529 Plan Student Housing Paying for Off Campus Housing with a 529 Plan Your student s room and board could be covered tax free for an entire 12 month lease even if he or she only takes classes for nine months of

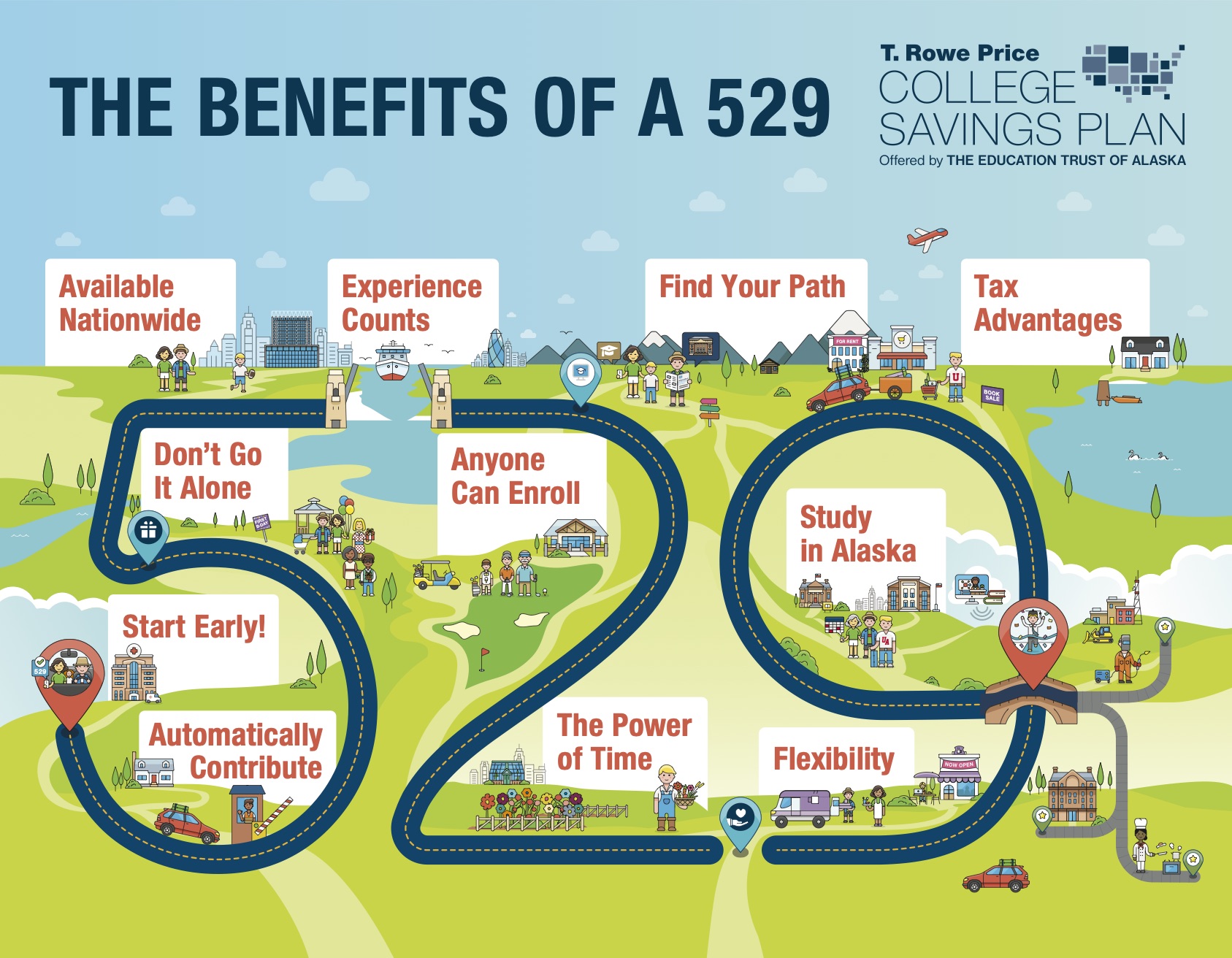

The short answer is Yes room and board expenses for off campus housing including a parent s home may be reimbursed through a 529 plan but not necessarily the full cost A 529 plan is an investment plan created to help save for future education expenses Savings from this plan can go toward K 12 education apprenticeship programs or college tuition payments

529 Plan Student Housing

529 Plan Student Housing

https://blog.centralnational.com/wp-content/uploads/2019/09/529-Infographic-1024x683.png

What To Do With Leftover Money In A 529 Plan Financial Samurai 529 Plan How To Plan

https://i.pinimg.com/originals/cb/bd/34/cbbd343070ea82d728ff57a72056330d.png

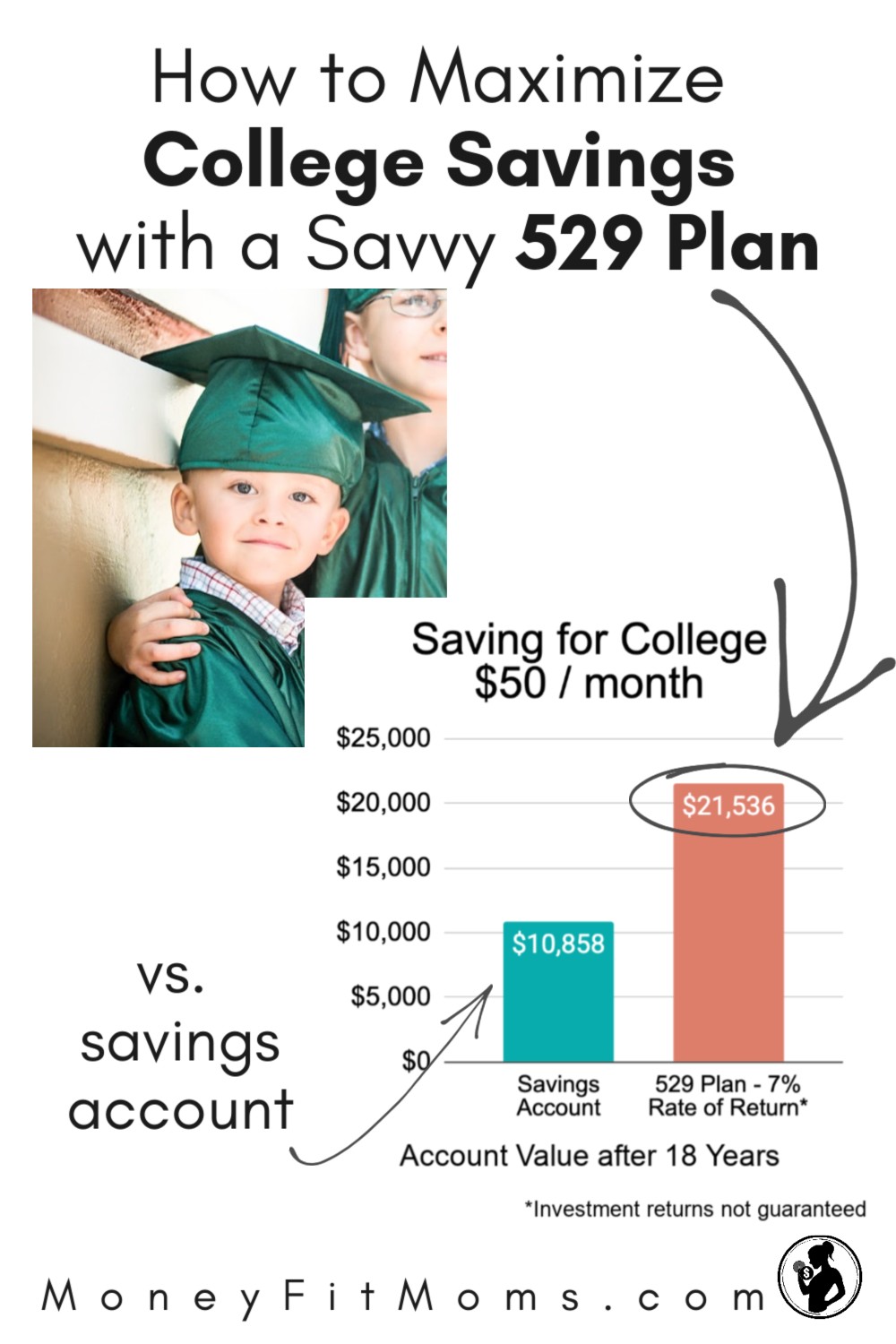

How To Maximize College Savings With A Savvy 529 Plan

https://moneyfitmoms.com/wp-content/uploads/2021/05/529-Plan-Saving-for-College-2.jpg

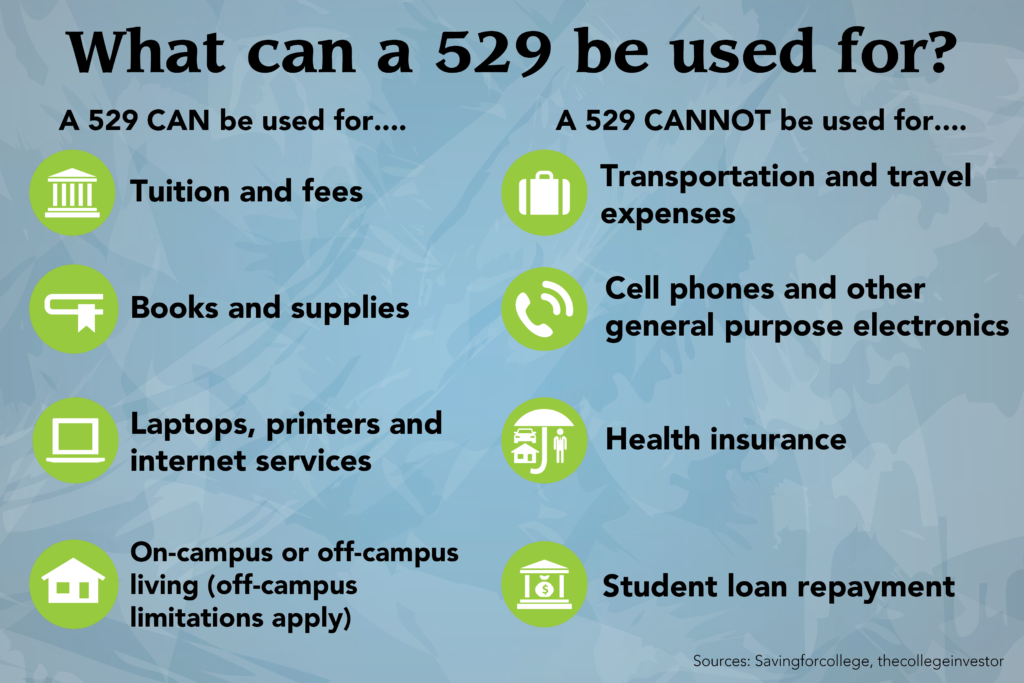

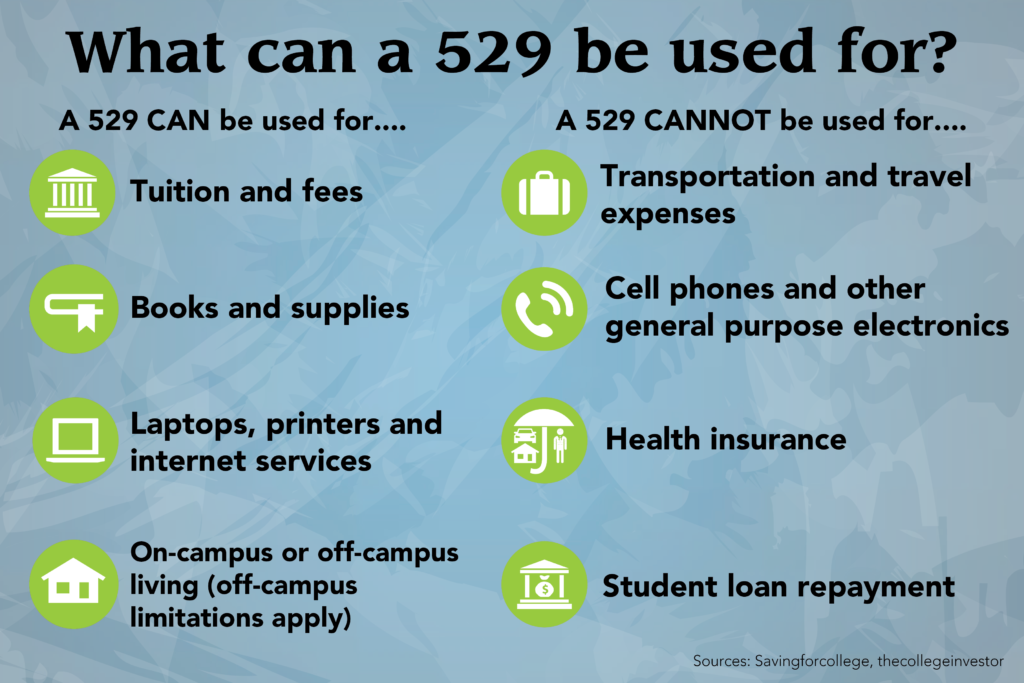

The purpose of a 529 plan is straightforward at first glance to provide families with a tax advantaged account for future education expenses But not all education costs are eligible How Can Of course the advice to save money in a 529 plan is mostly applicable if college is still in the future If you re in school now and if you or a family member is paying for housing it can benefit you to first contribute that money to a 529 and use it to cover your expenses

The definition of qualified higher education expenses for 529 plan purposes also includes up to 10 000 per year in tuition for K 12 schools and up to 10 000 in student loan repayments Here is a list of common educational expenses and their qualification status A 529 plan is a tax advantaged account that can be used to pay for qualified education costs including college K 12 and apprenticeship programs Student loan payments Off campus housing

More picture related to 529 Plan Student Housing

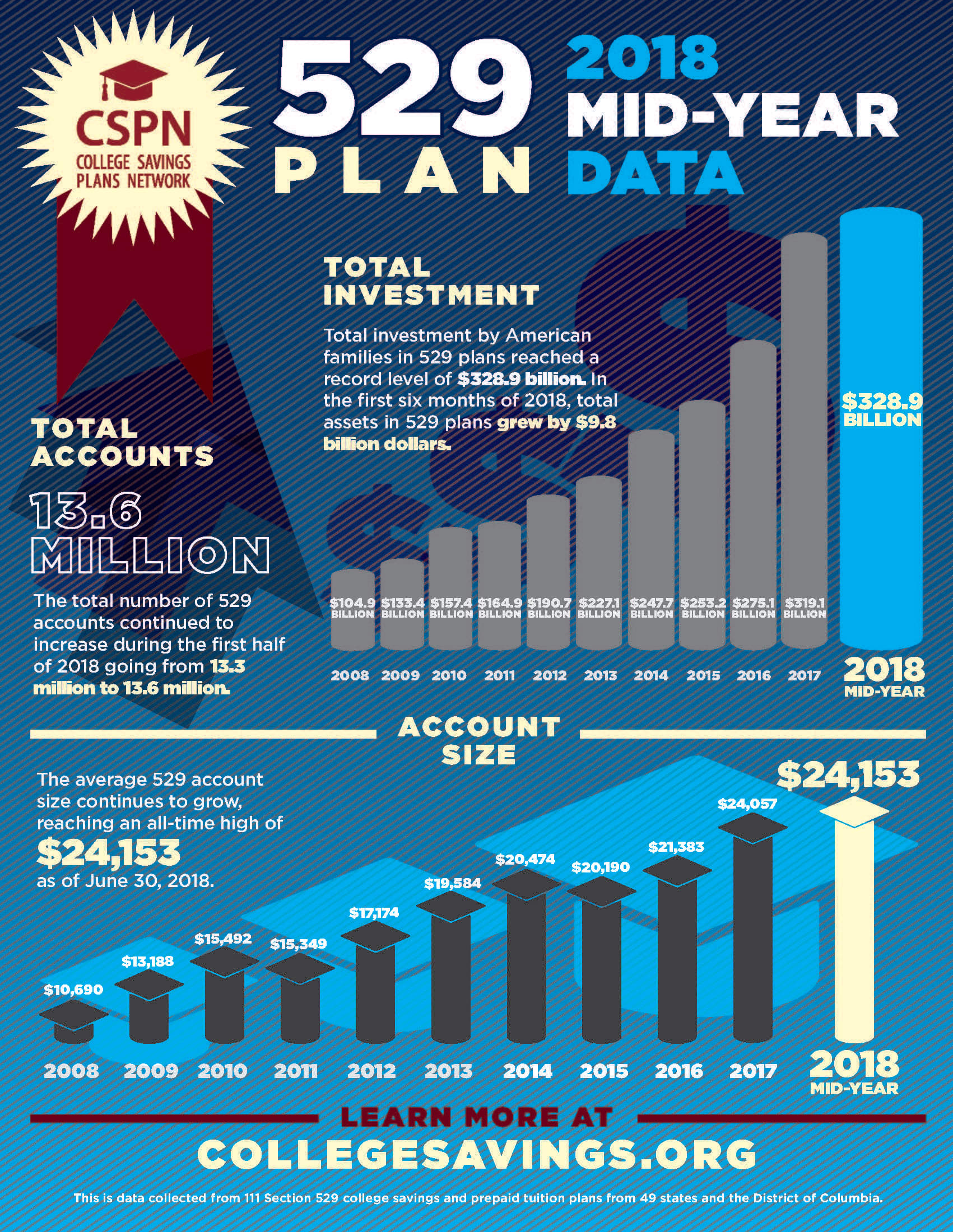

The Benefits Of A 529 Plan INFOGRAPHIC

https://web-resources.savingforcollege.com/images/sponsored-articles/the-benefits-of-a-529-infographic-thumbnail.jpg

529 Plans 29 Thoughts For 5 29 Lazy Man And Money

https://static.lazymanandmoney.com/images/2019/05/29121050/529-Plans.jpg

You Could Use Your 529 Plan If You Have One For Your Student Debt

https://image.cnbcfm.com/api/v1/image/105239358-529_v05.jpg?v=1529478335

May 29 2019 at 10 43 a m Opening a 529 plan allows parents to achieve tax free college savings for their children But without a full understanding of the 529 plan qualified expenses 1 17 Credit Qualified expenses that 529s cover A tax advantaged 529 college savings plan can be used to pay for college but not all expenses qualify Withdrawals from 529 plans are

How a 529 college savings plan works The cost of higher education continues to rise For the 2021 2022 academic year total tuition and fees at public institutions for first time full time Qualified Educational Housing Expenses Under 529 Plans 529 plan funds can indeed be used to cover housing costs both on and off campus for students during any academic period assuming the student is enrolled at least half time Wherever the student lives 529 plans cover room and board up to the same allowances imposed by the school

Private College 529 Plan Basics

https://www.upromise.com/articles/wp-content/uploads/sites/3/2021/02/AdobeStock_391386688-1536x1024.jpeg

What Is A 529 Plan And What You Need To Know About It Westface College Planning

https://westfacecollegeplanning.com/wp-content/uploads/65400391_l-2048x1365.jpg

https://www.kiplinger.com/article/college/t002-c001-s001-paying-for-off-campus-housing-with-a-529-plan.html

Paying for Off Campus Housing with a 529 Plan Your student s room and board could be covered tax free for an entire 12 month lease even if he or she only takes classes for nine months of

https://www.glassjacobson.com/blog/529-off-campus-housing/

The short answer is Yes room and board expenses for off campus housing including a parent s home may be reimbursed through a 529 plan but not necessarily the full cost

The Basics Of A 529 Plan Blog Student Loan Management 529 Plan How To Plan Saving For

Private College 529 Plan Basics

Demystifying The 529 College Savings Plan North Oaks Financial Group

Can 529 Be Used For Rent A Student s Guide ApartmentGuide

Is Your 529 Savings Plan In The Red Here s What To Do

Backer Review Making Your 529 Plan Accessible 529 College Savings Plan Saving For College

Backer Review Making Your 529 Plan Accessible 529 College Savings Plan Saving For College

529 Plans Archives College Aid Consulting Services

These 17 States Haven t Adopted The New Federal 529 Plan Rules Yet Personal Finance For

Saving For College With Maryland 529 Plans Saving For College 529 Plan How To Plan

529 Plan Student Housing - A 529 plan does include off campus rent as long as you re going to college half time for that semester but it only includes rent and utilities up to the amount specified by the college as a room and board allowance