Congressional House Tax Plan The refundable portion would rise by 200 to 1 800 per child for the 2023 tax year 1 900 in 2024 and 2 000 in 2025 An inflation adjustment in 2025 could raise the refundable portion further

WASHINGTON Senior lawmakers in Congress announced a bipartisan deal Tuesday to expand the child tax credit and provide a series of tax breaks for businesses The 78 billion tax agreement Published Sept 13 2021 Updated Sept 15 2021 WASHINGTON House Democrats on Monday presented a plan to pay for their expansive social policy and climate change package by raising taxes by

Congressional House Tax Plan

Congressional House Tax Plan

https://www.cleveland.com/resizer/gMS4lu9vJKlwGgoczpD-szyqiYM=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/YI5Q4KBDUVAHVPCJE4NRDX3ISQ.jpg

Senate Plan Tax Changes For Families Temporary Corporations Permanent

https://www.gannett-cdn.com/-mm-/ce331251ef518ae05fc71d8409171fa25753331e/c=0-52-1023-630/local/-/media/2017/09/27/USATODAY/USATODAY/636421327393960796-HATCH.JPG?width=1023&height=578&fit=crop&format=pjpg&auto=webp

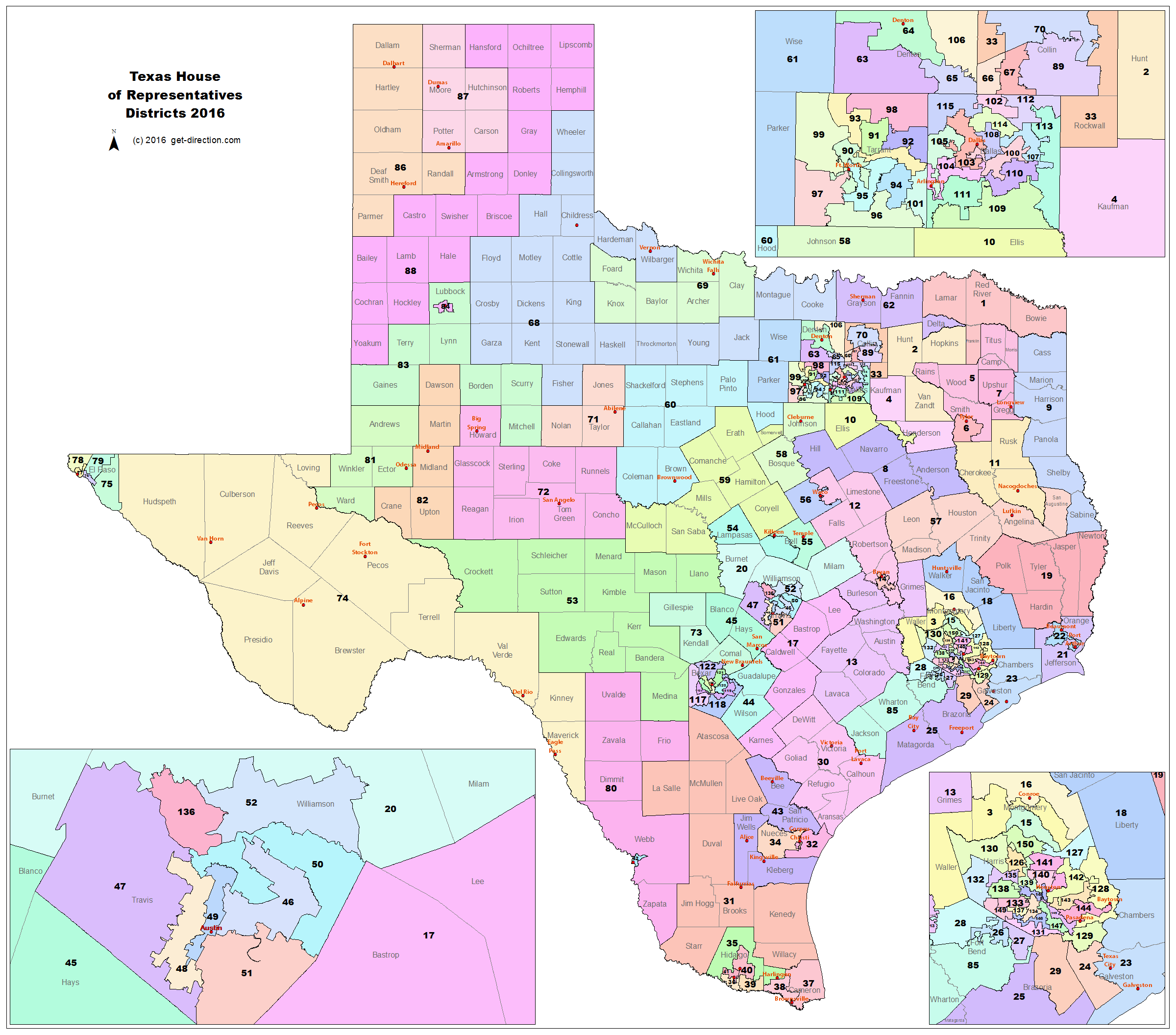

Map Of Texas Congressional Districts Map Images And Photos Finder

https://get-direction.com/images/usa/texas/texas-house-of-representatives-districts-2016.png

An expanded child tax credit In 2021 in the midst of the coronavirus pandemic President Biden and Democrats in Congress temporarily beefed up the child tax credit allowing most families to A plan by House Democrats to fund President Biden s 3 5 trillion social policy bill includes tax increases on corporations and the rich Credit

Congressional Republicans plan will increase middle class families taxes an average of nearly 1 500 this year alone and take 100 billion out of the hands of middle class families each year Key Points House Democrats outlined tax increases they aim to use to offset up to 3 5 trillion in spending on the social safety net and climate policy The proposal includes top corporate and

More picture related to Congressional House Tax Plan

Senate Tax Plan Is Better Than House Version Rep Massie Fox

https://cf-images.us-east-1.prod.boltdns.net/v1/static/854081161001/e2f191a0-f85e-459a-9639-00e559295680/3094ccbe-7a29-486c-a5b8-38f6fddfceab/1280x720/match/image.jpg

Congressional Leaders Signal Short term Funding Deal Needed To Avert

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1mLAhe.img

2024 Congressional Election Polling

https://www.nationaljournal.com/media/media/2023/07/18/congressional_party_polling.gif

10 min White House officials released a plan Thursday that they say would raise approximately 2 trillion in new revenue over 10 years to pay for their Build Back Better spending package the The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000 in 2025 as well as apply an inflation adjustment in 2025 that would make the cap match the credit maximum of 2 100

The plan also includes Biden s promised billionaires tax which would establish a minimum 25 rate for the top 0 01 of earners and include taxes on unrealized capital gains without taxes WASHINGTON A 78 billion tax package with major benefits for companies took a significant step towards becoming law on Friday when a key House panel overwhelmingly approved the bill by a

Colorado Congressional Districts Map 2022 SHO NEWS

https://i2.wp.com/www.fox21news.com/wp-content/uploads/sites/37/2021/09/Colorado-Congressional-Map-Second-Staff-Plan-Sept-2021.jpg

Ervaren Dossierverantwoordelijke Sempels Accountancy Tax

https://sempelsbhk.be/wp-content/uploads/2022/09/LOGO-SEMPELS.png

https://www.reuters.com/world/us/whats-bipartisan-tax-deal-moving-through-us-congress-2024-01-24/

The refundable portion would rise by 200 to 1 800 per child for the 2023 tax year 1 900 in 2024 and 2 000 in 2025 An inflation adjustment in 2025 could raise the refundable portion further

https://www.nbcnews.com/politics/congress/congress-announces-tax-deal-expand-child-tax-credit-business-breaks-rcna134067

WASHINGTON Senior lawmakers in Congress announced a bipartisan deal Tuesday to expand the child tax credit and provide a series of tax breaks for businesses The 78 billion tax agreement

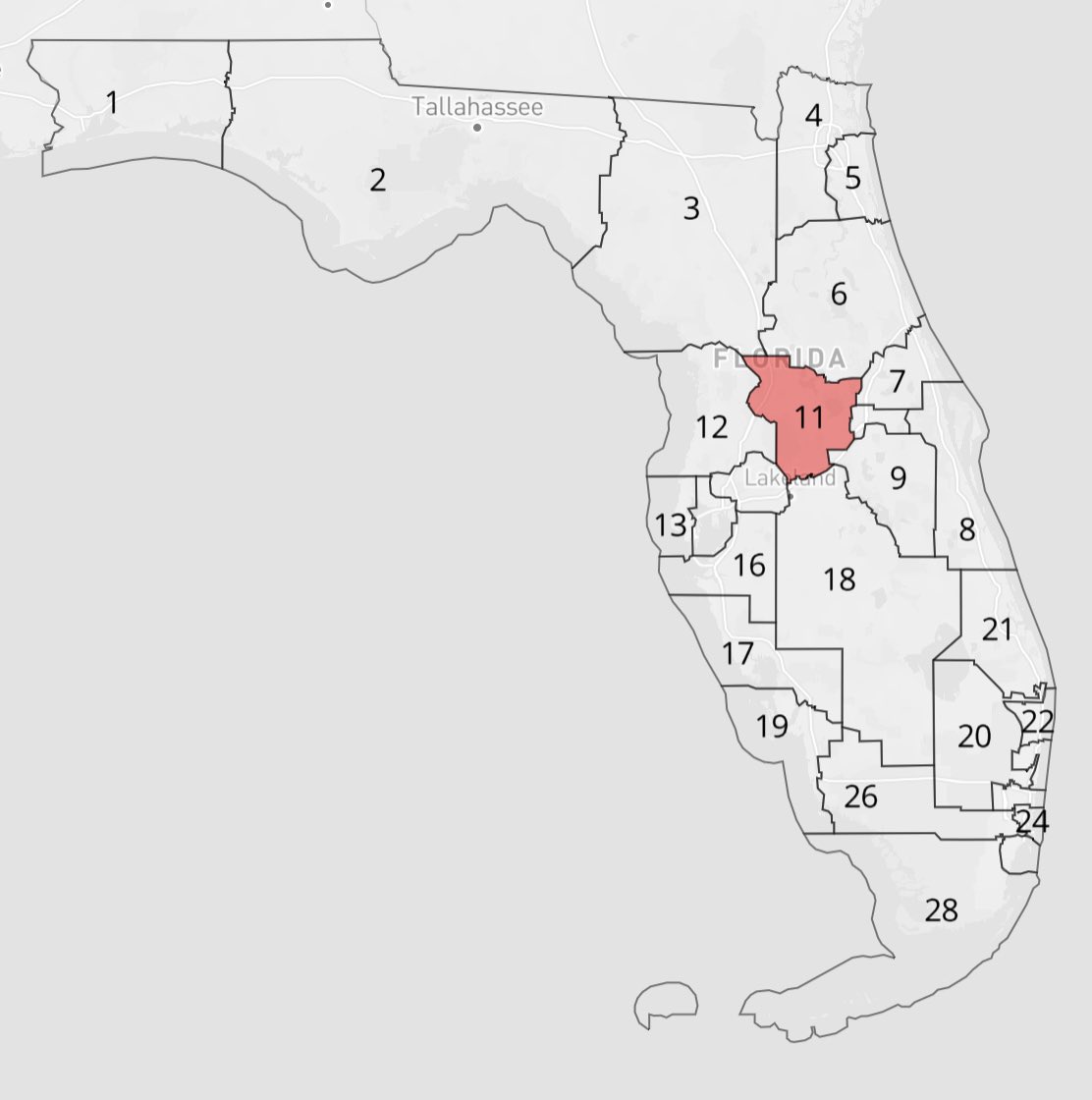

Florida Politics Enjoyer On Twitter This Congressional District

Colorado Congressional Districts Map 2022 SHO NEWS

WNC MOAA Legislative Affairs

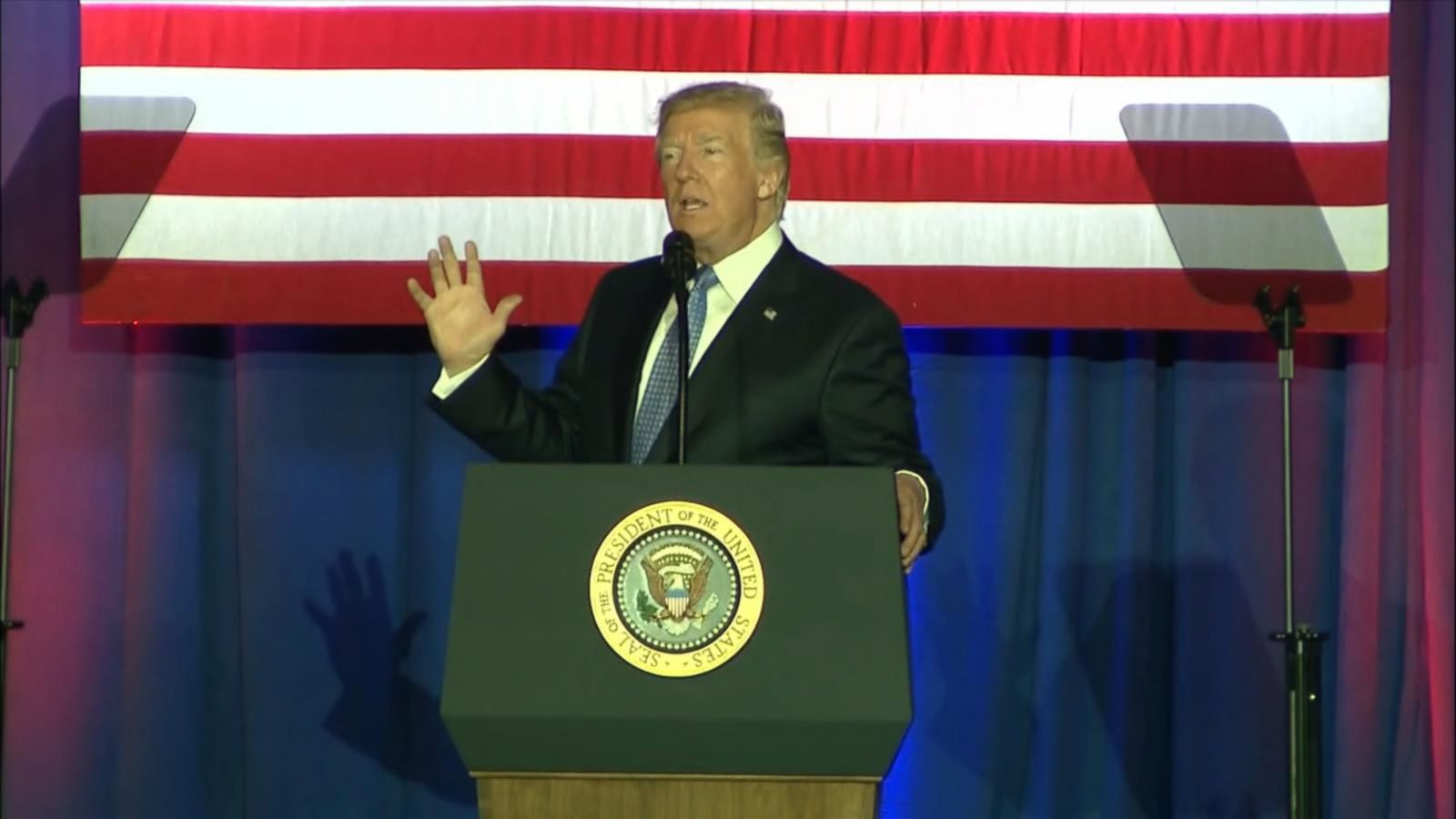

Trump Announces Plan To Cut Tax Rates Double Deductions Good Morning

Bipartisan Blockbuster Record Setting Percentage Of Congress Now

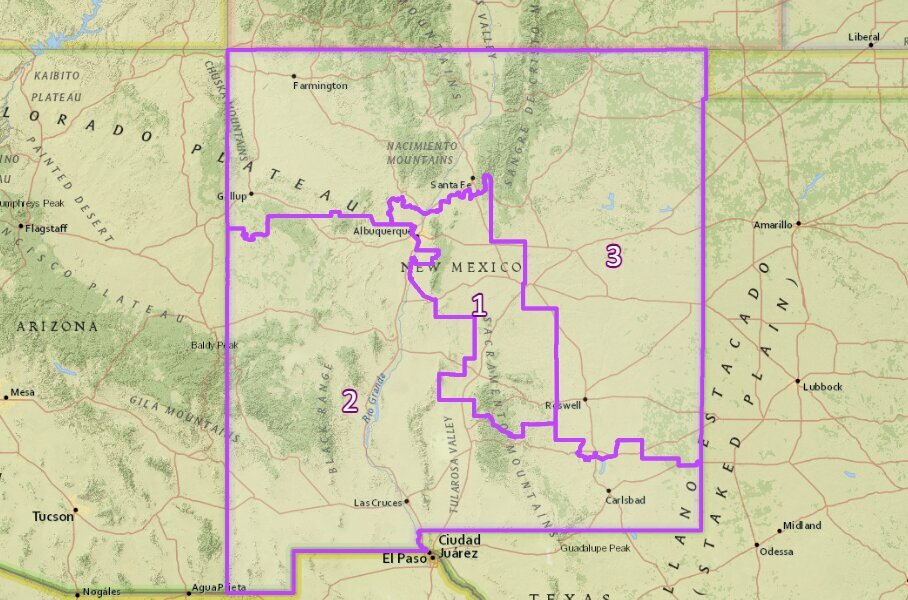

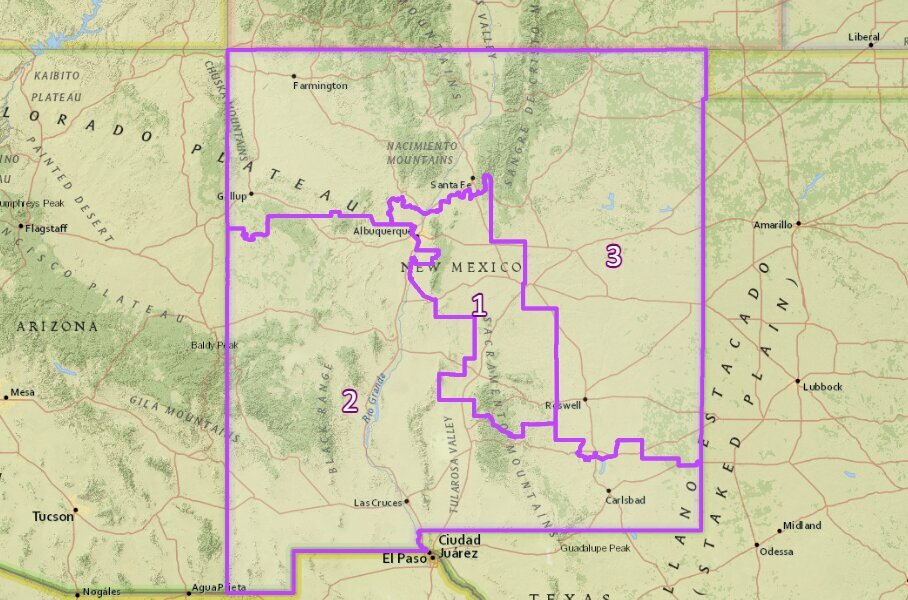

Debate Over Redistricting Commission Moves To Senate Desert Exposure

Debate Over Redistricting Commission Moves To Senate Desert Exposure

3 Tips For First Time Tax Filers Bookkeeping Services Tax Services

Laminated Map Us Congressional District Map House Districts By My XXX

The Chancellor Says He Wants Britain To Have the Most Competitive

Congressional House Tax Plan - 01 22 2024 10 00 AM EST Presented by With help from Brian Faler Driving the day ONE STEP AFTER ANOTHER Supporters of the bipartisan tax bill needed a statement vote out of the House Ways and