California Real Estate Planning Protect House From Costs PROP 19 CALIFORNIA STRATEGIES AND PROP 13 PROTECTIONS CunninghamLegal offers advanced legal strategies to avoid property reassessments under California Proposition 13 and Proposition 19 New strategies now available for Prop 19 transfers to children after the February 2021 deadline Protect your Prop 13 property tax Caps

California provides an automatic homestead exemption as of January 1 2021 ranging from 300 000 to 600 000 adjusted for inflation each year The exact amount depends on the median home price in the county where the property is located The minimum homestead protection in California is 300 000 California Proposition 19 significantly limits the ability to transfer your home or other real estate properties to your heirs children or family without property tax reassessment A property tax reassessment may add huge sums to the heirs tax liability The Act applies to all real property transfers on or after February 16th 2021

California Real Estate Planning Protect House From Costs

California Real Estate Planning Protect House From Costs

https://i.ytimg.com/vi/6I1q4AOAnQM/maxresdefault.jpg

California Real Estate Market Update For May 1st 8th 2023 YouTube

https://i.ytimg.com/vi/-6BrKH7kpRg/maxresdefault.jpg

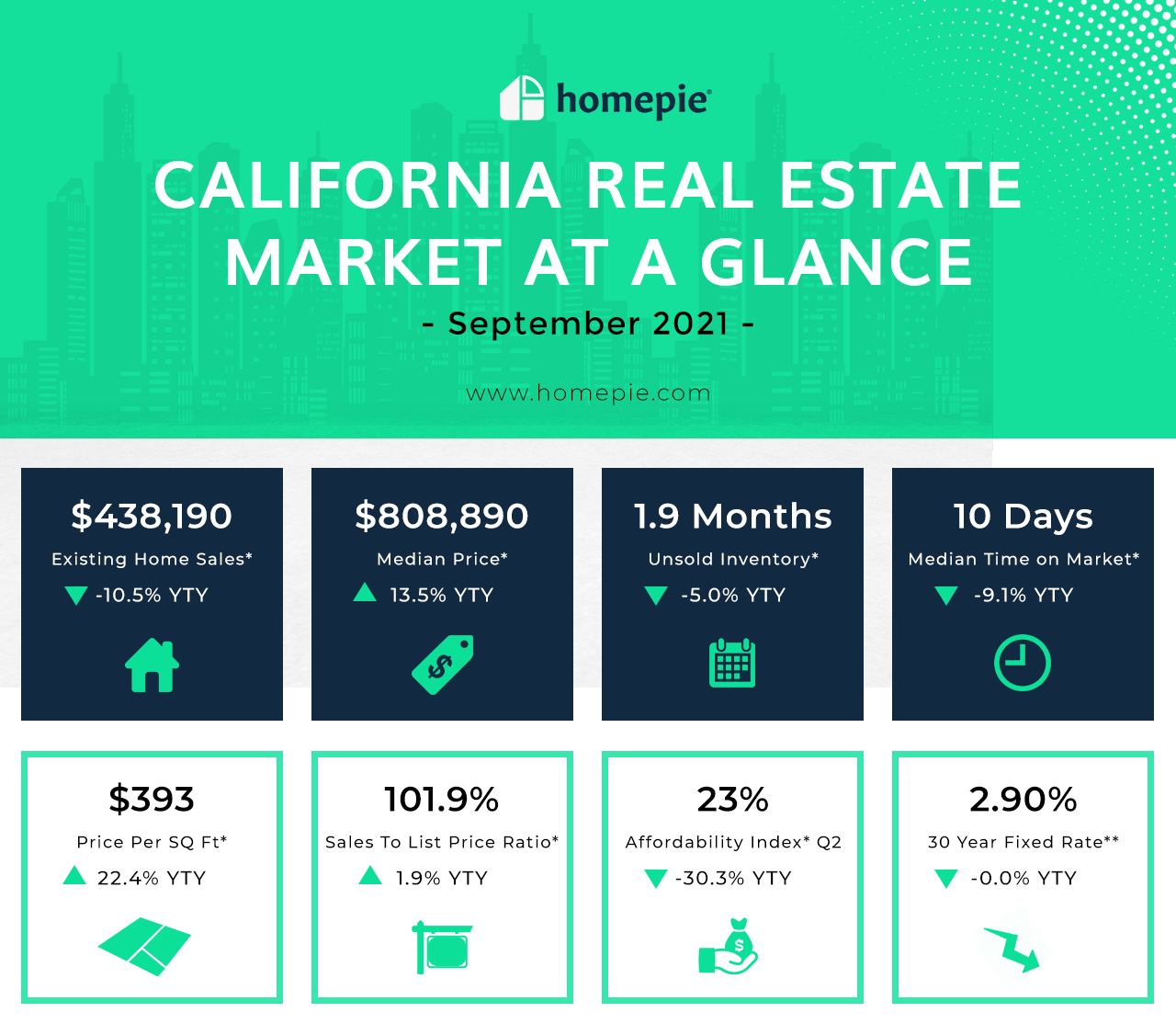

California Real Estate Market At A Glance September 2021

https://homepie.com/articles/wp-content/uploads/2021/10/California_September2021.png

California s newly passed Proposition 19 will likely have major tax consequences for individuals inheriting property from their parents Proposition 19 was approved by California voters in the November 2020 election and will result in significant changes to the property tax benefits Californians enjoyed previously under the 1978 Proposition 13 law in effect previously The minimum protection is 300 000 The maximum protection is the lower of 600 000 or the median house value in the county where the property is located These figures are adjusted annual based on the Consumer Price Index Since the California median house price is much higher than the national average

An irrevocable trust can protect your money from nursing home costs but they have costs and drawbacks of their own including permanently losing direct control of your assets Talk to a to learn about options for paying for long term care Irrevocable Trust Basics is a legal entity many people create as part of an Homeowners in California who desire to keep their real estate in the family need to understand the new rules under Proposition 19 We will help you navigate your future real estate succession planning and provide a sound estate planning strategy for avoiding costly property tax reassessment California s Proposition 19 and Property Tax

More picture related to California Real Estate Planning Protect House From Costs

Dfw Real Estate California Real Estate Real Estate Investing

https://i.pinimg.com/originals/74/33/93/743393098511fab3de4c7be541f33c57.jpg

California Real Estate Wholesaling Guide

https://d1yei2z3i6k35z.cloudfront.net/3147194/64c804ae45b92_CaliforniaRealEstateWholesalingGuide5.png

Best Places To Invest In California Real Estate Ark7

https://ark7.com/blog/wp-content/uploads/2023/06/California.png

EXAMPLE 1 John buys a property in his name for 500 000 He spends 50 000 fixing up and marketing the property and then sells it in his name for 600 000 netting a 50 000 profit Unfortunately 3 1 3 20 000 of the sales price is withheld Therefore 40 of John s profit goes to the FTB instead of into his pocket 11 25 2020 Updates On November 3 2020 California voters narrowly approved Proposition 19 The Home Protection for Seniors Severely Disabled Families and Victims of Wildfire or Natural Disasters Act and with it comes significant property tax changes for California real property owners

Buy long term care coverage Long term care insurance is specifically designed to help you cover the costs of nursing home care The coverage can help you pay for the gap between what Medicare covers and what it costs without dipping into your nest egg Although the annual costs of a long term care insurance policy can be steep it will serve A possible legal strategy remains open for people to pass their Prop 13 tax assessment caps to their children now that the Prop 19 Feb 16 2021 deadline has passed The Family Property LLC concept is complex but should be considered especially by high net worth families By James L Cunningham Jr Esq

Introduction To California Real Estate Investment By Walk In The

https://miro.medium.com/v2/resize:fit:1024/1*UEj8b_3woSmvVVm2r7GOBA.jpeg

The Implosion Of The California Housing Market Is HERE Real Estate Alley

https://i.ytimg.com/vi/0CCexNpGrL8/maxresdefault.jpg

https://www.cunninghamlegal.com/california-legal-services/california-prop-13-protection-prop-19-strategy/

PROP 19 CALIFORNIA STRATEGIES AND PROP 13 PROTECTIONS CunninghamLegal offers advanced legal strategies to avoid property reassessments under California Proposition 13 and Proposition 19 New strategies now available for Prop 19 transfers to children after the February 2021 deadline Protect your Prop 13 property tax Caps

https://www.assetprotectionplanners.com/strategies/protect-home-lawsuit-california/

California provides an automatic homestead exemption as of January 1 2021 ranging from 300 000 to 600 000 adjusted for inflation each year The exact amount depends on the median home price in the county where the property is located The minimum homestead protection in California is 300 000

California Real Estate Licensing Law Tap To Watch Video In 2021 Real

Introduction To California Real Estate Investment By Walk In The

California Real Estate California Locals

The Ins And Outs Of Inactive Real Estate Licenses In California By

ReImagine Conference And Expo Recap Marketing 4 Real Results

Doctrine Of Merger In California Real Estate Owning Adjoining Parcels

Doctrine Of Merger In California Real Estate Owning Adjoining Parcels

Parmjit Singh Real Estate Agent Better Homes And Gardens Real Estate

805title New Laws In California Real Estate

Q3 2022 Northern California Real Estate Market Update Windermere Real

California Real Estate Planning Protect House From Costs - In 2021 the average cost for a semi private room was 7 908 per month increasing to 9 034 per month for a private room When you consider the average Social Security payout is about 1 700 per month this leaves seniors struggling to afford the care they need It s no surprise that so many people turn to Medicaid for help