Are Memory Care Facility Expenses Tax Deductible Some memory care expenses and out of pocket medical expenses like prescriptions and on site nursing services for a loved one with

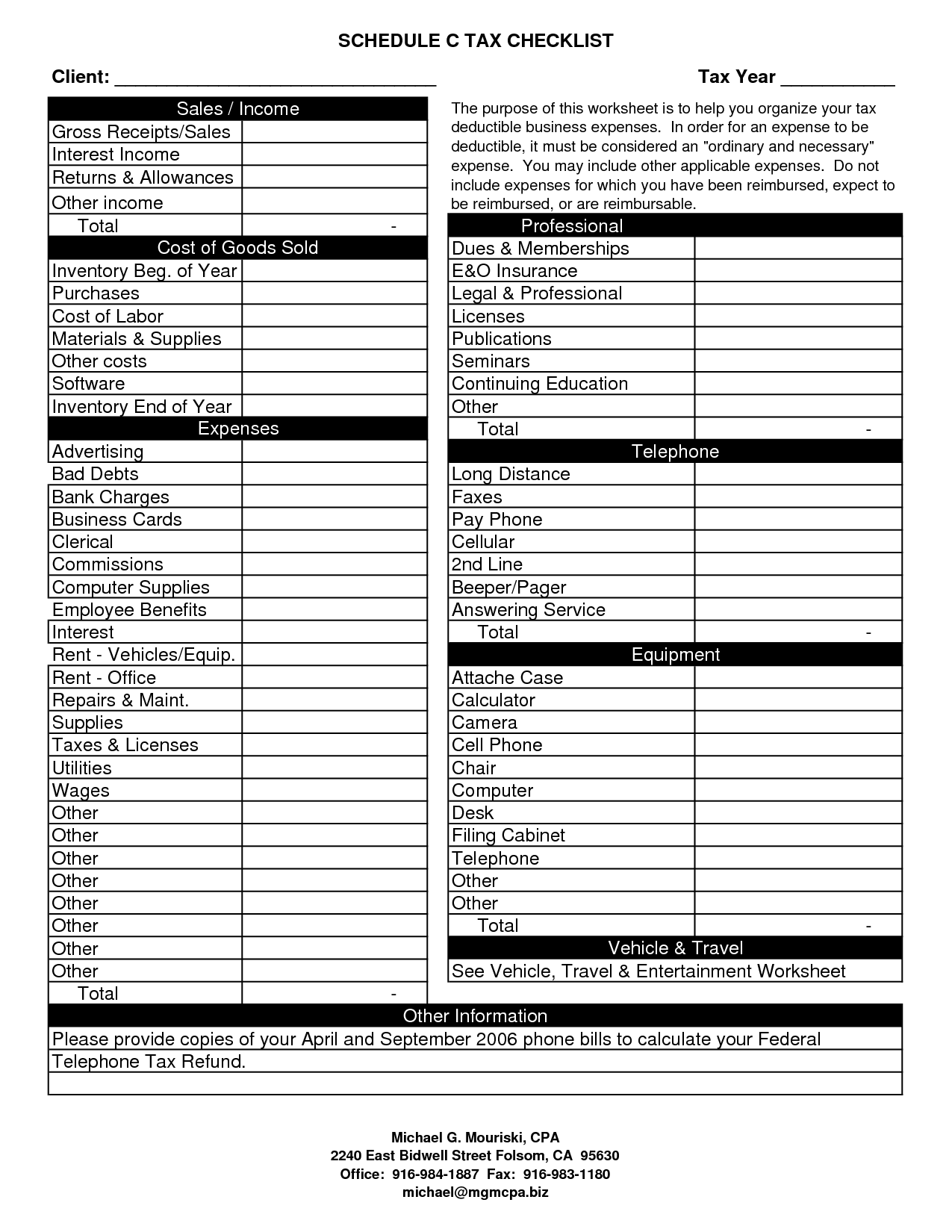

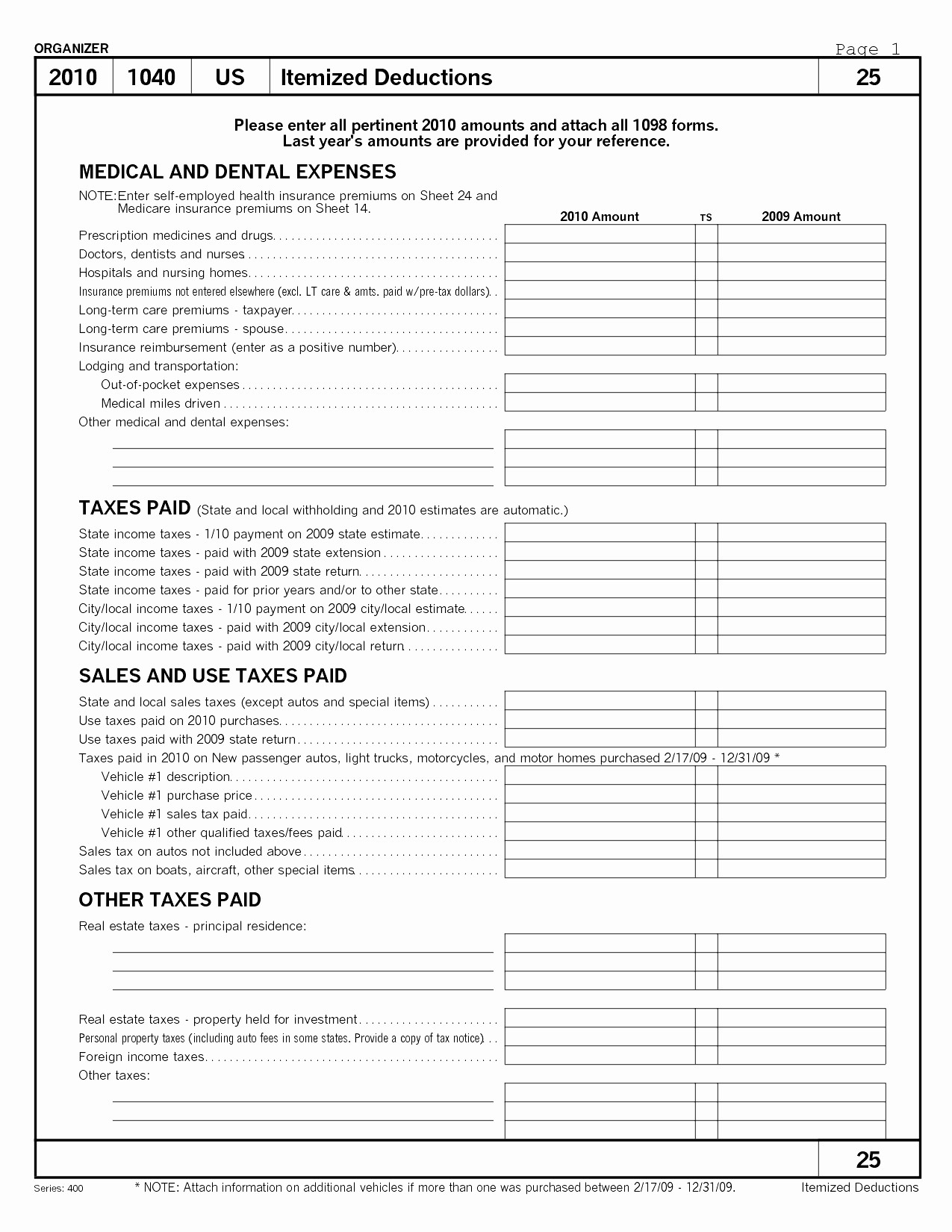

Deduct medical expenses on Schedule A Form 1040 Itemized Deductions The total amount of all allowable medical expenses is the amount of such expenses that exceeds The medical expenses included in the fees for Assisted Living or Memory Care can be written off on taxes with some qualifications and restrictions People who have an older loved one who

Are Memory Care Facility Expenses Tax Deductible

Are Memory Care Facility Expenses Tax Deductible

https://www.worksheeto.com/postpic/2010/07/schedule-c-tax-deduction-worksheet_449335.png

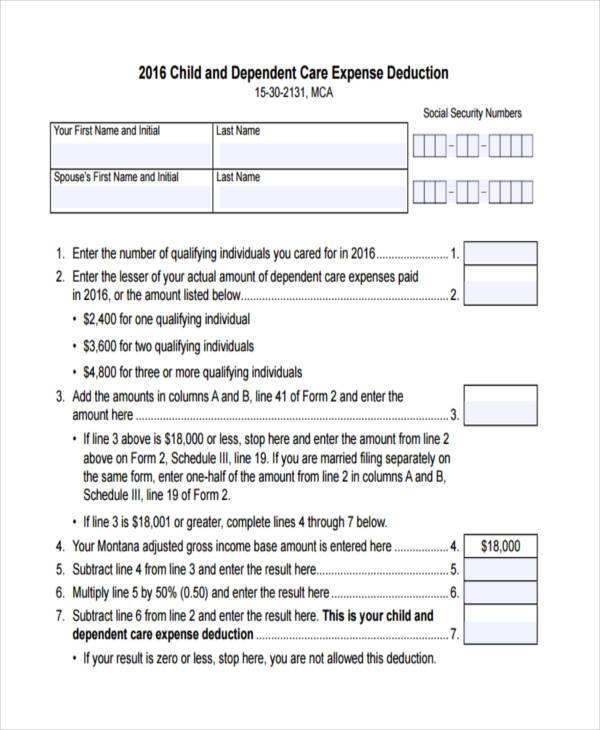

Daycare Tax Deductions Worksheet

https://i.pinimg.com/736x/de/09/f5/de09f5c78c889823cfbf86690091fee6.jpg

Hsa Limits 2025 Calculator For Married Joaquin Theo

https://www.cbiz.com/Portals/0/CBIZ_HCM/Images/2024-HSA-HDHP-Limits-Graphics.jpg

In order for assisted living expenses to be tax deductible the resident must Be considered chronically ill requires supervision due to a cognitive impairment such as Alzheimer s disease or another form of When it comes to how much people seeking long term care or with severe cognitive impairment can deduct from their taxes there are two income thresholds to consider If you are seeking to deduct medical expenses you

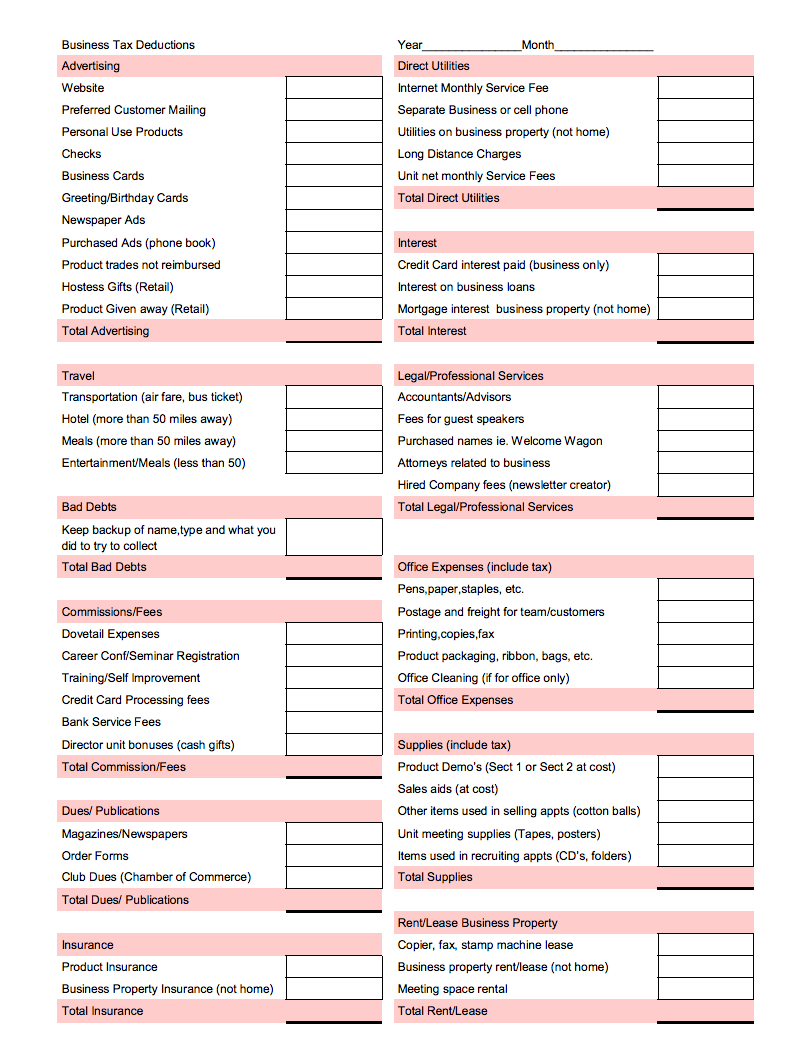

Fortunately many assisted living and memory care expenses are tax deductible Navigating the financial side of senior care can be overwhelming However understanding tax Memory care falls under the category of long term care services which are deductible expenses under the 1996 Health Insurance Portability and Accountability Act HIPAA The cost of memory care should be added to a

More picture related to Are Memory Care Facility Expenses Tax Deductible

Deducting Medical Dental Expenses On Your Tax Return PPL CPA

https://www.pplcpa.com/wp-content/uploads/2023/03/MEDICAL-EXPENSE-DEDUCTIBLE.png

FREE 8 Sample Child Care Expense Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2017/02/Child-Care-Expenses-Deduction-Form.jpg

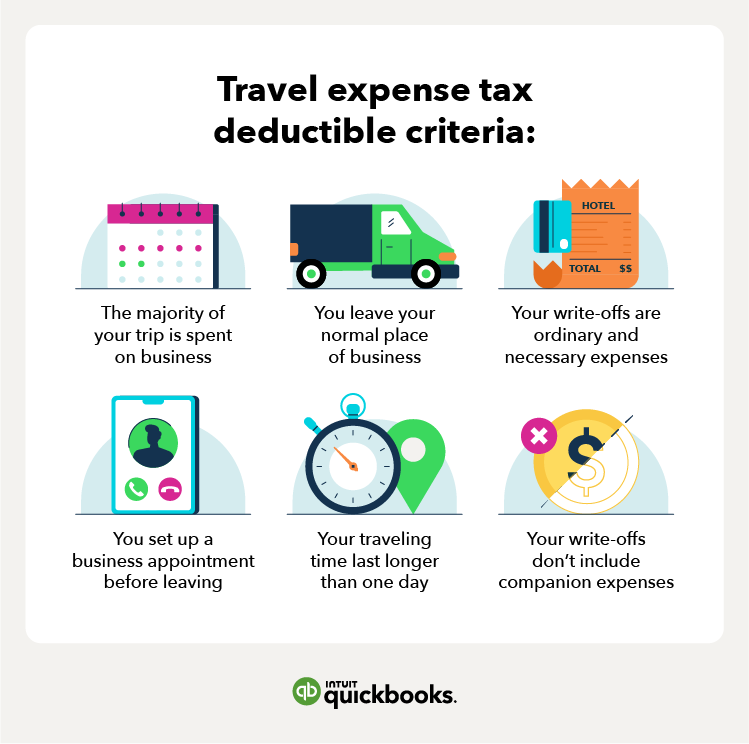

What Expenses Can You Deduct From An LLC Leia Aqui Can An LLC Write

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/tax-deduction-criteria.png

A prevalent concern among caregivers is whether the costs associated with memory care are tax deductible This article will clarify the IRS requirements identify Memory care is in the category of long term care services which are deductible expenses under the 1996 Health Insurance Portability and Accountability Act HIPAA You

Deductions for memory care expenses are available for those who itemize their deductions on IRS Form 1040 Schedule A If you provide care for a dependent in a memory It is crucial to keep detailed records of all expenses related to memory care including detailed receipts invoices and necessary documentation from the care facility Know

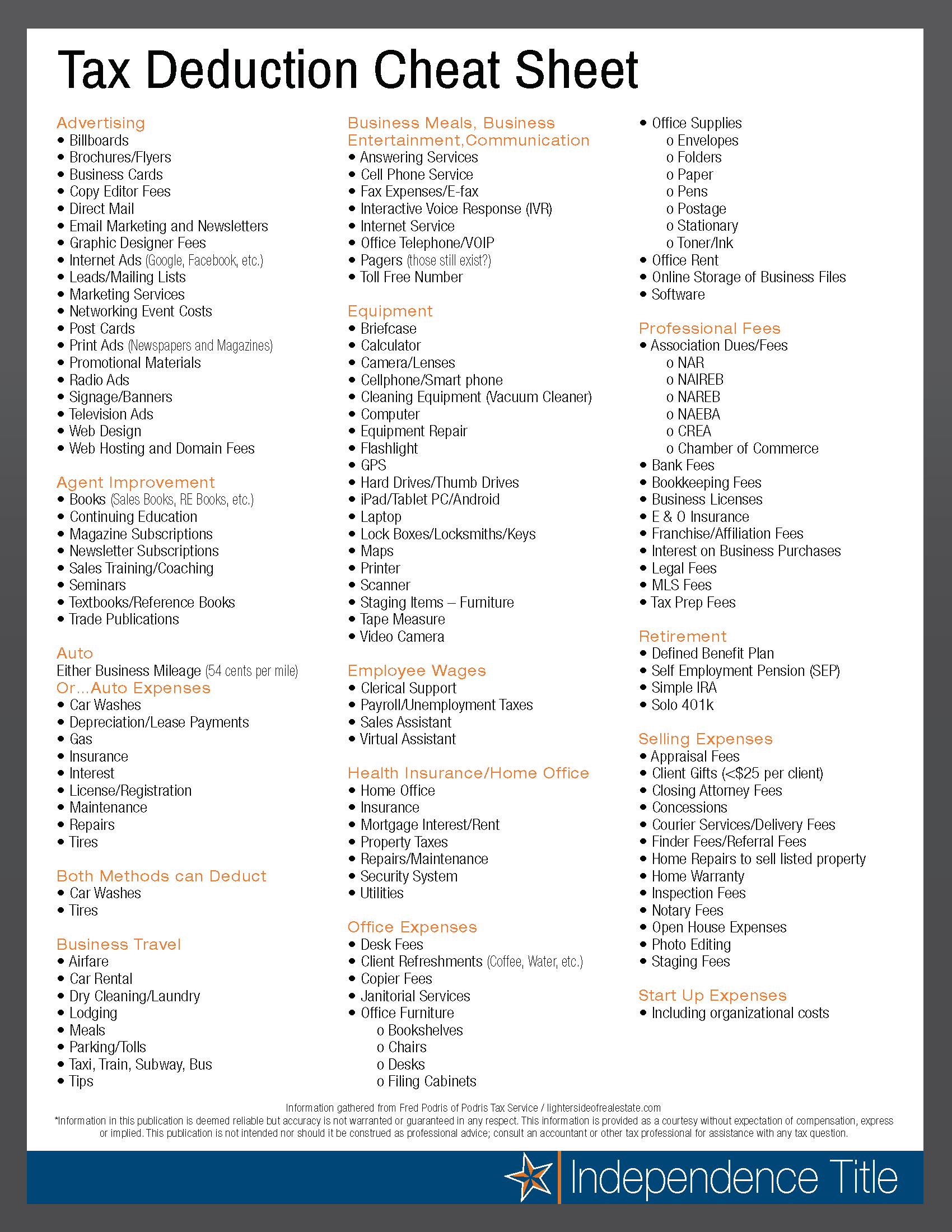

Are You Unsure What Expenses Are Deductible For You Business This

https://i.pinimg.com/originals/b9/76/ac/b976ac9170bf1f7f342c4f4eee6194f2.jpg

Real Estate Tax Deduction Sheet

http://independencetitle.com/wp-content/uploads/RealtorTaxTips2016_Page_2.png

https://www.aplaceformom.com › caregiv…

Some memory care expenses and out of pocket medical expenses like prescriptions and on site nursing services for a loved one with

https://www.irs.gov › ... › medical-nursing-home-special-care-expenses

Deduct medical expenses on Schedule A Form 1040 Itemized Deductions The total amount of all allowable medical expenses is the amount of such expenses that exceeds

Can You Deduct Business Expenses In 2025 Lorne Rebecka

Are You Unsure What Expenses Are Deductible For You Business This

Small Business Tax Deductions Worksheet 2022

List Of Tax Deductions For Realtors

What Medical Expenses Are Tax Deductible Optima Tax Relief

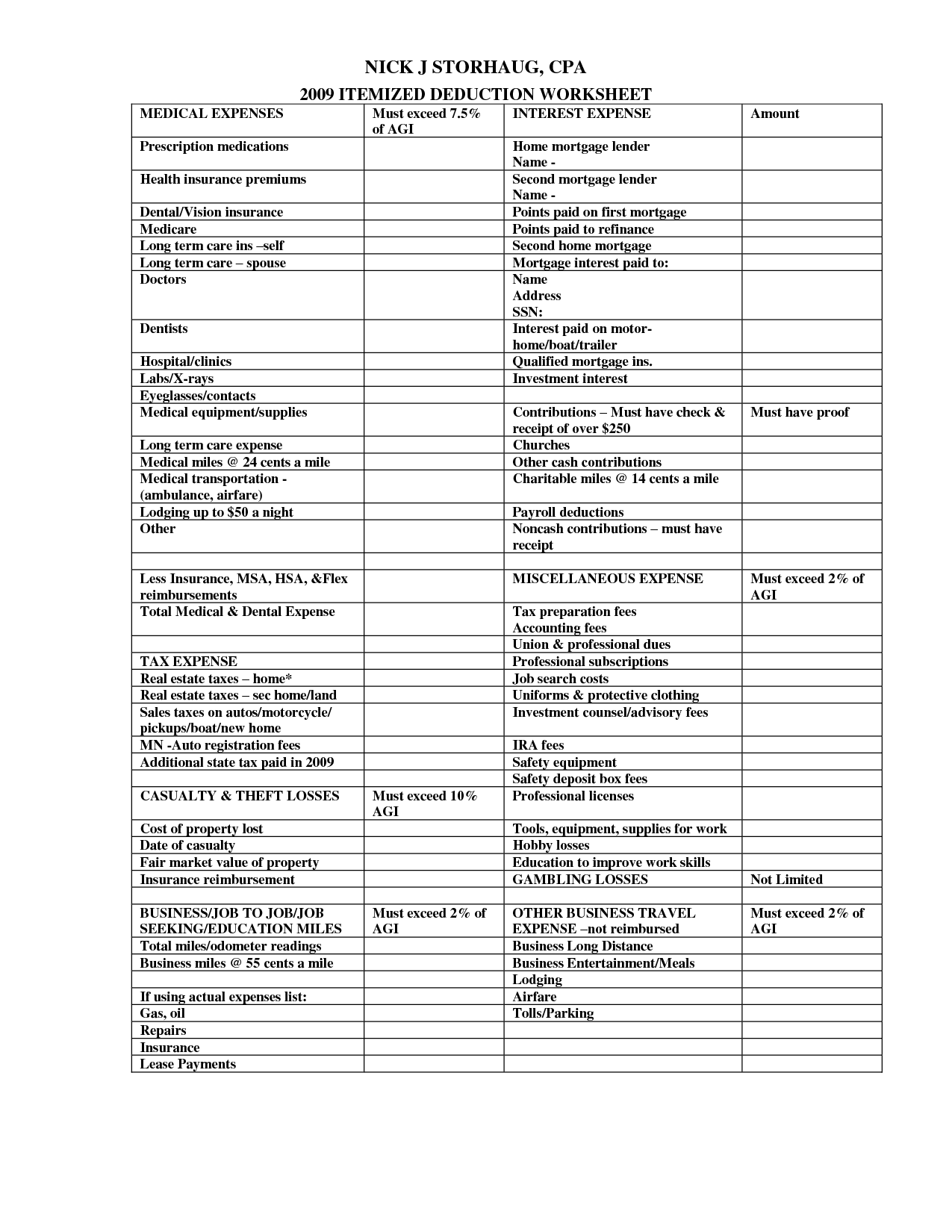

Tax Forms And Worksheets

Tax Forms And Worksheets

Real Estate Tax Deduction Sheet

Realtor Tax Deductions Worksheets

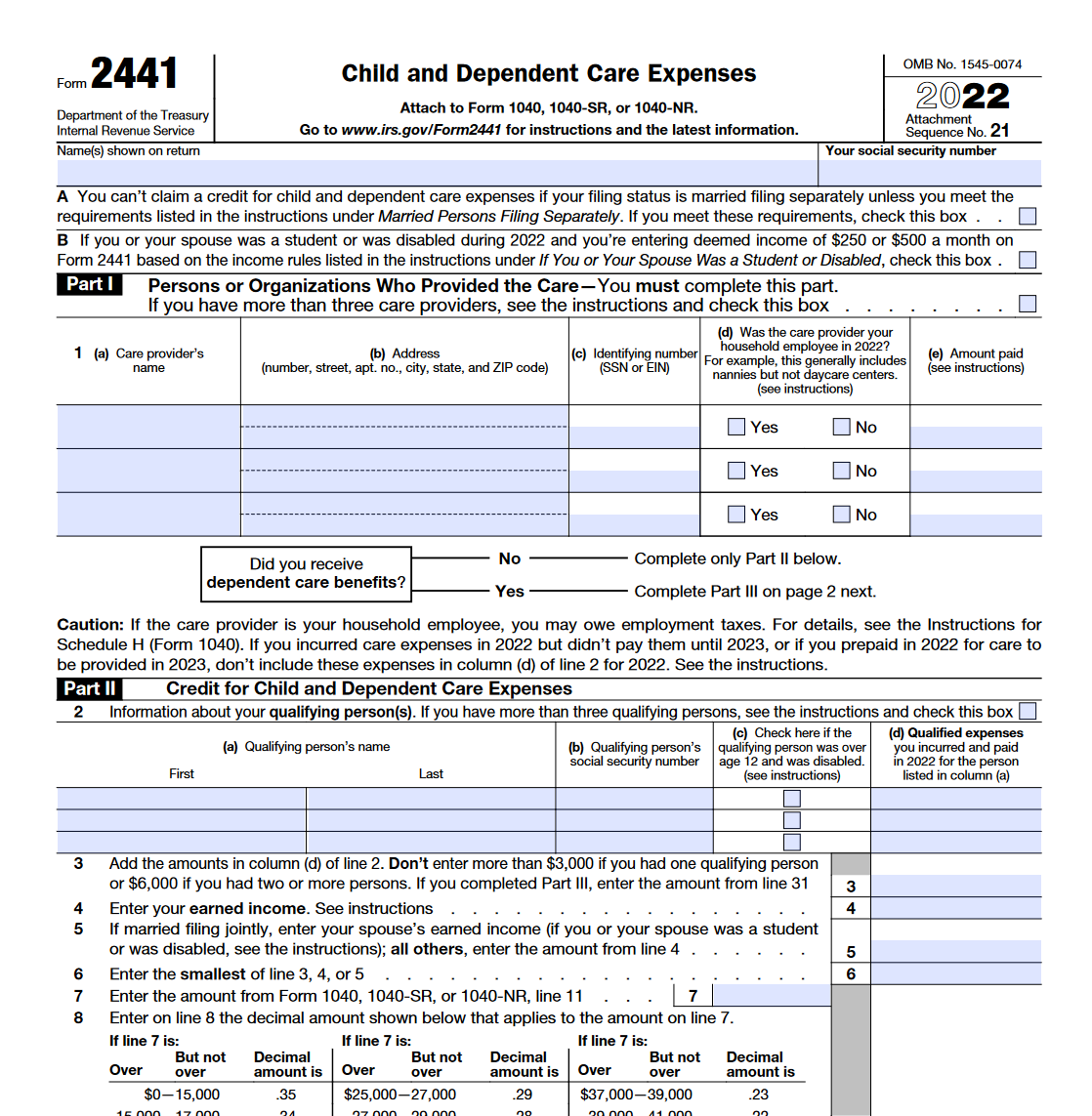

IRS Form 2441 Child And Dependent Care Expenses Forms Docs 2023

Are Memory Care Facility Expenses Tax Deductible - Memory care falls under the category of long term care services which are deductible expenses under the 1996 Health Insurance Portability and Accountability Act HIPAA The cost of memory care should be added to a