College Expenses Tax Plan House Senate 529 Plans tax free investment programs for college savers have been augmented by over a dozen articles of federal legislation since their introduction in 1996 improving tax benefits

Sen Tom Cotton R AR introduced the Student Loan Reform Act of 2022 which would impose a 20 percent luxury tax on undergraduate tuition fees over 40 000 to fund workforce training and place a 1 percent tax on the fair market value of private college endowments A Nov 7 memorandum from the Joint Committee on Taxation JCT found that 41 million donors would claim around 241 1 billion under the deduction in 2018 under current law as opposed to nine million donors claiming approximately 146 3 billion under the House plan

College Expenses Tax Plan House Senate

College Expenses Tax Plan House Senate

https://thenextfind.com/wp-content/uploads/2022/10/difference-between-house-senate.png

Claim Medical Expenses On Your Taxes Health For CA

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/02x.jpeg

Significance Of Tax Planning By Lifeline Tax Issuu

https://image.isu.pub/200728112906-06962b996f68596c04e8bd11f90f4d17/jpg/page_1.jpg

The law expands the benefits of 529 savings plans which are educational savings plans operated by a state state agency or educational institution named after the IRS code section that created them The Tennessean reported in January 2018 Before the new tax plan 529 plans were exclusively used for college related expenses but the new tax plan includes a provision that allows By Carrie Warick Director of Policy and Advocacy Over the past two weeks Congressional Republicans have released two different plans to fulfill their pledge to cut taxes and simplify the tax system one in the House and one in the Senate Both bills are named the Tax Cuts and Jobs Act but the content that affects higher education differs in several places

The independent Joint Committee on Taxation estimates the plan could cost roughly 70 80 billion Aides expect they could cover the cost by overhauling a COVID relief tax credit to save about November 03 2017 The GOP call to eliminate tax breaks for students will deliver relatively small savings to the federal budget But it could have a sizable impact on people struggling to afford

More picture related to College Expenses Tax Plan House Senate

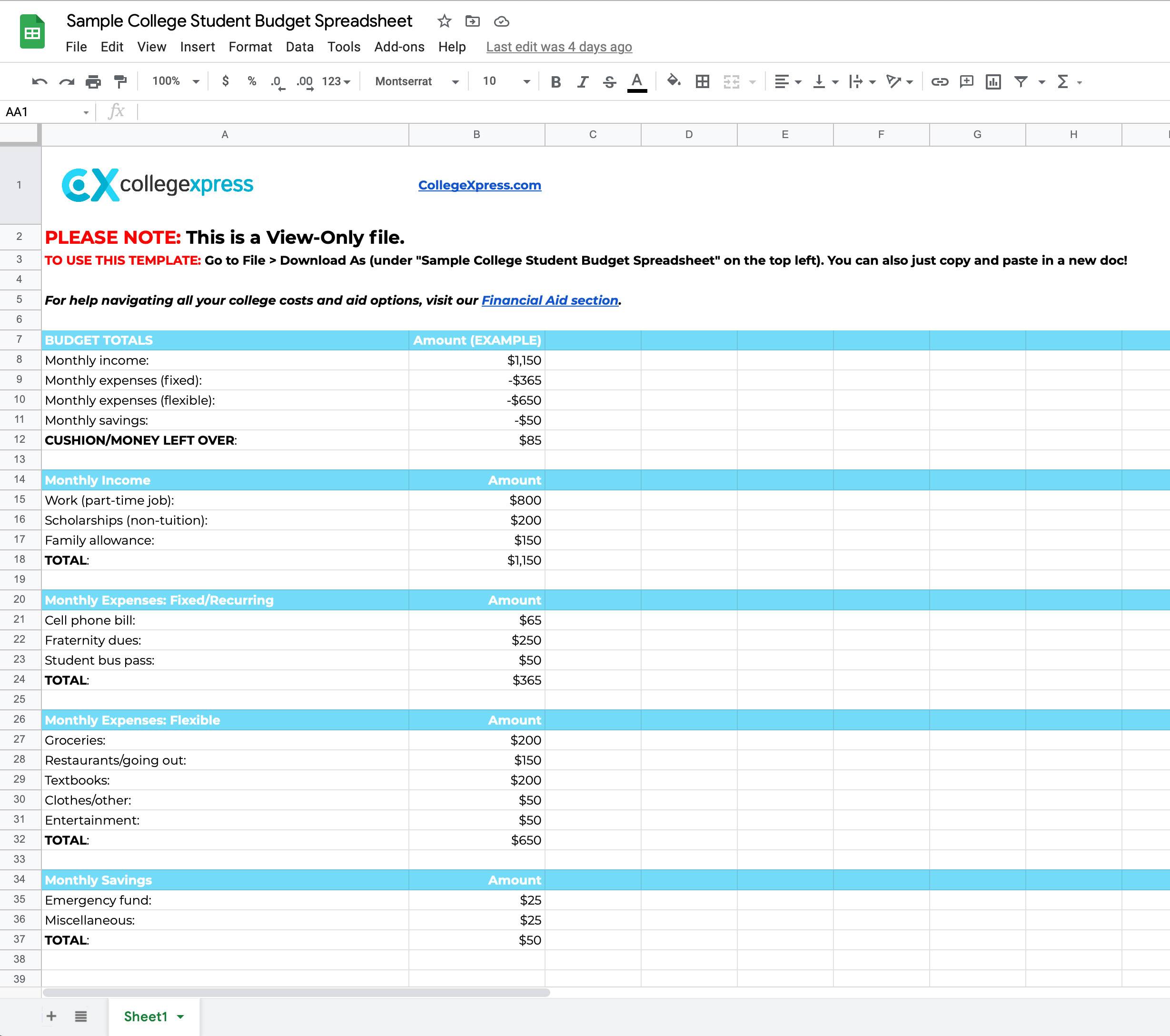

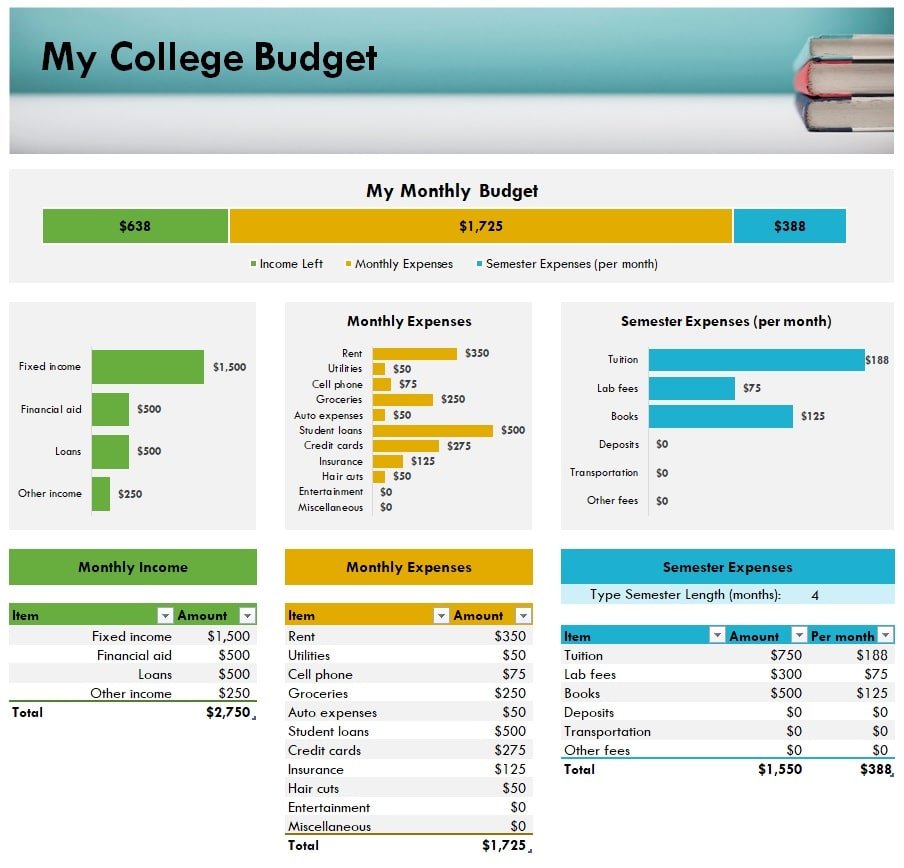

You Need A Budget College Mertqpost

https://images.collegexpress.com/article/updated-sample-college-student-budget-spreadsheet-template.jpg

Congress Finally Approves Pay For House Senate Interns HuffPost

https://img.huffingtonpost.com/asset/5b9b0b7f2000002d00fd0f32.jpeg?cache=2vr1lsnrx3&ops=1910_1000

Senate Approves GOP Tax Plan House To Revote Wednesday Fox61

https://media.tegna-media.com/assets/WTIC/images/1f337bd1-9fb7-4f97-bbcf-7dc2d447c765/1f337bd1-9fb7-4f97-bbcf-7dc2d447c765_1920x1080.jpg

For example let s say you re considering three ways to cover 30 000 in college expenses your cash flow a 529 plan or student loans If your effective tax rate is 35 and you pay for As the House and Senate iron out a tax plan the nation s 20 million college students are waiting to see how it might affect them as are the schools they attend The plan is likely to

An expanded child tax credit In 2021 in the midst of the coronavirus pandemic President Biden and Democrats in Congress temporarily beefed up the child tax credit allowing most families to The AOC is worth up to 2 500 per student for each of the first four years of college An earlier House bill would have expanded the benefit to a fifth year but that provision was omitted in

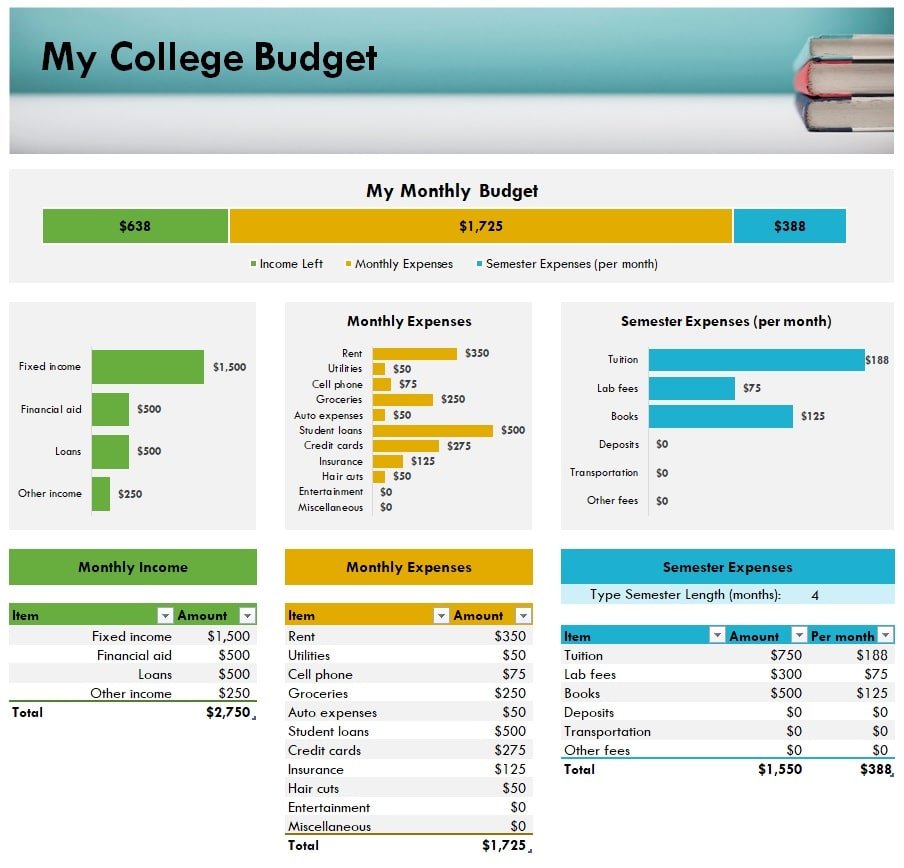

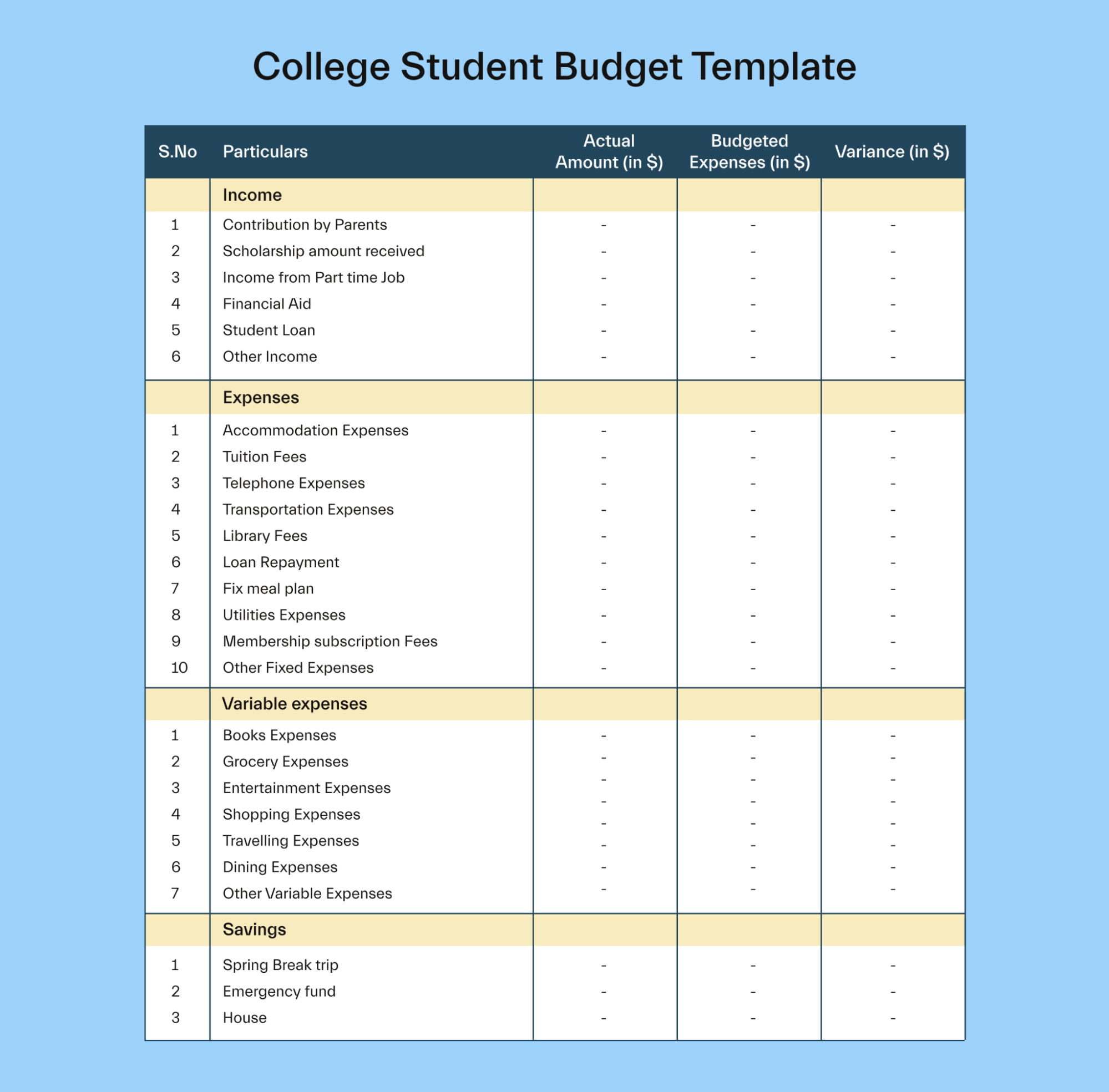

College Expense Budget Template In Excel Download xlsx

https://techguruplus.com/wp-content/uploads/2022/08/College-Expense-Budget-Template-in-Excel-Download.xlsx.jpg

The Senate Parliamentary Education Office

http://peo.gov.au/assets/images/Page-thumbnails/Interactive-posters/PiP-thumb-Senate.jpg

https://www.forbes.com/sites/brianboswell/2022/07/19/new-bill-could-make-529-plans-a-no-brainer/

529 Plans tax free investment programs for college savers have been augmented by over a dozen articles of federal legislation since their introduction in 1996 improving tax benefits

https://www.nacubo.org/News/2022/9/Federal%20Lawmakers%20Propose%20Strict%20Rules%20for%20Endowments%20and%20College%20Costs

Sen Tom Cotton R AR introduced the Student Loan Reform Act of 2022 which would impose a 20 percent luxury tax on undergraduate tuition fees over 40 000 to fund workforce training and place a 1 percent tax on the fair market value of private college endowments

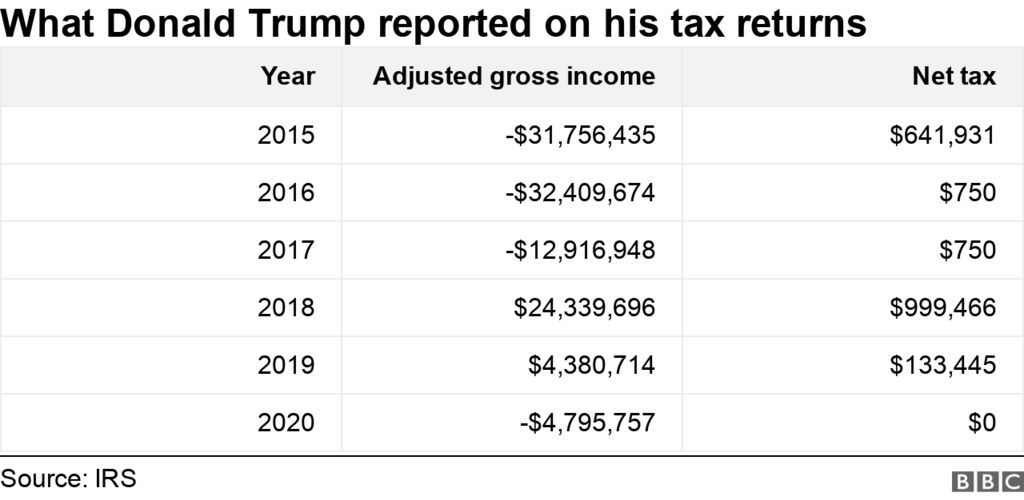

What Do Trump s Tax Returns Show MyJoyOnline

College Expense Budget Template In Excel Download xlsx

Everything You Need To Know About The Senate GOP Tax Plan Crain s

As Deadline Nears A Flurry Of Bills Pass In The House And Senate

Legislative Update

Learn How To Save Tax On Medical Expenses Section 80D YouTube

Learn How To Save Tax On Medical Expenses Section 80D YouTube

MoneyWatch States Could Tax Student Loans Forgiven Under President

College Student Budget Template Excel Printable Worksheets

Senate Bill Proposes Annual Reduction Of Personal Income Taxes In North

College Expenses Tax Plan House Senate - According to the U S Department of Education the maximum amount a student could receive through a Pell Grant for the 2023 2024 school year is 7 395 How taxes on the grant work right now Ulrich said it s almost like a punishment for students who are trying to make the best choices for their financial situation and academic career