Life Insurance Premium Tax Deduction In most cases you cannot deduct life insurance premiums on your taxes The Internal Revenue Service IRS generally views life insurance as a personal expense and thus it s not typically tax deductible from an individual s gross income However there are

Life insurance death benefit payouts are usually not taxable That means beneficiaries will receive the money without a tax burden hanging over their heads However there are certain Life insurance premiums paid by individuals are generally not tax deductible under U S tax law The Internal Revenue Service IRS classifies these premiums as personal expenses which are not eligible for deductions on individual tax returns

Life Insurance Premium Tax Deduction

Life Insurance Premium Tax Deduction

https://imgv2-2-f.scribdassets.com/img/document/621209247/original/e512c5247b/1708190931?v=1

Request Letter To Stop Deduction From Salary Request Letter For Stop

https://i.ytimg.com/vi/T2IaPwOvIX4/maxresdefault.jpg

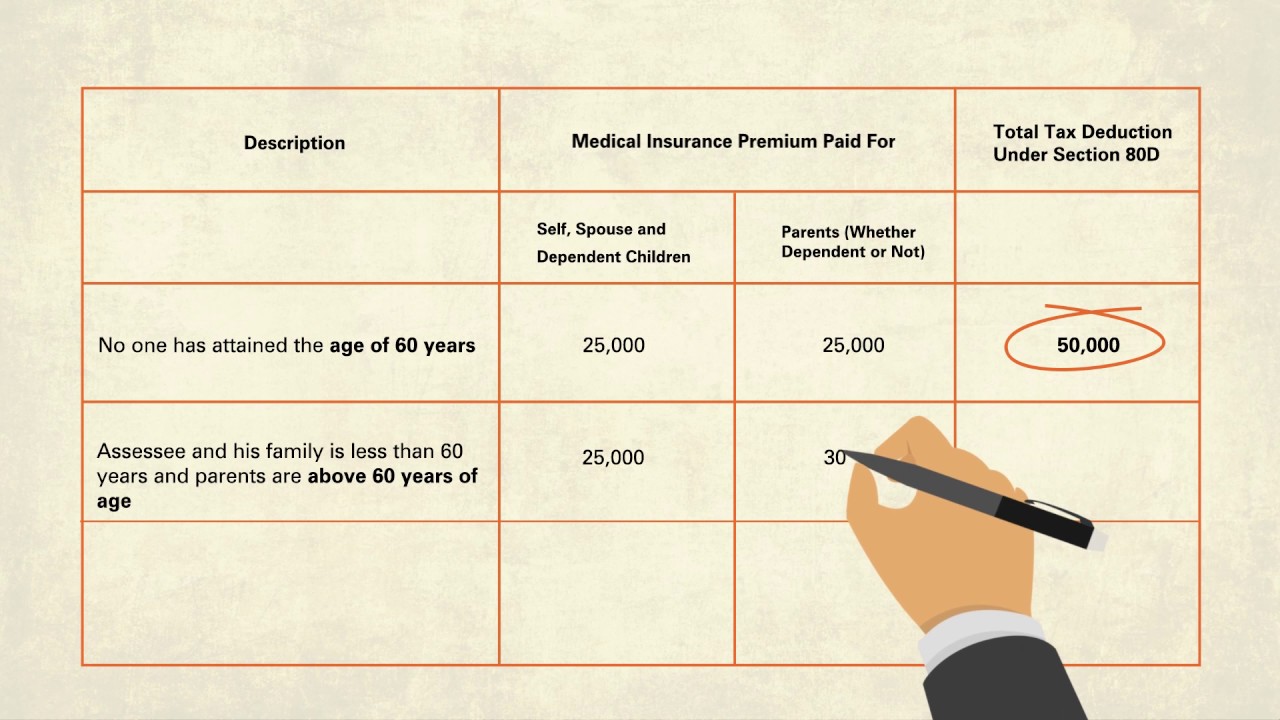

Tax Deduction Of Health Insurance Premium YouTube

https://i.ytimg.com/vi/aG6H_znBG44/maxresdefault.jpg

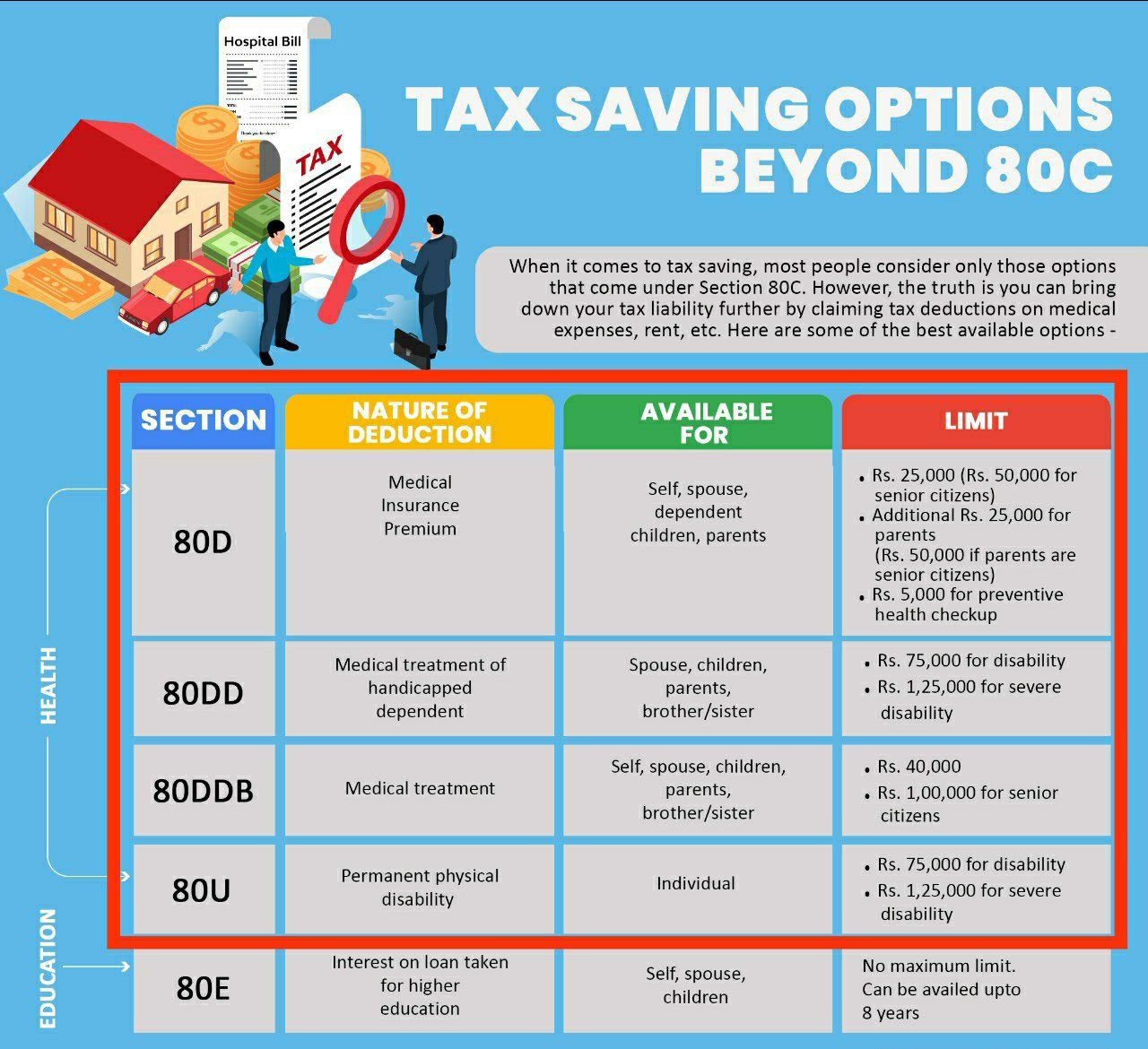

From a tax perspective self employed individuals have the opportunity to potentially deduct a portion of their life insurance premiums as a business expense However there are specific criteria that need to be met to qualify for this deduction Generally life insurance premiums are not tax deductible However there are some exceptions to this rule For instance some businesses may deduct premiums they pay on behalf of employees Life insurance premiums may be tax deductible in some cases including Group term life insurance

Are life insurance premiums tax deductible You generally can t deduct your life insurance premiums on your tax returns In most cases the IRS considers your premiums a personal expense like food or clothing Life insurance is also not required by your state or federal government so you can t expect a tax break after buying a policy There are a few times when you can deduct your life insurance premiums on your tax return If you re an employer offering an employee benefit if a divorce agreement requires you to buy a policy on your spouse or if you donate your policy to charity

More picture related to Life Insurance Premium Tax Deduction

Section 80C Deductions List Save Income Tax With Section 80C Options

https://i.ytimg.com/vi/6nlYwNEIo48/maxresdefault.jpg

No Tax Deduction On Life Insurance Premium Impacting The Insurance

https://i.ytimg.com/vi/-SBUlmh_EcQ/maxresdefault.jpg

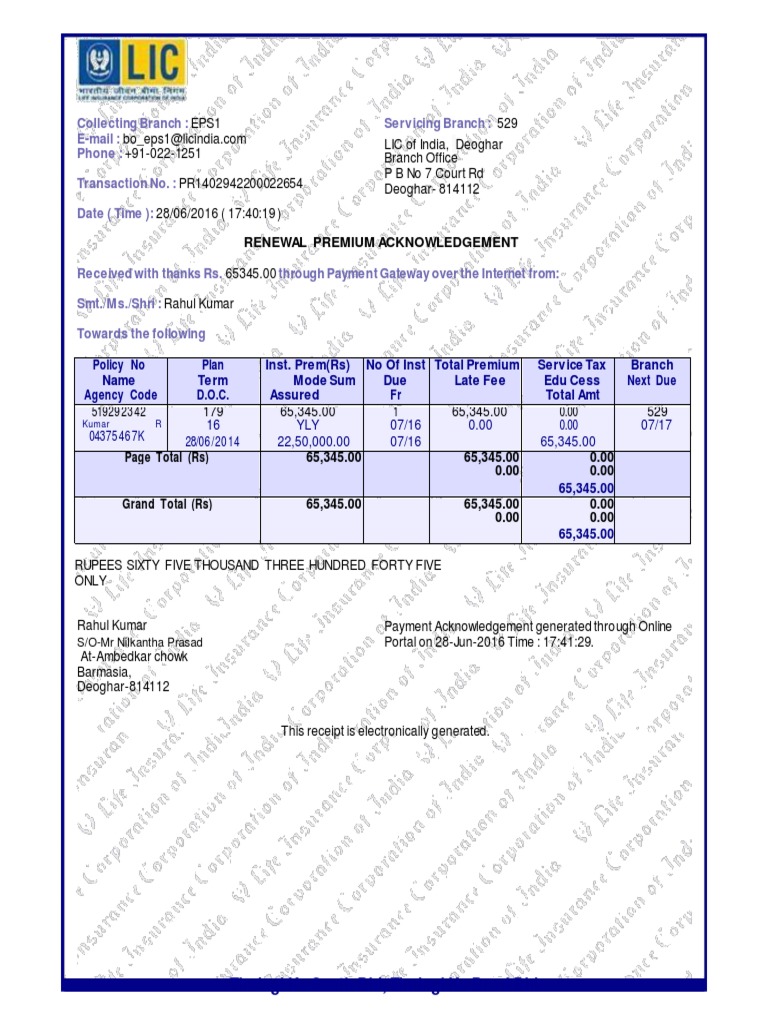

LIC Receipt pdf Payments Taxes

https://imgv2-2-f.scribdassets.com/img/document/352522811/original/fbaf481399/1583337625?v=1

The short answer Life insurance premiums generally aren t tax income deductible but when a death benefit 2 is paid out that is generally subject to income taxes However there are a few exceptions to both so here s what you should consider Life insurance premiums are not tax deductible for most people If you re a business owner and premiums for your employees are a business expense they may be deductible Life insurance

[desc-10] [desc-11]

2025 Business Auto Deduction Mauricio Vanhernandez

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

80c Deductions

https://www.caindelhiindia.com/blog/wp-content/uploads/2021/07/80c.jpg

https://www.financestrategists.com › insurance...

In most cases you cannot deduct life insurance premiums on your taxes The Internal Revenue Service IRS generally views life insurance as a personal expense and thus it s not typically tax deductible from an individual s gross income However there are

https://www.forbes.com › advisor › life-insurance › is...

Life insurance death benefit payouts are usually not taxable That means beneficiaries will receive the money without a tax burden hanging over their heads However there are certain

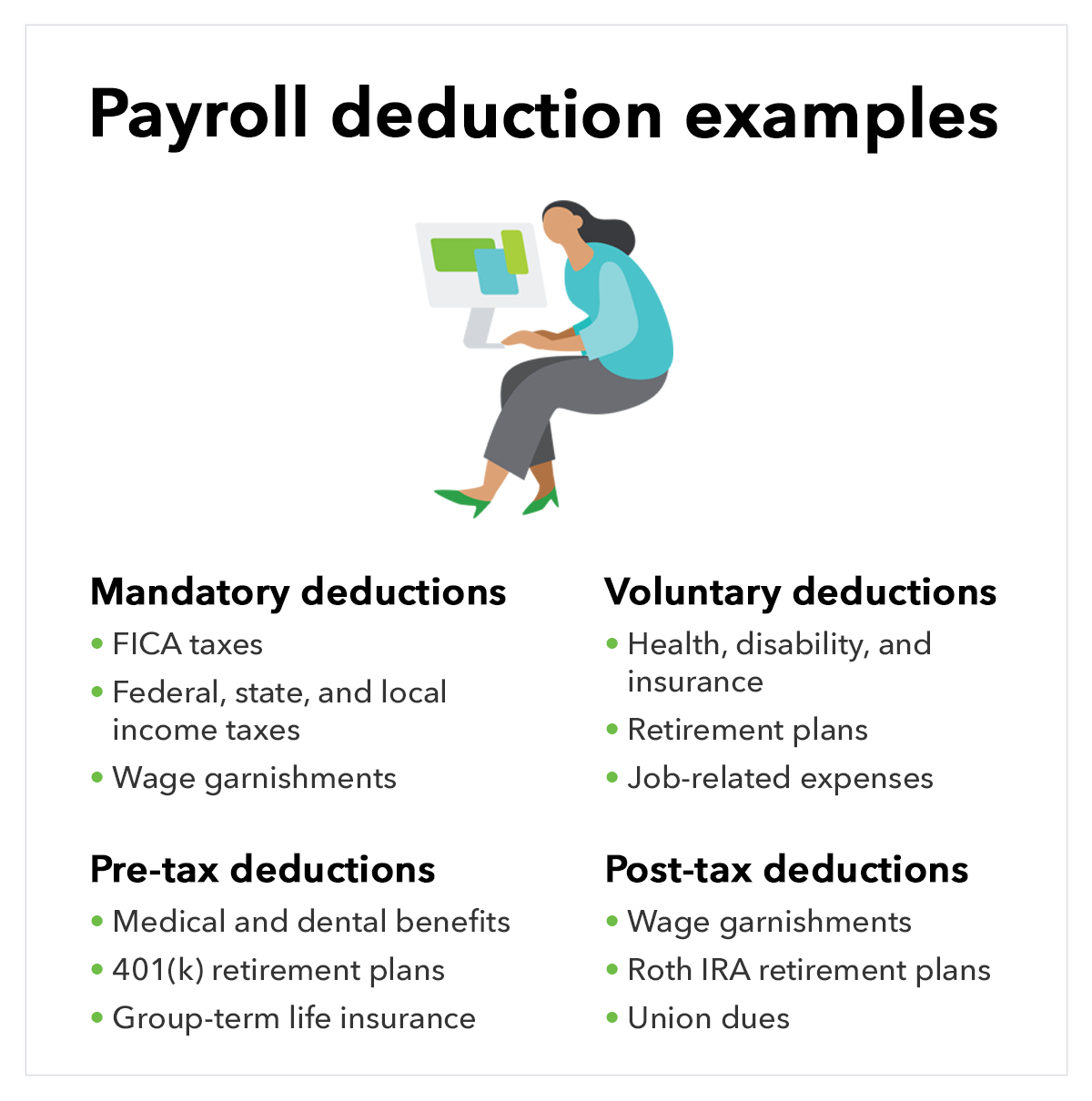

What Are Payroll Deductions Mandatory Voluntary Defined QuickBooks

2025 Business Auto Deduction Mauricio Vanhernandez

:max_bytes(150000):strip_icc()/Are-health-insurance-premiums-tax-deductible-4773286_v1-dbe23582da6346498c4596ab0bfa05f2.jpg)

Health Insurance Premiums

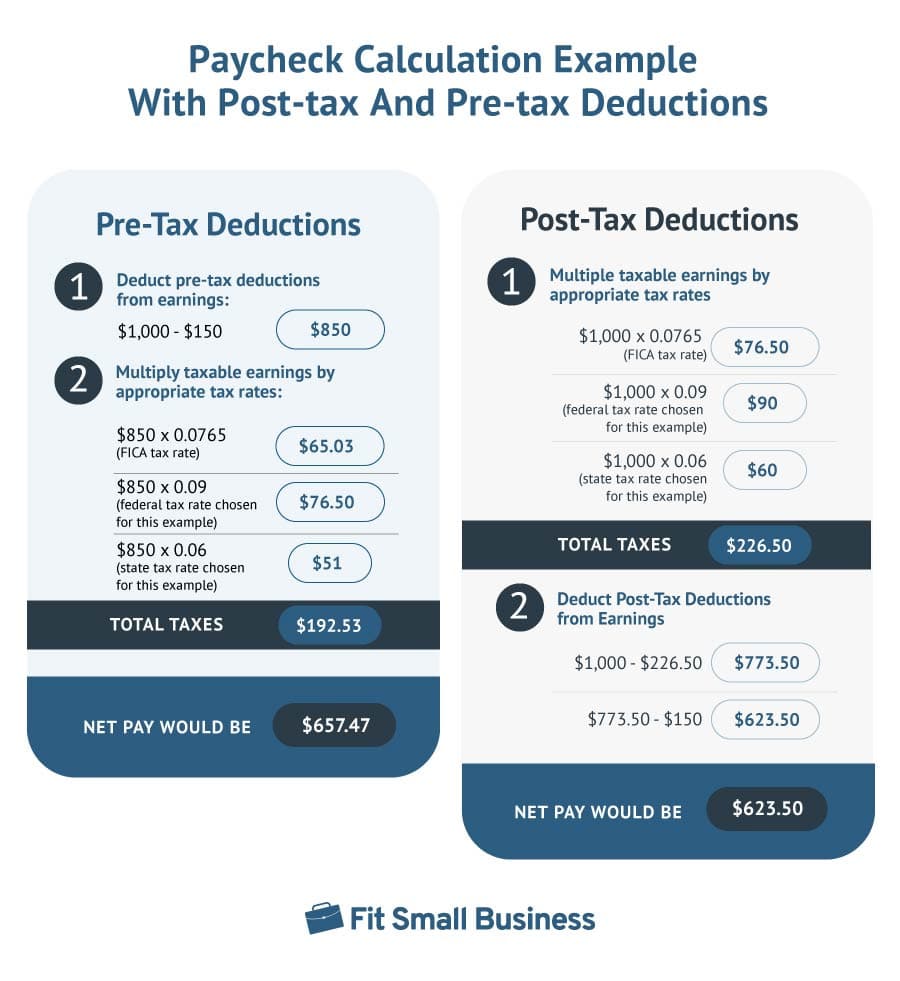

Pre tax Post tax Deductions An Ultimate Guide

What Is A Conditional Receipt

Tax Credits 2024 Revenue 2024 Doti Michell

Tax Credits 2024 Revenue 2024 Doti Michell

Tax Calculator 2025 Philippines Marcus P Gibbes

Tax Benefit On Life Health Insurance Premium Payments Claims

Tax Deductions For Donations 2025 Asier Vanmorales

Life Insurance Premium Tax Deduction - There are a few times when you can deduct your life insurance premiums on your tax return If you re an employer offering an employee benefit if a divorce agreement requires you to buy a policy on your spouse or if you donate your policy to charity