Affordable Housing Tax Plan The Budget Invests in building and preserving millions of affordable homes for rent and ownership and reducing barriers to housing production from restrictive land use policies to practices

In calendar years 2018 2021 the 9 LIHTC ceiling was increased by 12 5 allowing states to allocate more credits for affordable housing projects The new provision restores the 12 5 increase Explore the child tax credit and other provisions in the 2024 bipartisan tax deal Tax Relief for American Families and Workers Act of 2024 Increase the amount of low income housing tax credit LIHTC available to states by 12 5 percent and lower the bond financing threshold for the credit from 50 percent to 30 percent from 2023 through 2025

Affordable Housing Tax Plan

Affordable Housing Tax Plan

https://whyy.org/wp-content/uploads/planphilly/assets_7/http-planphilly-com-sites-planphilly-com-files-longshot-jpg.original.jpg

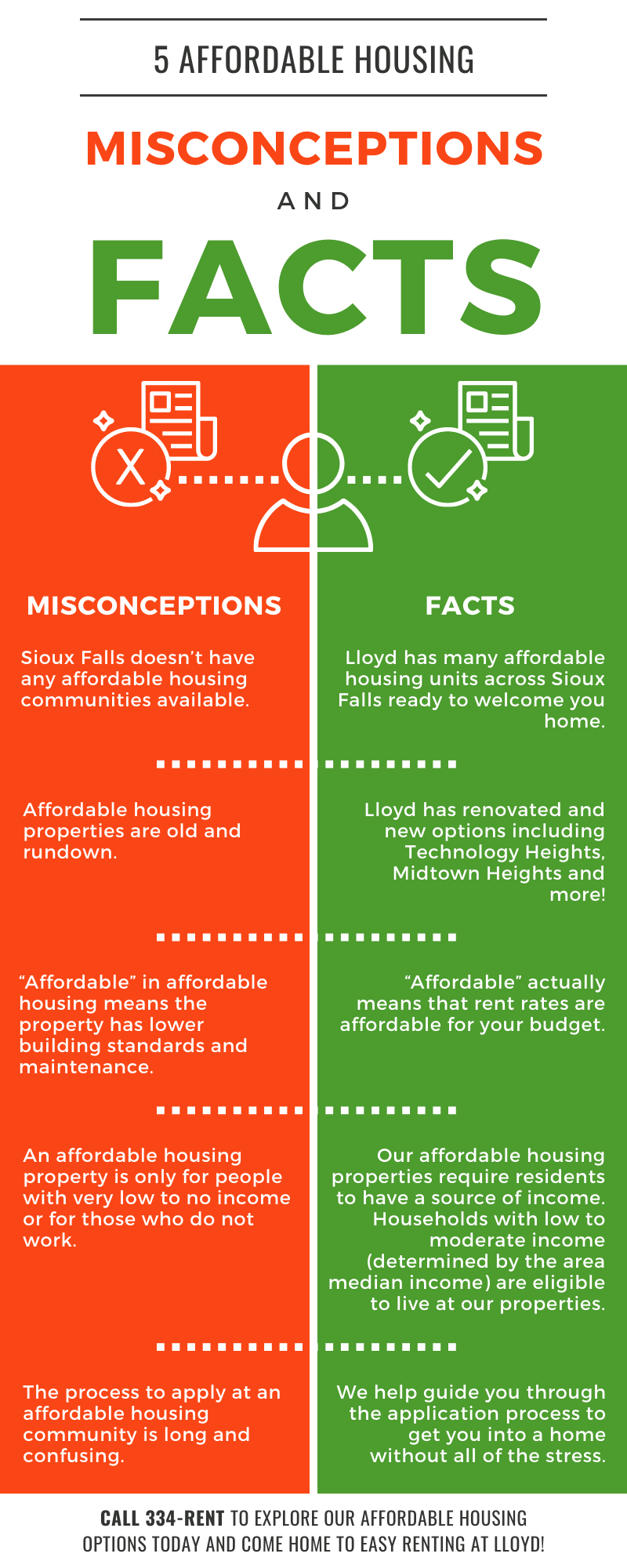

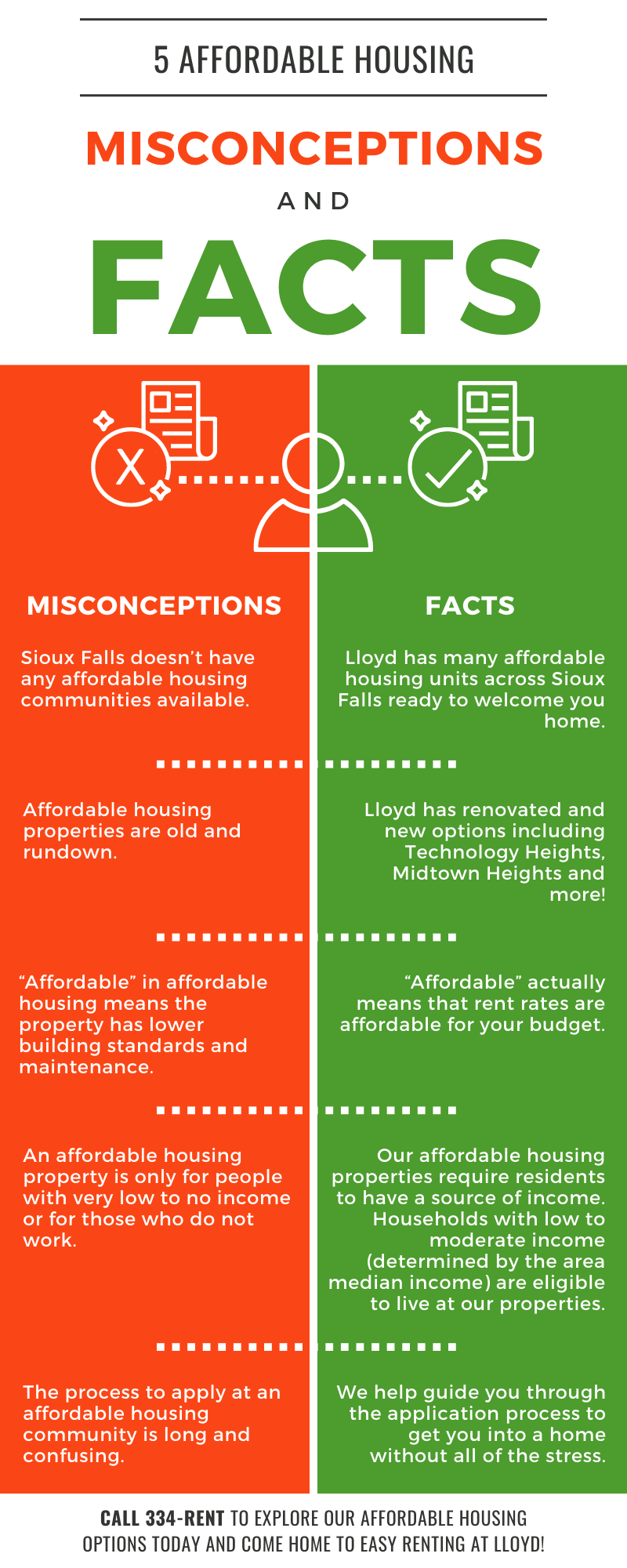

Lloyd Affordable Housing Lloyd Companies

https://lloydcompanies.com/wp/wp-content/uploads/2020/09/Affordable-Housing-Infographic-9.2.20.png

Affordable Housing Audit Scotland

https://www.audit-scotland.gov.uk/uploads/images/report/nr_200409_affordable_housing.png

The Low Income Housing Tax Credit LIHTC program is the most important resource for creating affordable housing in the United States today Created by the Tax Reform Act of 1986 the LIHTC program gives State and local LIHTC allocating agencies the equivalent of approximately 9 billion in annual budget authority to issue tax credits for the acquisition rehabilitation or new construction of Affordable Housing Gets Boost in Congressional Tax Reform Proposal The bipartisan tax deal would raise allocations for the Low Income Housing Tax Credit a critical tool for encouraging

WASHINGTON Oct 7 Reuters The U S Treasury moved to preserve and expand the supply of affordable housing on Friday by finalizing a new tax credit income rule that may qualify more September 01 2021 FACT SHEET Biden Harris Administration Announces Immediate Steps to Increase Affordable Housing Supply Briefing Room Statements and Releases Immediate Steps Supplement the

More picture related to Affordable Housing Tax Plan

Virginia Lawmakers Approve New Affordable Housing Tax Credit Program Growing Homes Together

https://growinghomestogether.org/wp-content/uploads/2021/03/iStock-1001201974-scaled.jpg

Affordable Rental Housing After Tax Reform

https://s3.studylib.net/store/data/008839588_1-6d3566ab2d3161e953a036cfee1cfed4-768x994.png

Affordable Housing Lottery Application Guideline Rentability Affordable Housing NYC HPD

http://www.rentability.nyc/wp-content/uploads/2018/09/affordable-housing-lottery-application-guideline.jpg

As his Action Plan reflects President Biden believes the best thing we can do to ease the burden of housing costs is to boost the supply of quality housing Guidance released by Treasury today takes two additional steps 1 increasing flexibility to use SLFRF to fully finance long term affordable housing loans and 2 expanding presumptively eligible affordable housing uses to further maximize the availability of SLFRF funds for affordable housing

Affordable Housing Credit Improvement Act of 2021 This bill revises provisions of the low income housing tax credit and renames it as the affordable housing credit The bill increases the per capita dollar amount of the credit and its minimum ceiling amount beginning in 2021 and extends the inflation adjustment for such amounts The Low Income Housing Tax Credit LIHTC subsidizes the acquisition construction and rehabilitation of affordable rental housing for low and moderate income tenants The LIHTC was enacted as part of the 1986 Tax Reform Act and has been modified numerous times Since the mid 1990s the LIHTC program has supported the construction or

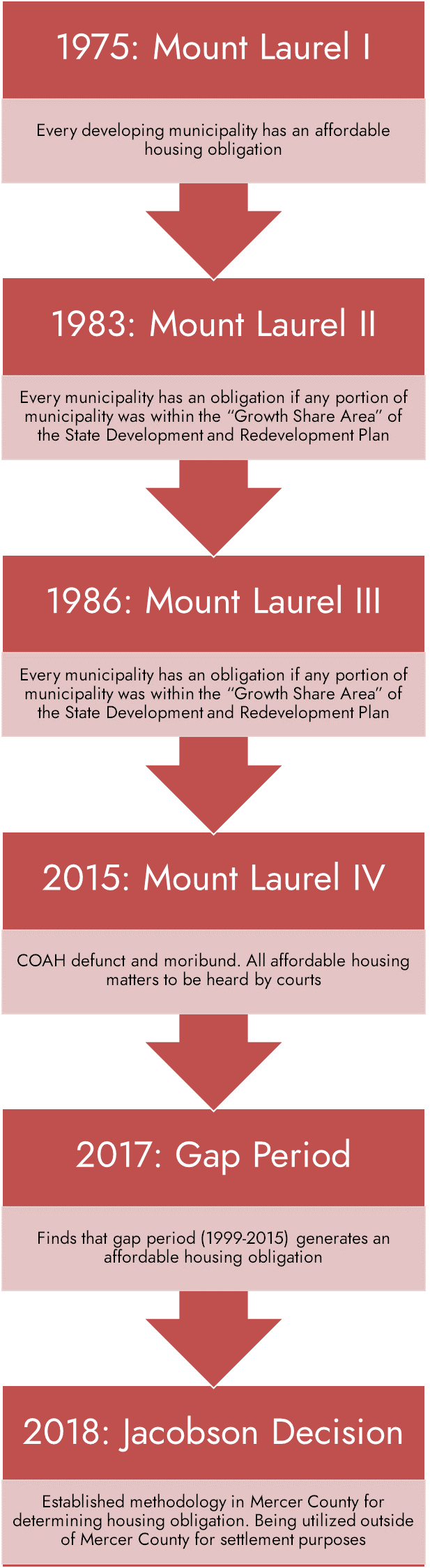

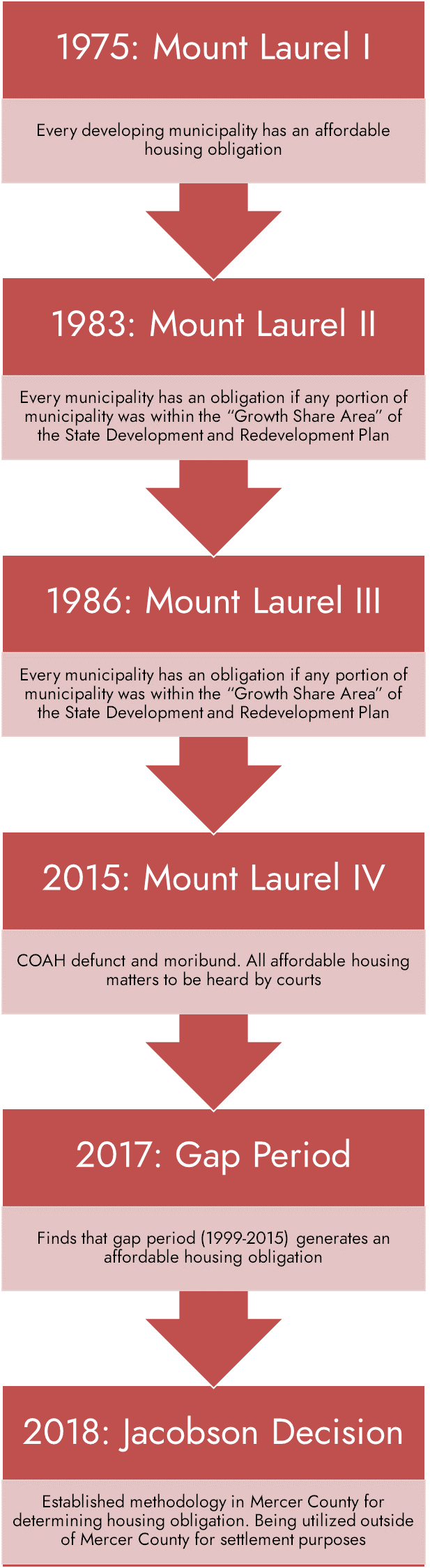

Affordable Housing Burgis Associates Inc

http://burgis.com/wp-content/uploads/2021/10/Affordable-Housing-Flowchart.png

Grossman St Amour Certified Public Accountants PLLC

http://chicagoagentmagazine.com/wp-content/uploads/2011/08/AffordableHousing.jpg

https://www.whitehouse.gov/briefing-room/statements-releases/2023/03/09/fact-sheet-president-bidens-budget-lowers-housing-costs-and-expands-access-to-affordable-rent-and-home-ownership/

The Budget Invests in building and preserving millions of affordable homes for rent and ownership and reducing barriers to housing production from restrictive land use policies to practices

https://dsnews.com/news/01-19-2024/tax-bill-affordable-housing

In calendar years 2018 2021 the 9 LIHTC ceiling was increased by 12 5 allowing states to allocate more credits for affordable housing projects The new provision restores the 12 5 increase

Removing Sunsets On Affordable Housing Tax Credit Program Provides One Step To Addressing

Affordable Housing Burgis Associates Inc

2109230184 1 The Affordable Housing Tax Credit Coalition

Private Contractor Partnership Breaks Ground On New Affordable Housing Options Indy Gateway

Department Affordable Housing

Neighborhood Homes Investment Act Targets Renovations Affordability The Business Journals

Neighborhood Homes Investment Act Targets Renovations Affordability The Business Journals

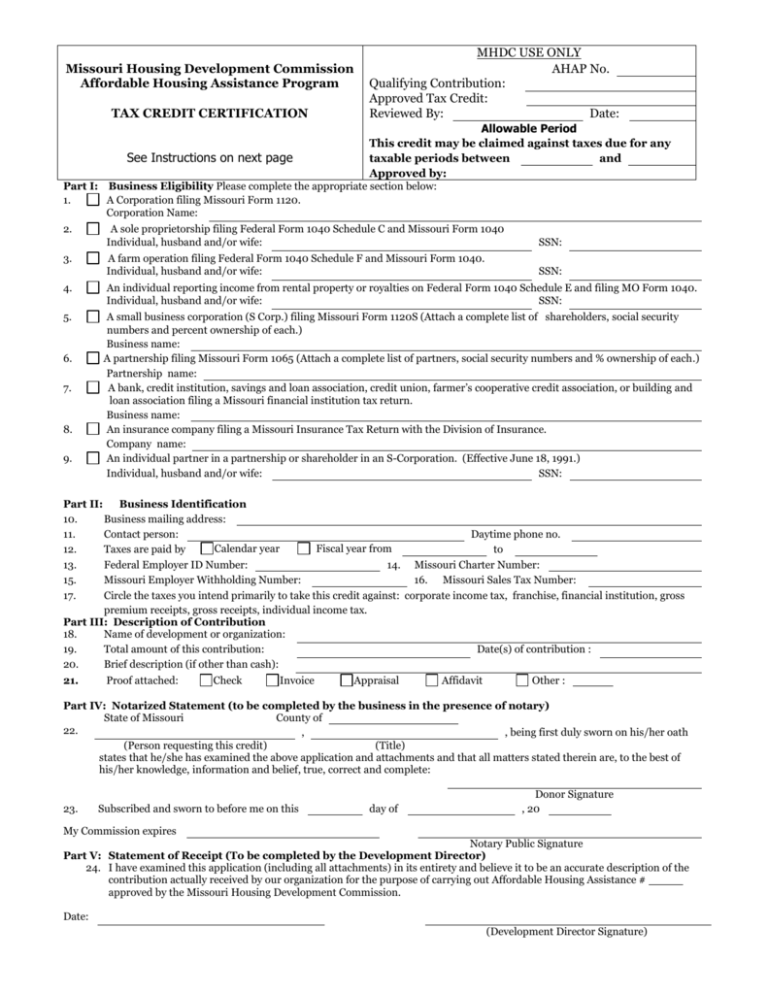

Affordable Housing Tax Credit Certification Document

Affordable Housing By DETAIL Issuu

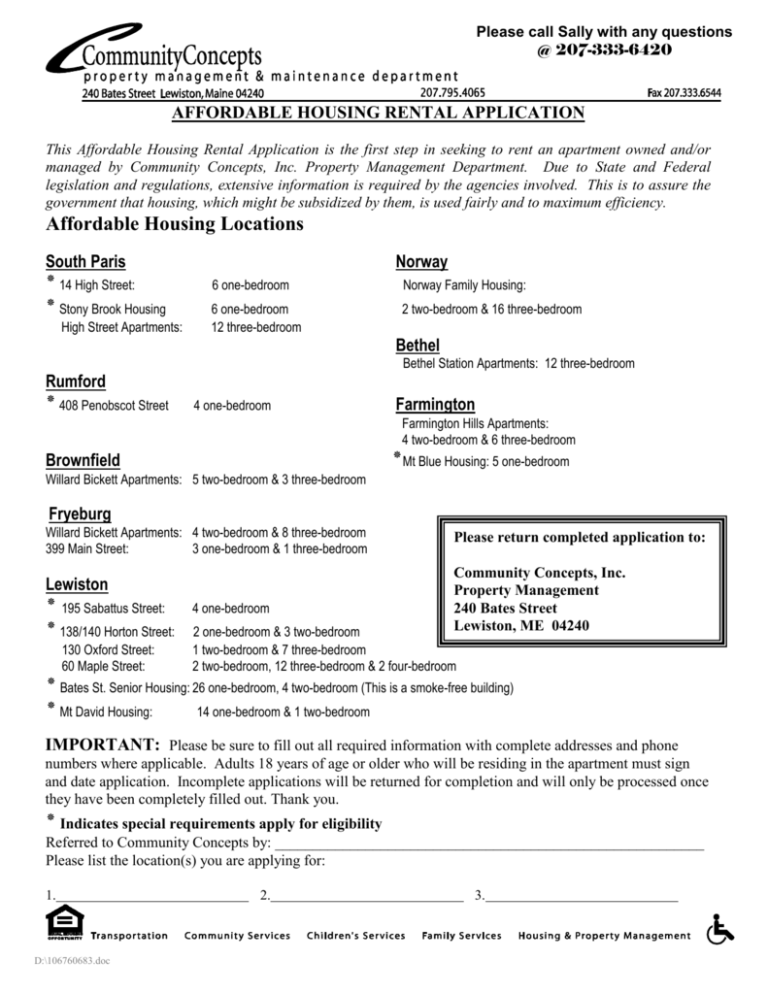

Affordable Housing Locations

Affordable Housing Tax Plan - September 01 2021 FACT SHEET Biden Harris Administration Announces Immediate Steps to Increase Affordable Housing Supply Briefing Room Statements and Releases Immediate Steps Supplement the