Biden Tax Plan Housing Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000

These deductions would be in place through the 2025 tax year and retroactively to 2022 The bill would also eliminate the double taxation of businesses and workers that operate both in the United In 2018 Congress temporarily raised the amount of tax credits allocated to each state by 12 5 but that expansion expired in 2021 the current tax deal seeks to restore the increase The

Biden Tax Plan Housing

Biden Tax Plan Housing

https://www.gannett-cdn.com/presto/2020/11/09/NETN/531e0b0e-8e84-42e6-bef8-4361ce661051-p1Biden110920.jpg?crop=2901,1632,x289,y279&width=2901&height=1632&format=pjpg&auto=webp

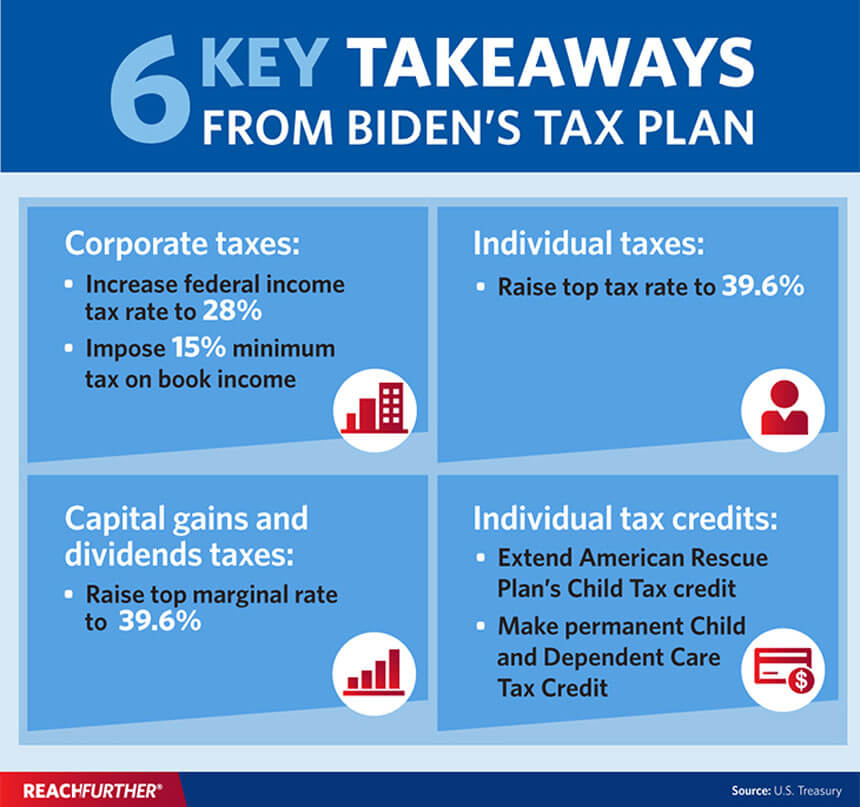

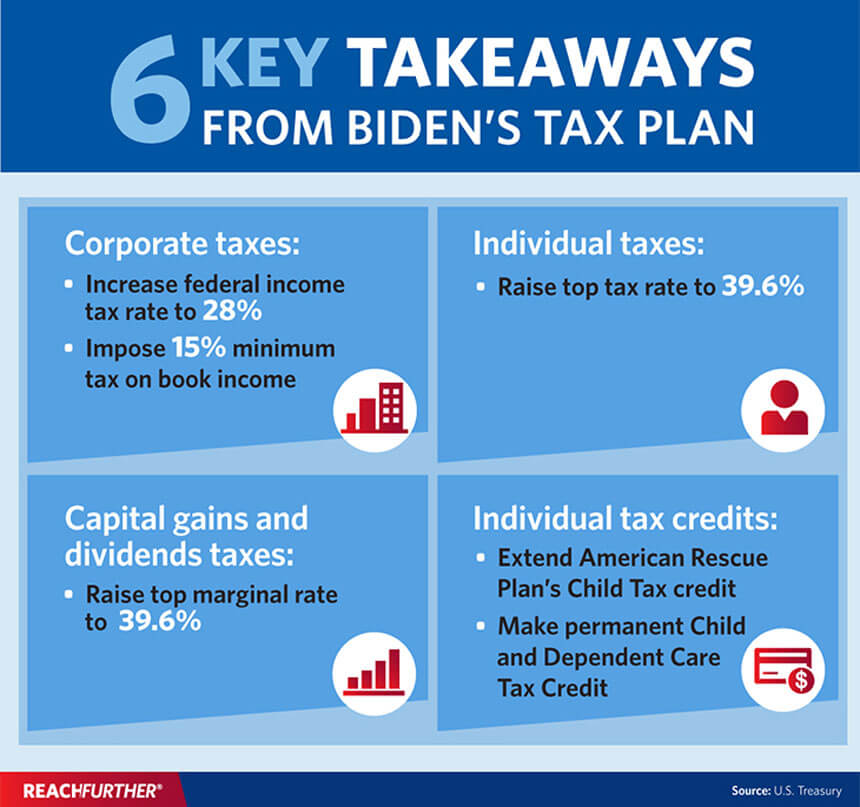

What Biden s Proposed Tax Plan Means For Businesses

https://www.eastwestbank.com/content/dam/ewb-dotcom/reachfurther/newsarticlestore/846/Key-Takeaways-From-Bidens-Tax-Plan.jpg

Biden s Tax Plan Aims To Raise 2 5 Trillion And End Profit Shifting The New York Times

https://static01.nyt.com/images/2021/04/07/business/07dc-biden-tax01alt/07dc-biden-tax01alt-facebookJumbo.jpg

The plan also seeks to promote and expand eviction prevention reforms including those advocated as part of the Biden Administration s implementation of the Emergency Rental Assistance program An expanded child tax credit In 2021 in the midst of the coronavirus pandemic President Biden and Democrats in Congress temporarily beefed up the child tax credit allowing most families to

A critical foundation of that vision and the central goal of the Biden Harris Administration s Housing Supply Action Plan is an economy where everyone has access to a safe and affordable home The most significant pay for in The American Jobs Plan AJP is an increase in the corporate tax rate from 21 to 28 The plan also proposes a minimum book tax for corporations of 15

More picture related to Biden Tax Plan Housing

Zoning Biden Infrastructure Bill Would Curb Single family Housing

https://www.gannett-cdn.com/presto/2021/04/13/USAT/ae56bb3e-6c2b-40d6-b1fb-234a005253a4-XXX_OHCOL_053120_MT_EVICTION_BJP_01.JPG?crop=2399%2C1350%2Cx0%2Cy401&width=1200

Fact Check National Property Tax Isn t Part Of Joe Biden s Plan

https://www.gannett-cdn.com/presto/2020/09/09/PDTF/ccf8e43f-51a2-4b6c-8ddc-57877b22263b-AP_Election_2020_Biden_MIPA3_3.jpg?crop=5392,3033,x0,y369&width=3200&height=1800&format=pjpg&auto=webp

Here s President Biden s Infrastructure And Families Plan In One Chart The New York Times

https://static01.nyt.com/images/2021/04/28/us/-promo-1619645711761/-promo-1619645711761-facebookJumbo.png

As President Biden said last week tackling inflation is his top economic priority Today President Biden is releasing a Housing Supply Action Plan to ease the burden of housing costs over time The proposed First Down Payment Tax Credit is one of many housing related proposals that Biden campaigned on The administration has plans to help cost burdened renters address racial inequities

June 24 2021 at 12 53 p m How a Homebuyer Tax Credit Would Work Getty Images President Joe Biden included a first time homebuyer tax credit in his campaign platform and now many lawmakers are taking action in Congress to see some form of assistance available to first time buyers Between ensuring a good credit score and saving for a down The plan didn t follow up on the president s campaign promise of providing a 15 000 tax credit for first time home buyers Biden s Housing Plan Aims to Help First Time Buyers Address

Here Come The Biden Taxes WSJ

https://images.wsj.net/im-319017?width=860&height=573

President Biden Releases 2020 Federal Tax Returns

https://www.gannett-cdn.com/presto/2021/05/10/USAT/0b094928-abf9-4f4e-9f1d-76de8f2cad6a-AP_AP_Poll_Biden.jpg?crop=3107,1748,x0,y158&width=3107&height=1748&format=pjpg&auto=webp

https://taxfoundation.org/blog/bipartisan-tax-deal-2024-tax-relief-american-families-workers-act/

Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000

https://www.reuters.com/world/us/whats-bipartisan-tax-deal-moving-through-us-congress-2024-01-24/

These deductions would be in place through the 2025 tax year and retroactively to 2022 The bill would also eliminate the double taxation of businesses and workers that operate both in the United

Zoning Biden Infrastructure Bill Would Curb Single family Housing

Here Come The Biden Taxes WSJ

Biden Defends Plans To Tax The Rich The New York Times

Biden s Modest Tax Plan The New York Times

President elect Joe Biden s Tax Plans Are The Latest Trend On Twitter

Biden Releases Financial Info Made More Than 15 5M Before Taxes Over Past Two Years

Biden Releases Financial Info Made More Than 15 5M Before Taxes Over Past Two Years

How The Wealthy Are Planning For Biden s Tax Increases The New York Times

Joe Biden s Tax Returns Show More Than 15 Million In Income After 2016 The New York Times

Bidens Tax Returns Show Income Of 607 336 In 2020 WSJ

Biden Tax Plan Housing - The Biden administration announced an action plan Monday aimed at boosting the supply of affordable housing amid rising home prices and overall high inflation Taken together administration