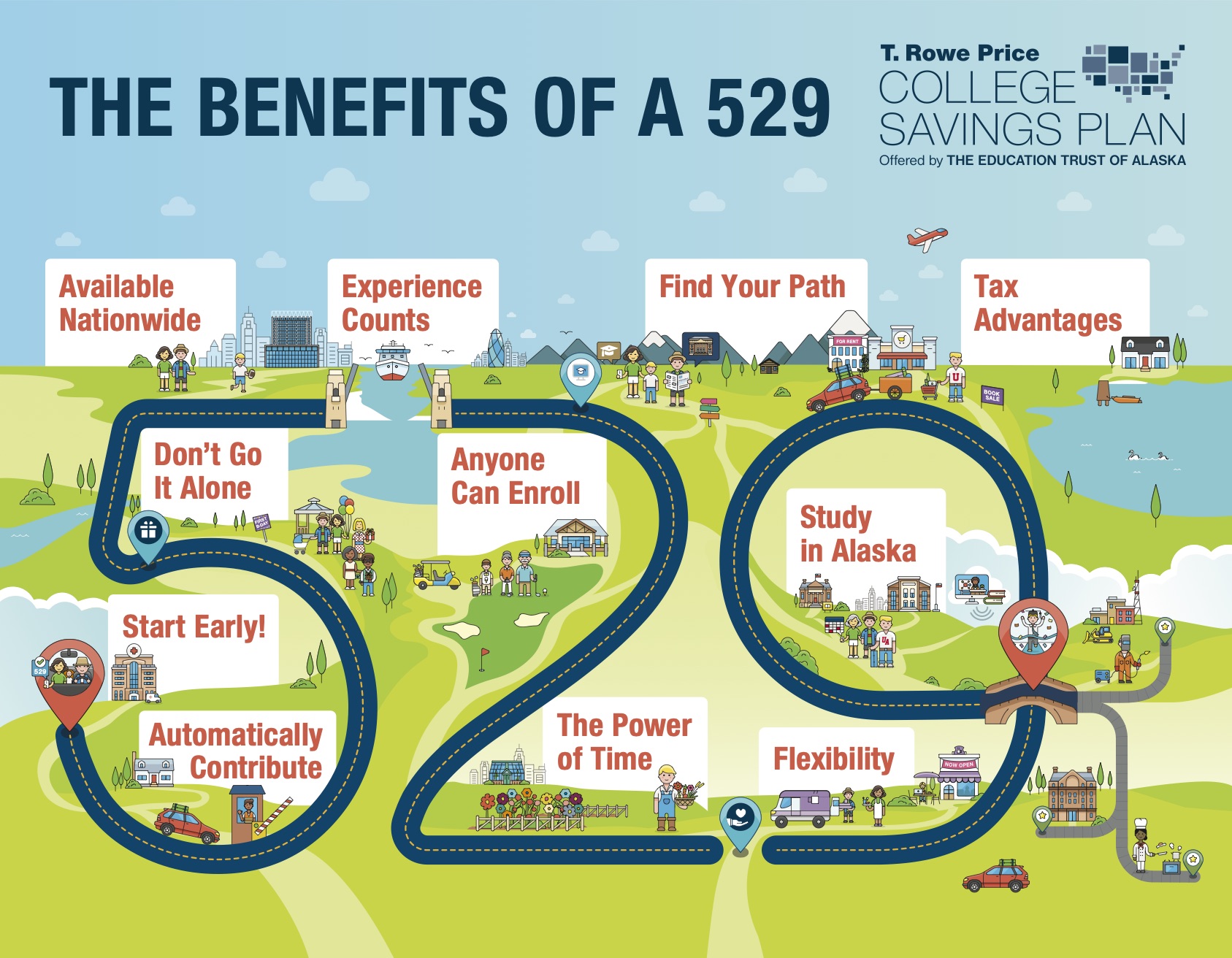

The Benefits Of A 529 Plan INFOGRAPHIC

https://web-resources.savingforcollege.com/images/sponsored-articles/the-benefits-of-a-529-infographic-thumbnail.jpg

529 Plan Comparison Chart

https://wp-media.petersons.com/blog/wp-content/uploads/2018/08/10123950/piktochartlogo.png

Investment returns are not guaranteed and you could lose money by investing in the Direct Plan For more information about New York s 529 College Savings Program Direct Plan download a Disclosure Booklet and Tuition Savings Agreement or request one by calling 877 NYSAVES 877 697 2837 This document includes investment objectives risks charges expenses and other information While it s clear that money from 529s can be used to cover college education expenses like tuition if the student attends a participating college it can be hard to figure out if the IRS will

The American Opportunity Credit is worth up to 2 500 for each of the first four years of college and is based on 100 of the first 2 000 spent on qualified education expenses tuition and fees 2 You can reimburse exactly the COA allowance regardless of your expenses In other words you can be reimbursed for room and board expenses you actually spent but you can t be reimbursed for more than the room and board allowance regardless of your expenses

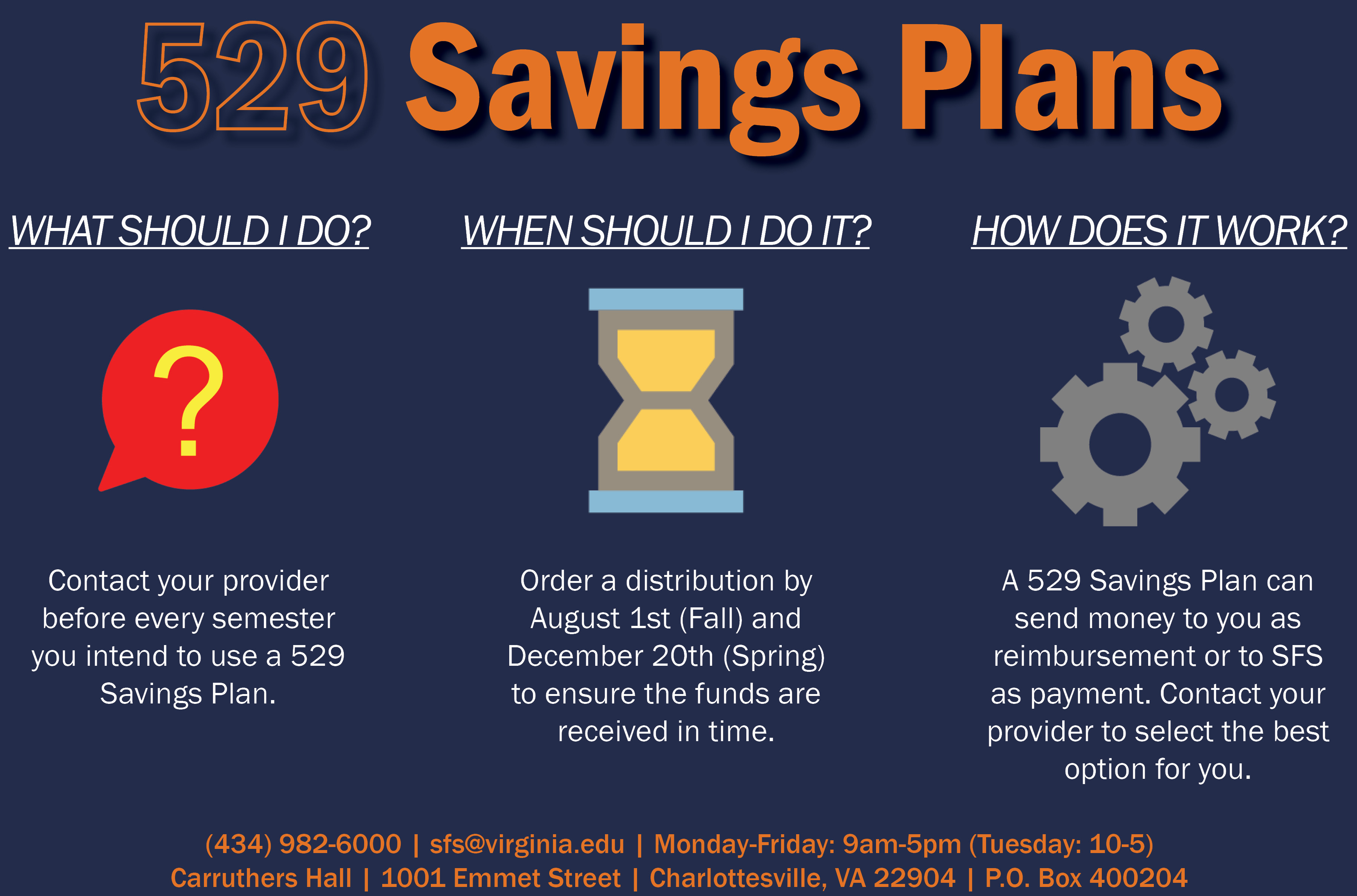

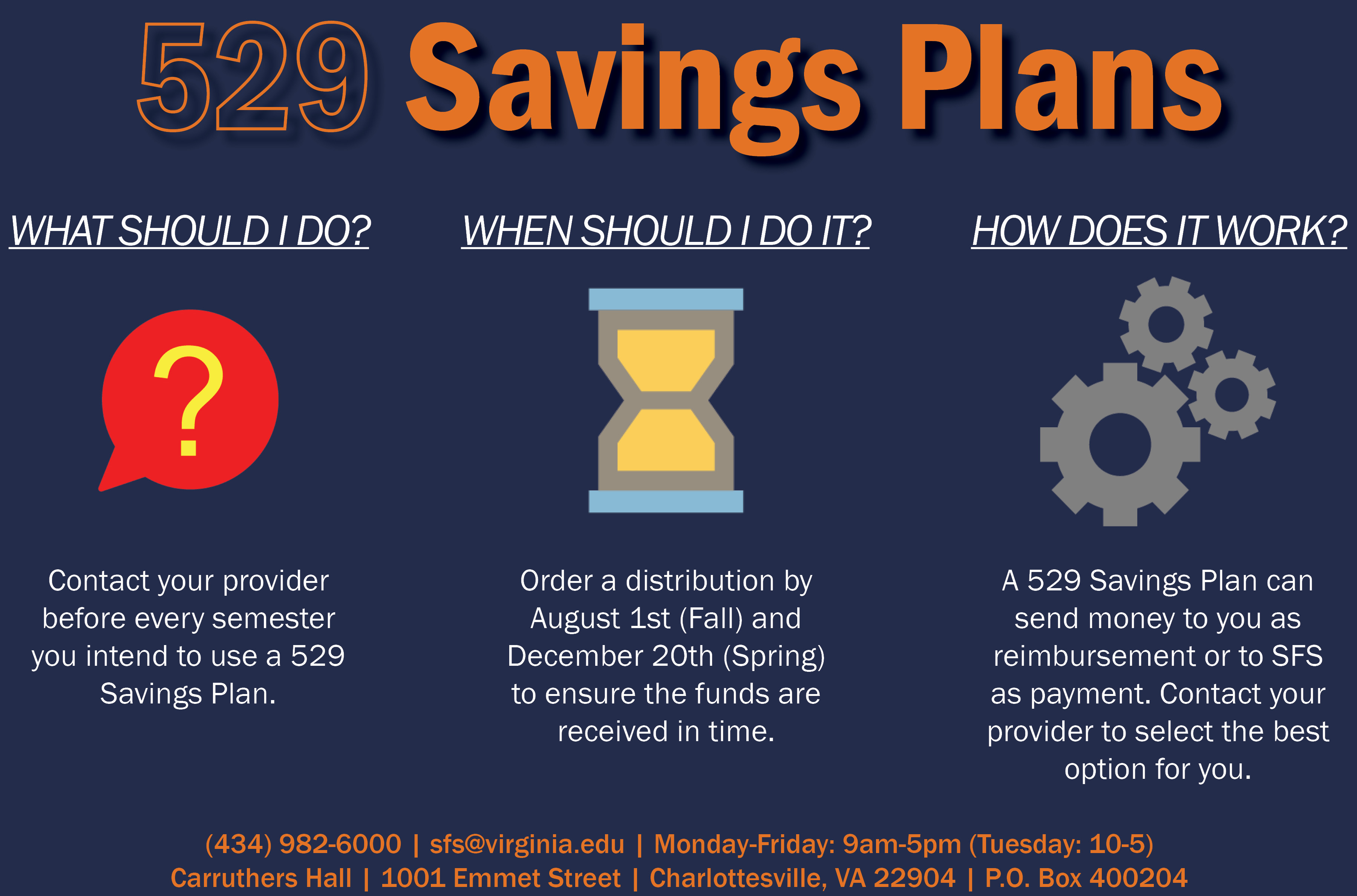

529 College Savings State Prepaid Tuition Programs Student Financial Services

https://sfs.virginia.edu/sites/sfs/files/529 Savings.jpg

What You Need To Know About 529 Plans CNBconnect

https://blog.centralnational.com/wp-content/uploads/2019/09/529-Infographic-1024x683.png

https://www.forbes.com/advisor/student-loans/529-plan-withdrawal-rules/

4

https://www.kiplinger.com/article/college/t002-c001-s001-paying-for-off-campus-housing-with-a-529-plan.html

Paying for Off Campus Housing with a 529 Plan Your student s room and board could be covered tax free for an entire 12 month lease even if he or she only takes classes for nine months of the

529 Plan Rules And Uses Of 529 Plan Advantages And Disadvantages

529 College Savings State Prepaid Tuition Programs Student Financial Services

Understanding 529 Plans Infographic

529 Plan Rules Good Life Wealth Management

Significant Changes In 529 Plan Rules May Benefit Families Acumen Wealth Advisors

If 529 Plans Get Taxed Here s Another Tax free Option

If 529 Plans Get Taxed Here s Another Tax free Option

Back To School Understanding 529 Plan Changes And Power Of Attorney Documents Mission Wealth

Avoid 529 Withdraw Penalties In 2021 How To Plan 529 Plan College Expenses

Topiclocal An Overview On Top Rated 529 Plans

529 Plan Rules Housing - A Student s Guide A 529 plan can help parents and students save for future education expenses 529 plans can be used for rent but there are restrictions to how much students can spend There are many tax benefits and advantages to opening a 529 plan Alex Heinz October 18 2021 5 Minute Read Share