Alimony House Tax Plan The IRS imposes seven requirements on taxpayers seeking to deduct alimony payments Make payments in cash or by check You must pay alimony by cash or check for the benefit of a spouse or former spouse The value of in kind alimony for example giving your spouse your car isn t deductible

Starting in 2019 alimony payments made under divorce agreements cannot be deducted by the spouse who pays them nor are they taxable for the spouse who receives them The same goes for child Here the statuses separating or recently divorced people should consider Married filing jointly On a joint return married people report their combined income and deduct their combined allowable expenses For many couples filing jointly results in a lower tax than filing separately Married filing separately

Alimony House Tax Plan

Alimony House Tax Plan

https://i.pinimg.com/originals/b3/f0/f4/b3f0f45827486fbb01ecda9e24ceeed2.png

Alimony And Taxes In Florida Divorce Cases Ayo And Iken

https://www.myfloridalaw.com/wp-content/uploads/2018/03/alimony-and-income-tax-768x512.jpg

Alimony Taxes Is Alimony Taxable In 2018

https://www.communitytax.com/wp-content/uploads/2018/11/Any-and-all-divorces-which-take-place-after-December-31st.jpg

Updated for Tax Year 2023 October 19 2023 7 36 AM OVERVIEW Filing for a divorce can cause some complexities in your tax situation Learn how alimony is taxed and other tax reporting tips you should know while filing taxes after a divorce TABLE OF CONTENTS Divorce and taxes Alimony taxation How the IRS defines alimony payments Click to expand Taxable Income How To Report Alimony Payments on Your Taxes The rule for reporting alimony payments depends on when you got divorced By William Perez Updated on December 8 2022 Reviewed by Ebony J Howard Fact checked by Yasmin Ghahremani In This Article Tax Rules for Divorces Before 2019 Reporting Alimony You ve Received

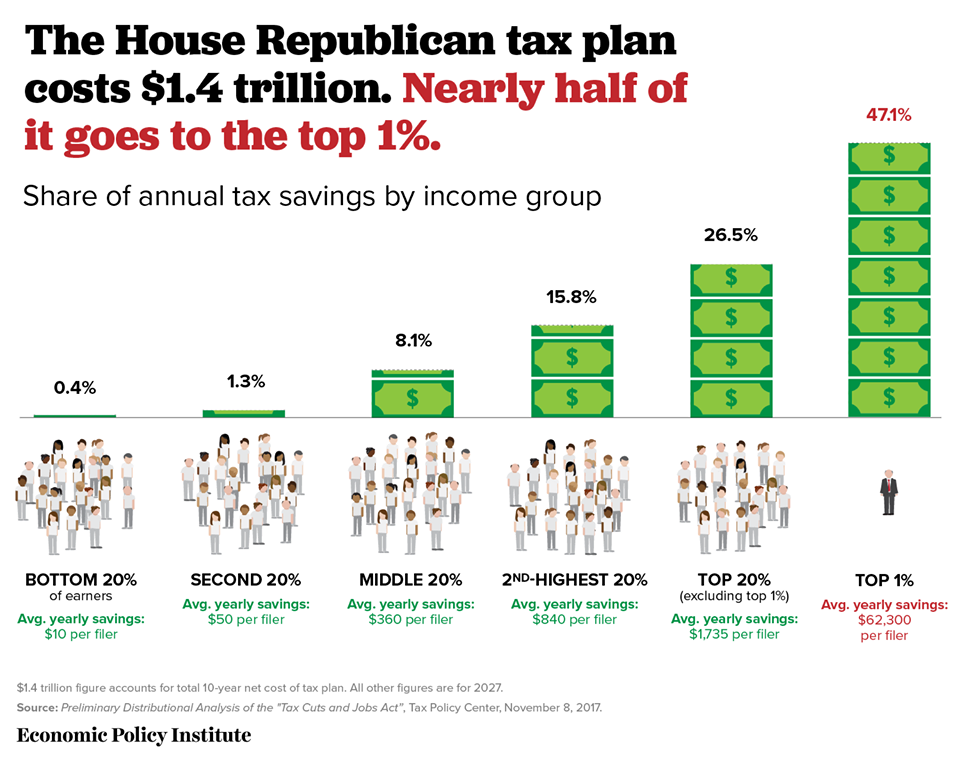

Alimony agreements are binding plans for interspousal financial assistance that can come in a variety of shapes and sizes Read ahead to learn about how alimony works We ll cover everything By JENNIFER PELTZ Updated 9 03 AM PST December 22 2017 NEW YORK AP Congress giant tax overhaul is poised to reach virtually every corner of American life even Splitsville Republicans delivered their sweeping plan to an exultant President Donald Trump who signed it into law Friday

More picture related to Alimony House Tax Plan

USING DEPRECIATION FROM RENTAL REAL ESTATE TO LOWER YOUR AGI Commercial Real Estate Real

https://i.pinimg.com/originals/f6/c9/1b/f6c91b90c4063216d27a255fe8dbce19.png

New Alimony Tax Law In California Is Alimony Tax Deductible

https://www.familylawsandiego.com/images/blog/shutterstock_331471637.jpg

The Rules For Alimony And Taxes In Tax Year 2019 With Images Alimony Tax Deductions Tax

https://i.pinimg.com/originals/b0/d9/74/b0d9744ac88d1226d982a943a449afb9.png

Consider that someone receiving 300 a week in alimony under the new law will get 15 600 in tax free money annually That creates a disproportionate benefit for the recipient and a detriment to the payer who must shell out the money with no tax benefit An experienced divorce attorney can provide legal advice when negotiating a divorce settlement involving potential alimony payments How does that work Consider a spouse who pays 30 000 in spousal support and whose income is taxed at 32 A tax deduction for paying spousal support would save this spouse almost 10 000 in taxes

A husband pays 4 000 monthly to his former wife 3 000 is allocated to the support of the children and 1 000 is allocated as alimony However the husband was unable to pay anything for the last month of the tax year so the wife received a total of 44 000 instead of 48 000 Therefore the amount that must be allocated as child support The Tax Cuts and Jobs Act eliminated the federal income tax deduction for alimony payments required under divorce agreements executed after Dec 31 2018

House And Senate Discuss Major Changes To Florida Alimony Laws Henderson Franklin Attorneys

https://www.henlaw.com/wp-content/uploads/2019/07/alimony-istock-purchased.jpg

Tapuriah Jain Associates December 2012

https://4.bp.blogspot.com/-Z-DgiVRcK1E/UwMN9h-LfmI/AAAAAAAADIg/V_viPrprGK4/s1600/Alimony+Tax.png

https://www.divorcenet.com/states/nationwide/the_seven_alimony_rules

The IRS imposes seven requirements on taxpayers seeking to deduct alimony payments Make payments in cash or by check You must pay alimony by cash or check for the benefit of a spouse or former spouse The value of in kind alimony for example giving your spouse your car isn t deductible

https://www.usatoday.com/story/money/taxes/2024/01/11/taxes-divorce-401k-custody-alimony/72163810007/

Starting in 2019 alimony payments made under divorce agreements cannot be deducted by the spouse who pays them nor are they taxable for the spouse who receives them The same goes for child

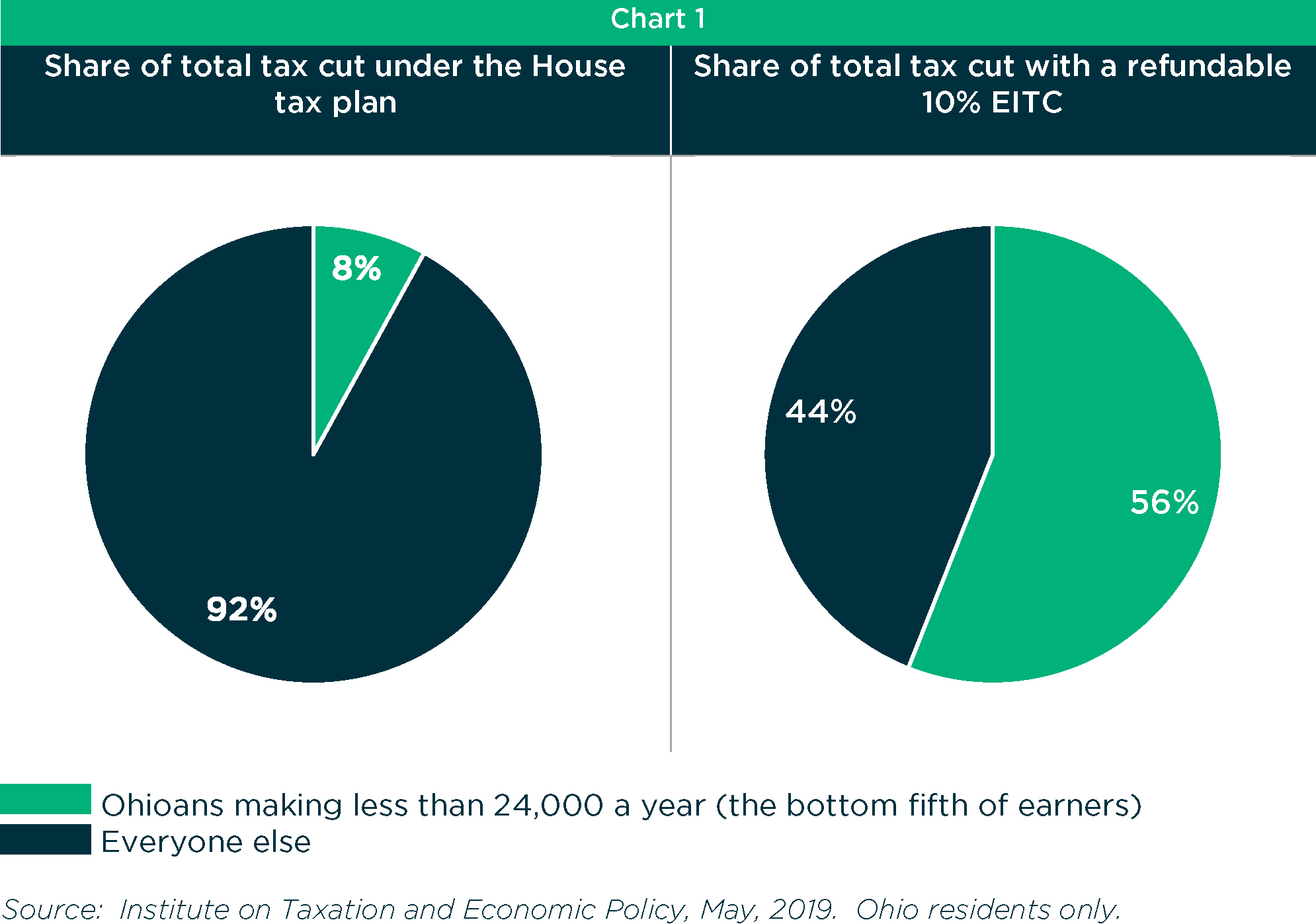

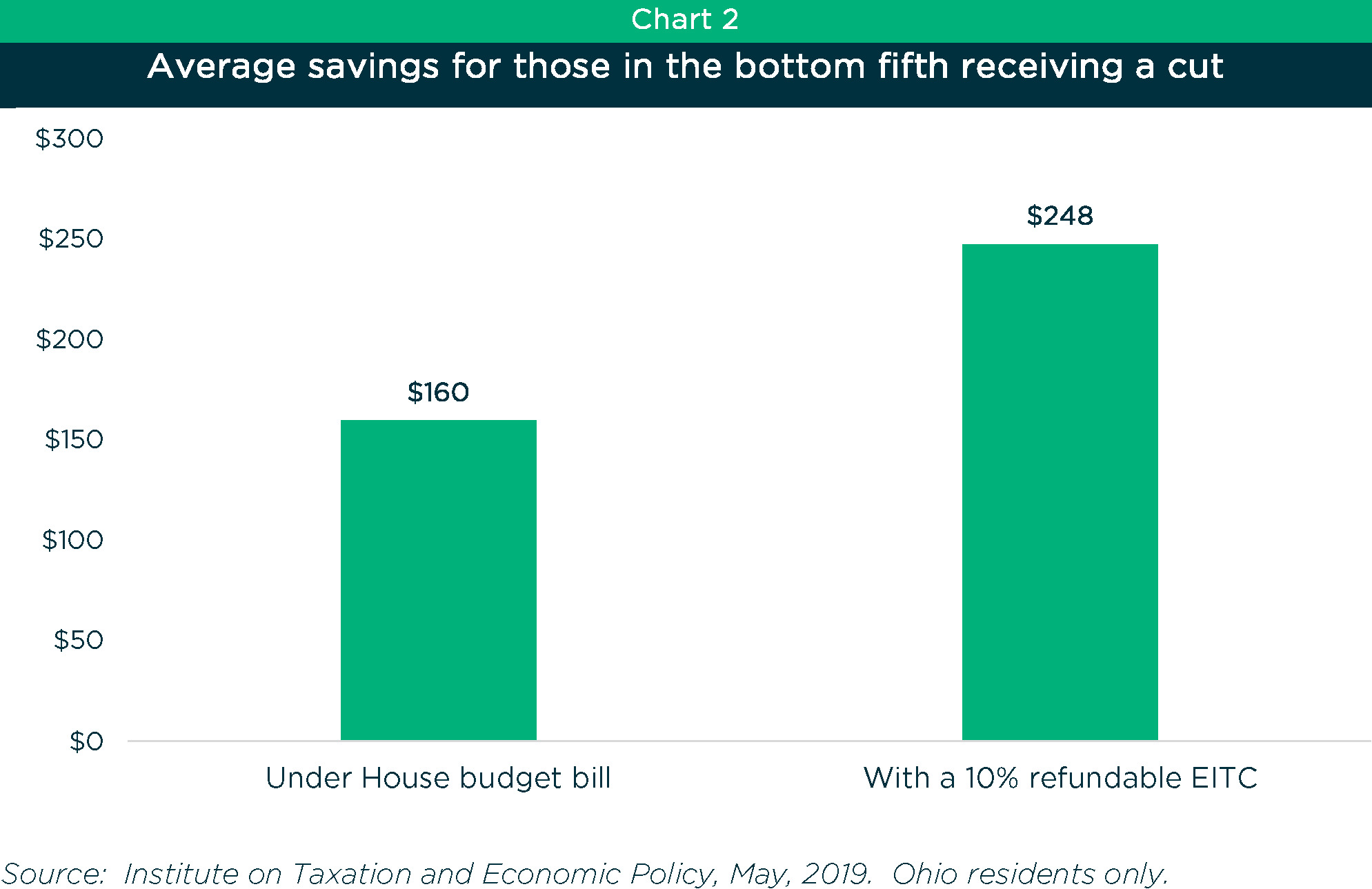

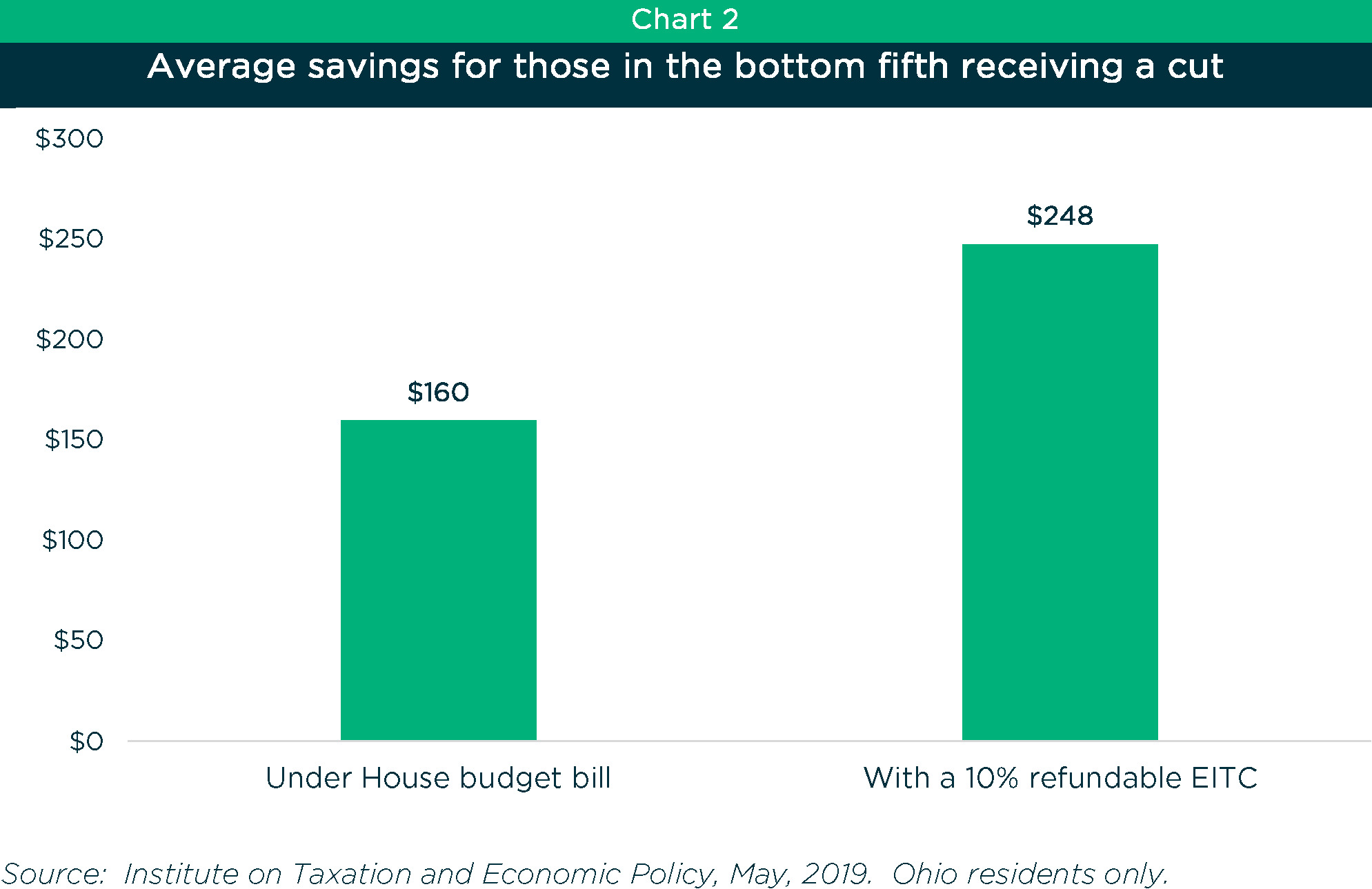

Jobsanger House GOP s Tax Plan Is NOT A Middle Class Tax Cut

House And Senate Discuss Major Changes To Florida Alimony Laws Henderson Franklin Attorneys

New Federal Tax Plan Comes With Changes Affecting Alimony Las Vegas Review Journal

Alimony And Tax Reform H R Block

The Good And The Bad In The House Tax Plan

The Good And The Bad In The House Tax Plan

The Good And The Bad In The House Tax Plan

Last Year The Tax Reform Bill Presented By The House Of Representatives Included A Provision To

Use Tax Planner Software To Offer Tax Planning Corvee

Trump s Tax Plan Alimony McIlveen Family Law Firm

Alimony House Tax Plan - Alimony has two important tax statuses If you finalized your divorce before Jan 1 2019 the person who collects alimony pays taxes on this money This means that the person who pays alimony can claim a full tax deduction for the payments while the person who receives the alimony pays taxes on it as income