Cashing In A 529 Plan For Off Campus Housing For example if your college estimates 800 per month for rent your 529 dollars can be used for up to 800 including utilities but any more than that will be taxed under normal federal income tax With that in mind a healthy dose of research will be needed before your move

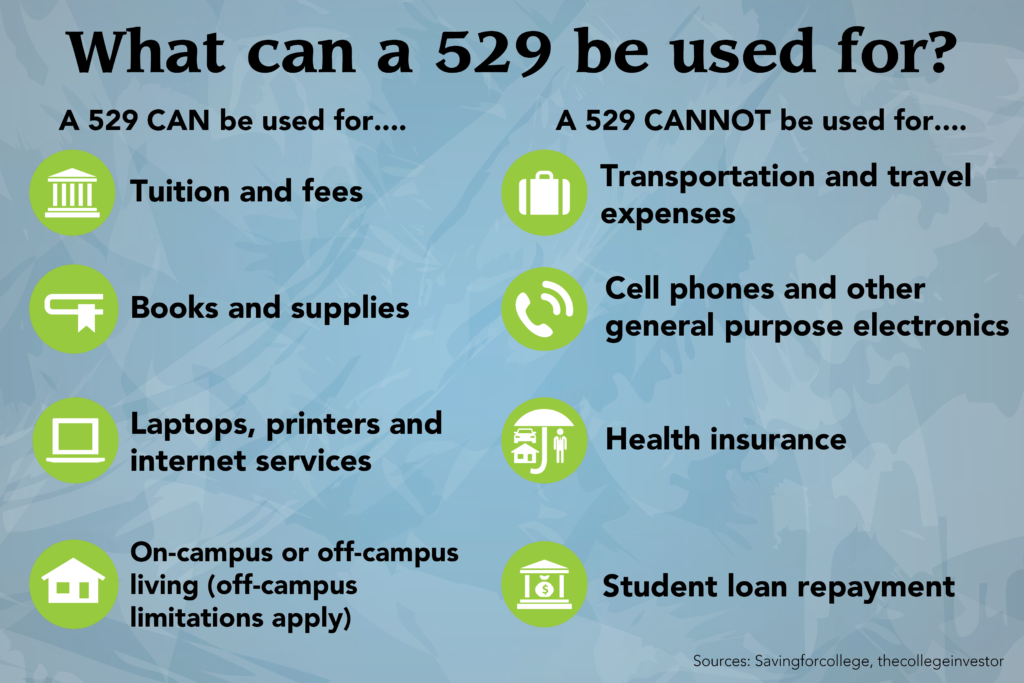

Off campus room and board 529 plan allowable claim amount My son lived on campus for the first year and is going to live off campus starting this fall The CLA estimate listed on the school website for 2022 2023 is a lot lower than the actual amount charged to us for the school year 2021 2022 Actual on campus room and board charges vary based By Kathryn Flynn July 27 2023 You can withdraw 529 plan savings tax free to pay for qualified education expenses which include costs required for enrollment and attendance at in state out of state public and private colleges universities or other eligible post secondary educational institutions

Cashing In A 529 Plan For Off Campus Housing

Cashing In A 529 Plan For Off Campus Housing

https://static.lazymanandmoney.com/images/2019/05/29121050/529-Plans.jpg

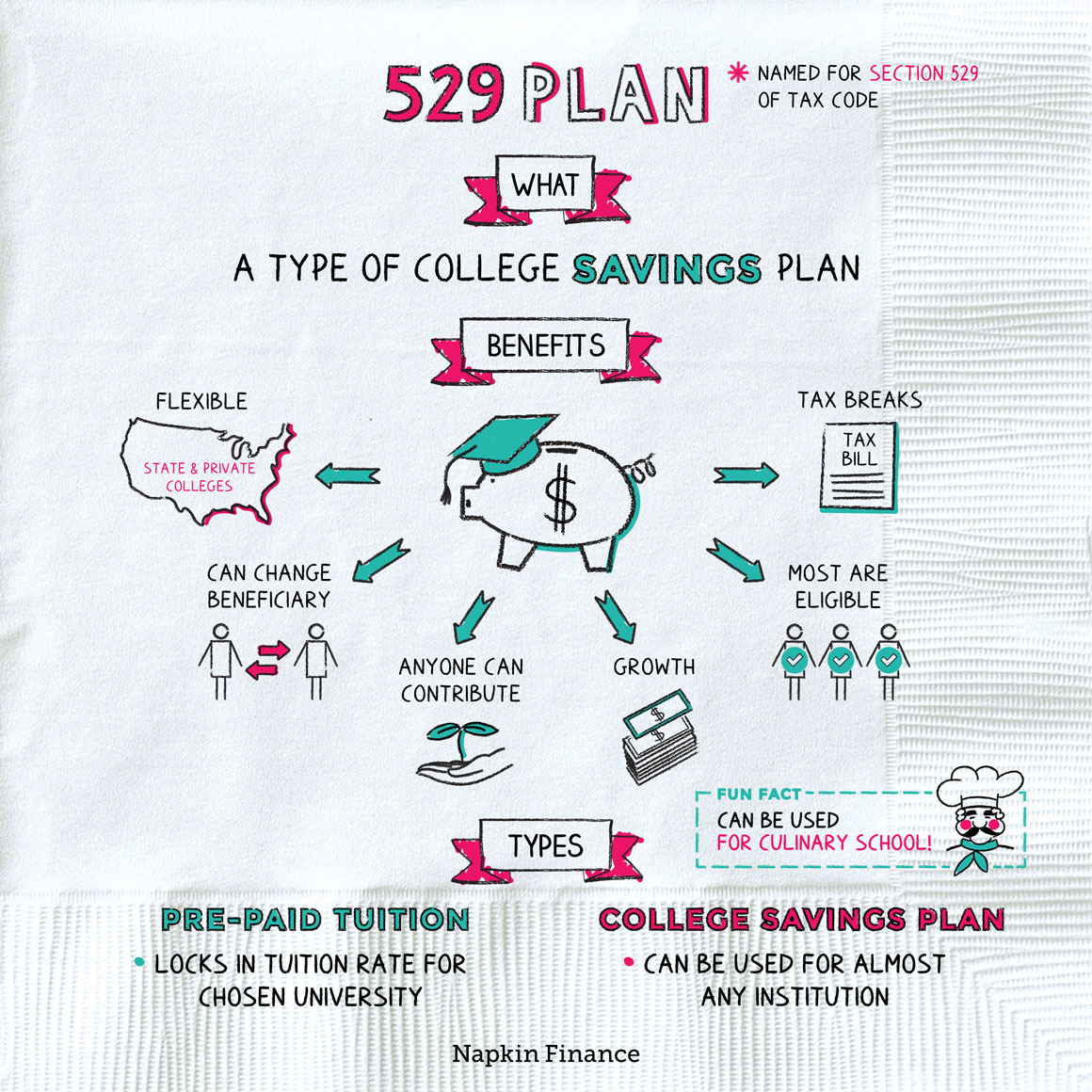

Everything You Need To Know About 529 College Savings Plans In 2023

https://529-planning.com/wp-content/uploads/2020/12/GettyImages-182175346-5c4e721dc9e77c0001d7bb0f.jpg

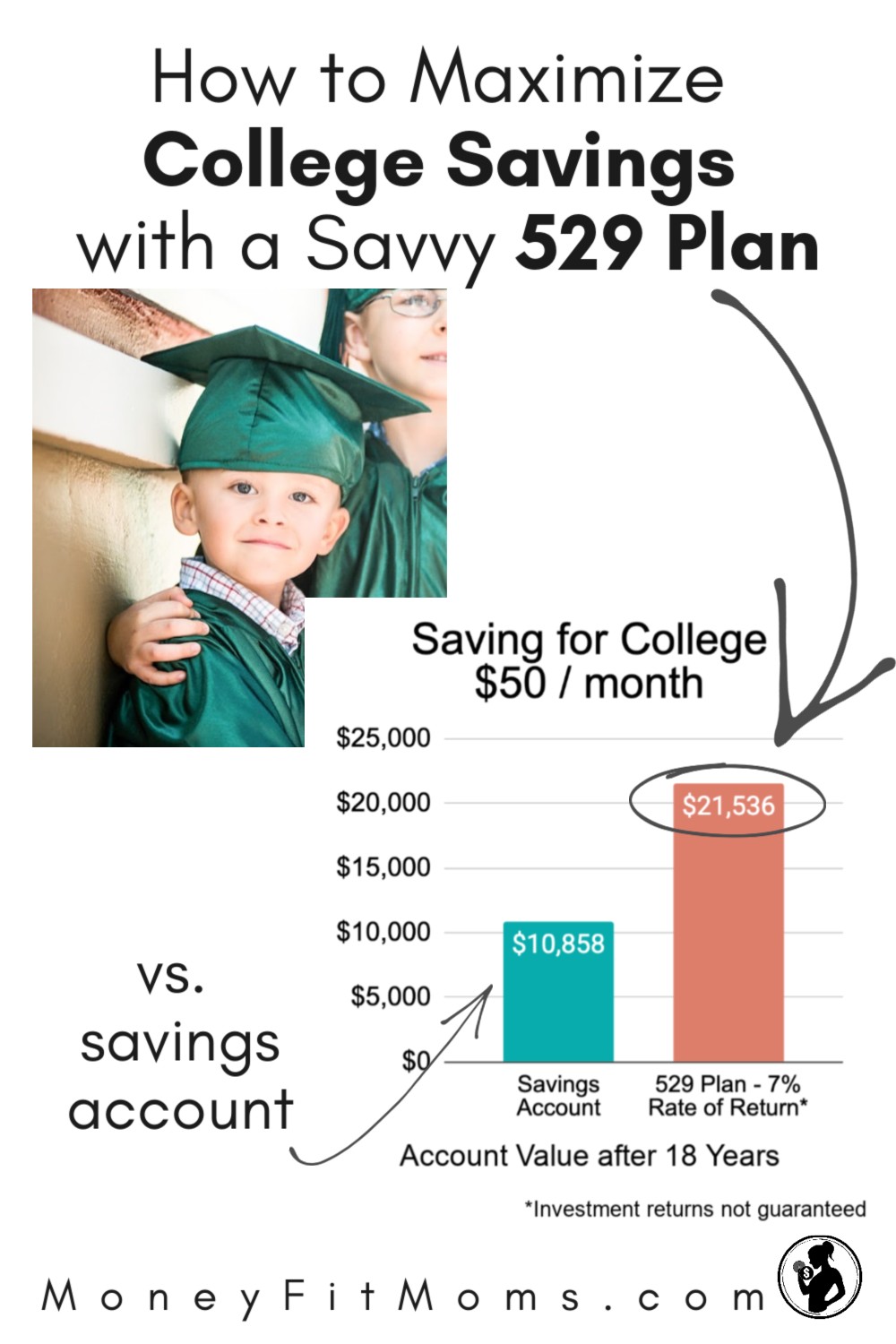

Do 529 Plans Outperform Savings Accounts

https://wiserinvestor.com/wp-content/uploads/2022/11/Copy-of-Website-Image-Blog-8.jpg

Another option that s new this year is to use the leftover 529 money to fund Roth IRAs for your children the original beneficiaries If the account has been open at least 15 years each year The short answer is Yes room and board expenses for off campus housing including a parent s home may be reimbursed through a 529 plan but not necessarily the full cost

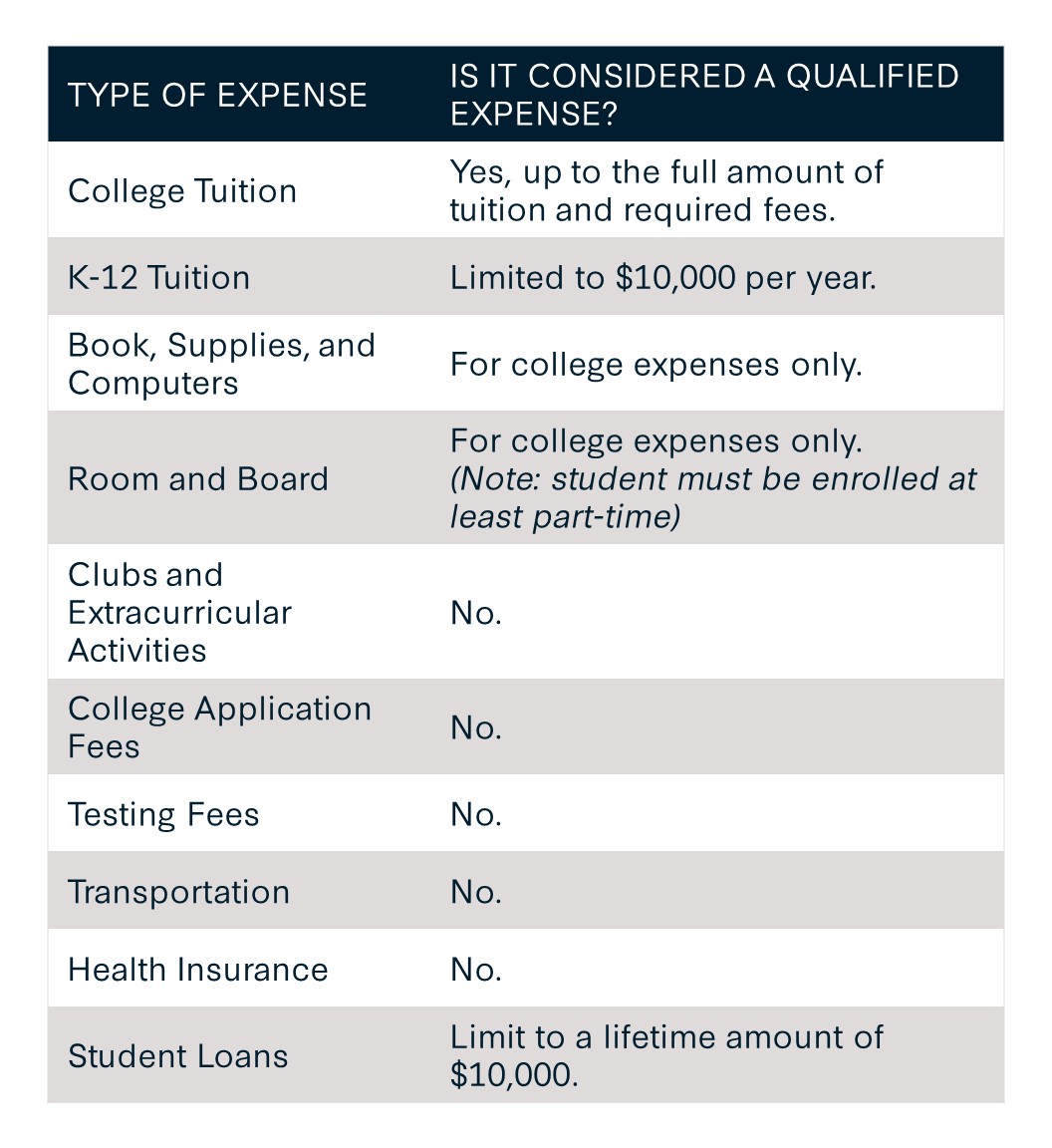

Your 529 money can also be spent on expenses for K 12 education up to 10 000 per student each year But not every state will recognize elementary and secondary school expenses as qualified In general you can use 529 funds to pay for your student s off campus housing costs However housing is one of many expenses that are subject to a reimbursement limit Essentially the school sets a budget or allowance for room and board referred to as the cost of attendance

More picture related to Cashing In A 529 Plan For Off Campus Housing

How To Maximize College Savings With A Savvy 529 Plan

https://moneyfitmoms.com/wp-content/uploads/2021/05/529-Plan-Saving-for-College-2.jpg

Understanding 529 Plans Infographic

https://www.carsonwealth.com/wp-content/uploads/2015/06/529-Plans-Infographic-e1434750644953.jpg

Ready To Use Your 529 Plan Coldstream

https://www.coldstream.com/wp-content/uploads/2022/09/Ready-to-Use-Your-529-Account-Graphic.jpg

Whether you live on campus or off you can use your 529 plan spending for your room and board expenses The caveat here is that your off campus housing costs can t be higher than you d pay to live on campus if you want to use 529 funds Required Textbooks and Supplies May 29 2019 at 10 43 a m Opening a 529 plan allows parents to achieve tax free college savings for their children But without a full understanding of the 529 plan qualified expenses and

p I would be interested in hearing from parents who use funds from 529 accounts to pay for off campus housing costs p p Our 529 plan states that the limit for off campus housing is the allowance included in the COA at the university or if greater the actual amount charged by the university for room and board costs p p On University X s website estimates for off campus room If your student lives off campus you can use 529 funds to cover the cost of rent and utilities up to the college s housing allowance said Lee C McGowan a financial adviser in Concord

The Unique Benefits Of 529 College Savings Plans

https://www.thetaxadviser.com/content/dam/tta/issues/2023/may/529-2.png

Benefits Of A 529 Plan District Capital 41 OFF

https://napkinfinance.com/wp-content/uploads/2018/07/NapkinFinance-529Plan-Napkin-02-26-19-v05-1.jpg

https://www.forrent.com/blog/off-campus-living/529-plan-for-off-campus-housing/

For example if your college estimates 800 per month for rent your 529 dollars can be used for up to 800 including utilities but any more than that will be taxed under normal federal income tax With that in mind a healthy dose of research will be needed before your move

https://ttlc.intuit.com/community/taxes/discussion/off-campus-room-and-board-529-plan-allowable-claim-amount/00/2762564

Off campus room and board 529 plan allowable claim amount My son lived on campus for the first year and is going to live off campus starting this fall The CLA estimate listed on the school website for 2022 2023 is a lot lower than the actual amount charged to us for the school year 2021 2022 Actual on campus room and board charges vary based

Understanding 529 Plan Qualified Expenses For Off Campus Housing

The Unique Benefits Of 529 College Savings Plans

Contributions To College Savings Plans Pick Up As Inflation Eases The

The Pros And Cons Of Investing In A 529 Plan For College Bennett

9 Benefits Of A 529 Plan District Capital

How To Close A 529 Plan Finance Zacks

How To Close A 529 Plan Finance Zacks

What You Need To Know About 529 Plans CNBconnect

529 Plan Qualified Expenses Using The 529 To Pay Off Campus Rent

What Is A 529 Plan Flipboard

Cashing In A 529 Plan For Off Campus Housing - The short answer is Yes room and board expenses for off campus housing including a parent s home may be reimbursed through a 529 plan but not necessarily the full cost