Tax Planning For House Property To place a property into service you must meet two requirements 1 the property must be ready for use and 2 the property must be available for use Generally your rental is ready for use when the city or locality of your rental property will conservatively issue a Certificate of Occupancy

Your area s property tax levy can be found on your local tax assessor or municipality website and it s typically represented as a percentage like 4 To estimate your real estate taxes you In addition to the federal estate tax 17 states and Washington D C impose an estate or inheritance tax Those states are Connecticut Hawaii Illinois Iowa Kentucky Maine Maryland

Tax Planning For House Property

Tax Planning For House Property

https://www.veteransunited.com/assets/craft/images/blog/_blogHero/va-home-loan-property-tax.jpg

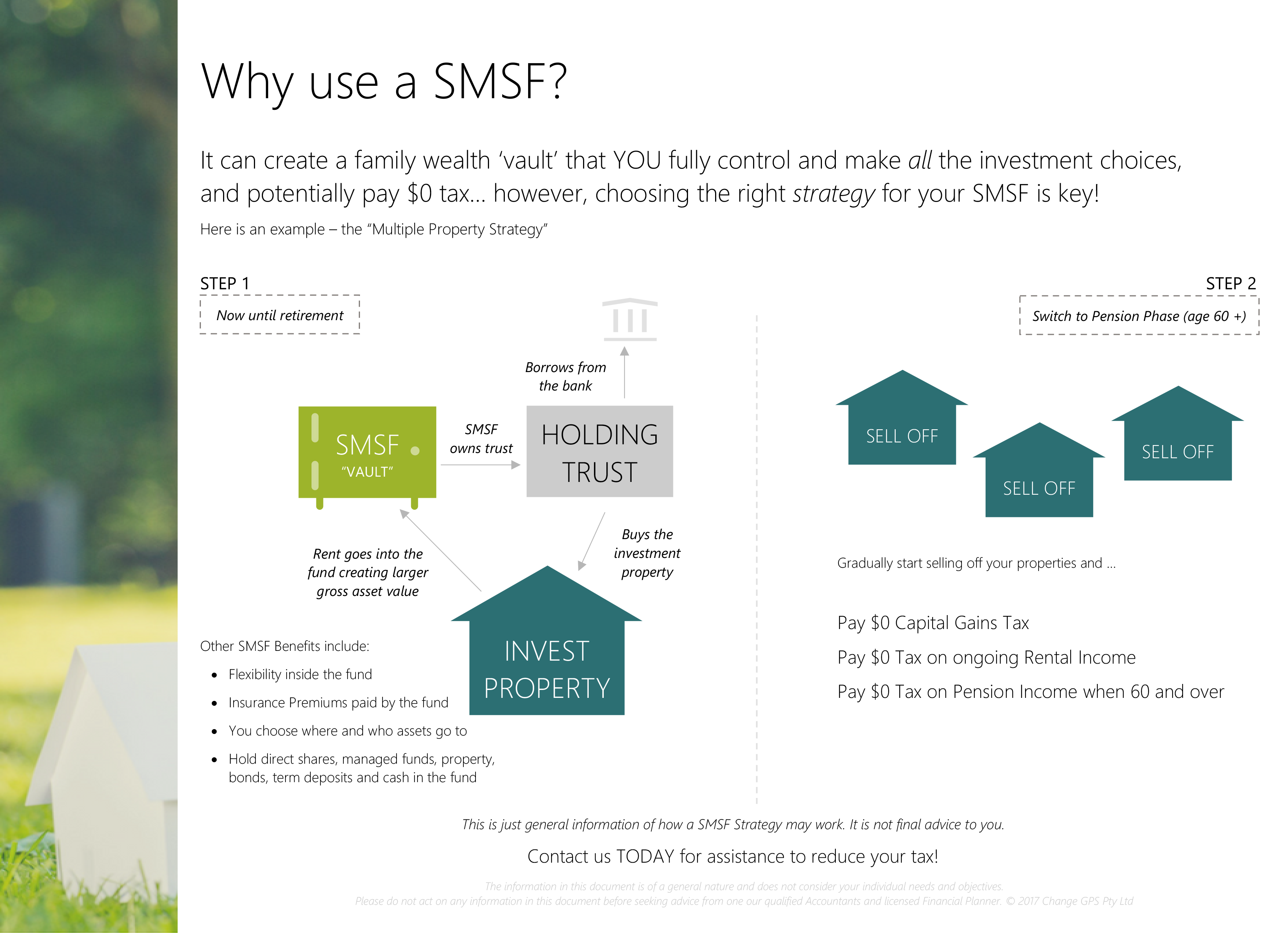

Pdfpreview Tax Planning Infographic 4 Why Use A SMSF docx Precision Taxation Accounting

https://www.ptam.com.au/wp-content/uploads/2017/04/pdfpreview_Tax-Planning-Infographic-4-Why-use-a-SMSF.docx.png

Significance Of Tax Planning By Lifeline Tax Issuu

https://image.isu.pub/200728112906-06962b996f68596c04e8bd11f90f4d17/jpg/page_1.jpg

Tax planning is a crucial aspect of successful real estate investment It involves understanding and applying tax laws regulations and strategies to minimize tax liabilities and maximize returns on investments The primary objectives of tax planning for real estate include reducing taxable income taking advantage of tax credits and 5 Real Estate Investing Tax Strategies 1 Minimize or Avoid Capital Gains Tax When it comes to tax on capital gains there are two ways they re taxed long term and short term capital gains Short term capital gains are applied to any asset you ve bought and sold for a profit within a year They re taxed at the same rate as income tax

When you file your tax return you must decide whether to take the standard deduction 13 850 for single tax filers 27 700 for joint filers or 20 800 for heads of household or married filing With the passage of so much tax legislation over the past several years including the tangible property regulations the Tax Cuts and Jobs Act the CARES Act several COVID 19 stimulus bills and various new federal state and local regulations there is tremendous opportunity to implement tax planning and tax saving strategies for real estate owners

More picture related to Tax Planning For House Property

Goldstone Financial Group Tax Planning Services More

https://www.goldstonefinancialgroup.com/wp-content/uploads/2022/12/tax-planning.png

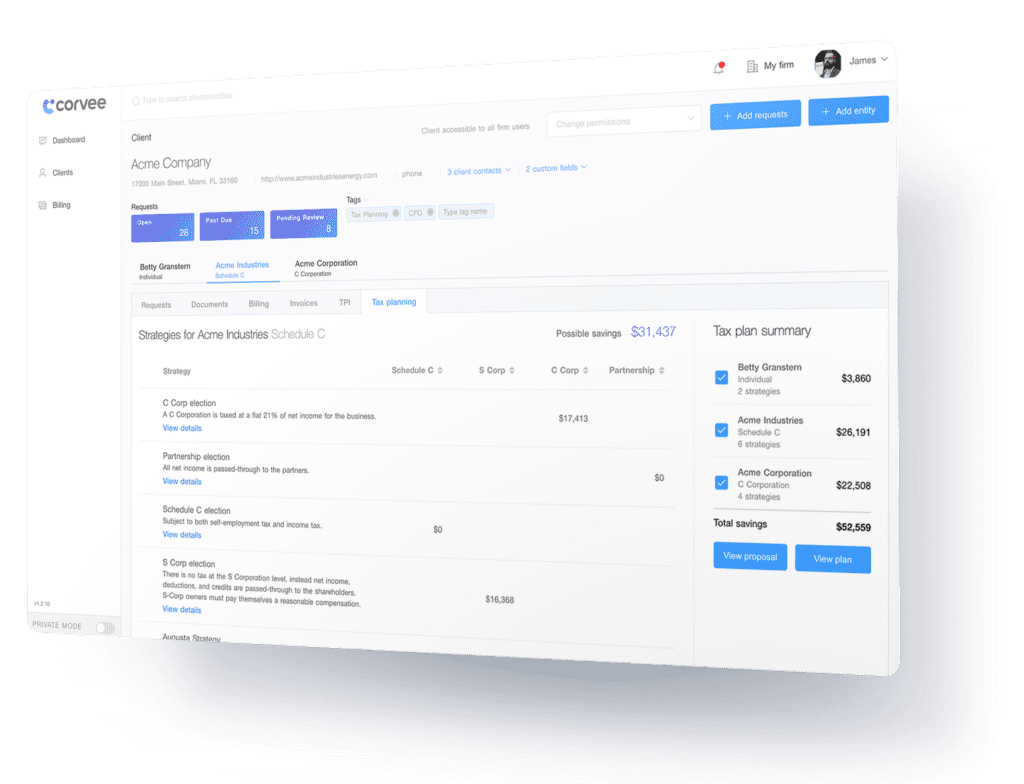

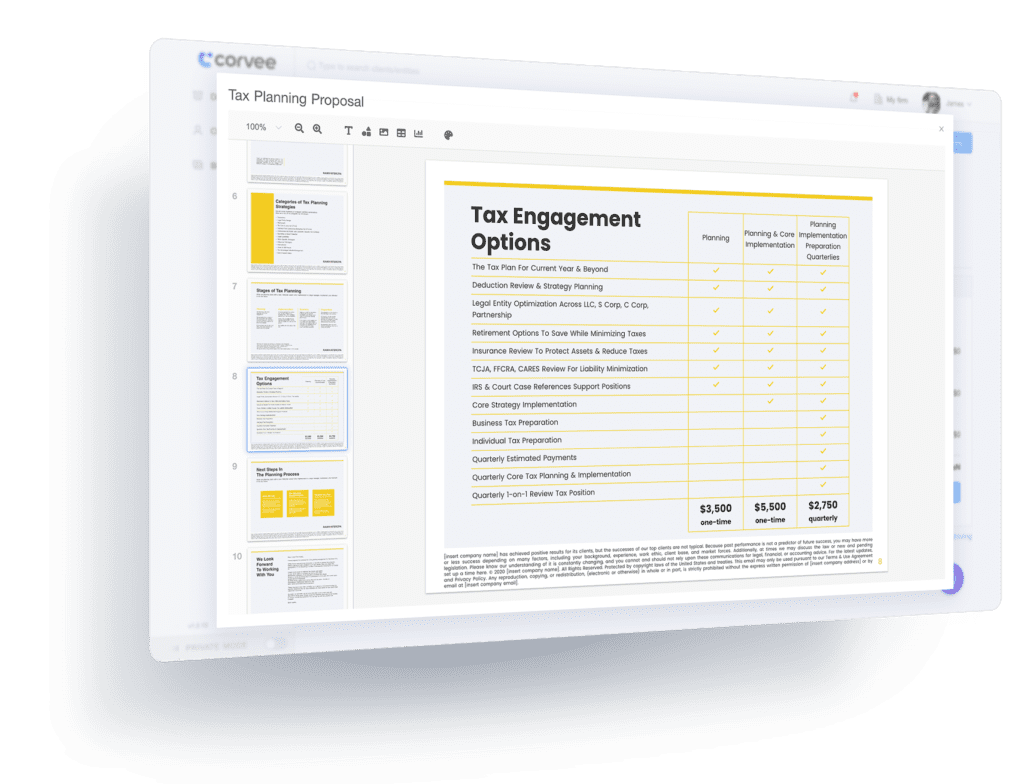

Best Tax Planning Software For Accountants Corvee

https://corvee.com/wp-content/uploads/2020/09/35-Recommendations-Tax-Plan-.png

Tax Planning Making Waves Financial Group

https://www.makingwavesmanagementgroup.com/wp-content/uploads/2022/01/tax-planning-768x740.png

1 The nature and purpose for which the asset was initially acquired and the duration of ownership 2 The purpose for which the property was subsequently held 3 The extent to which the taxpayer made any improvements to theproperty 4 The number extent continuity and substantiality of the sales 5 Capital Gains Tax Rates For 2023 The capital gains tax rates for 2023 are tiered based on the asset sold and the individual s taxable income These rates are structured as 0 15 20 25 or 28 offering varying tax implications for different income levels and types of assets

Real Estate Tax Planning is a critical component of any successful real estate investor s strategy It involves proactively looking for potential tax saving opportunities and structuring investments in line with the latest tax laws and regulations Property tax Real estate property taxes also known as ad valorem taxes are collected Filing taxes can be a complex process especially with real estate investments in the mix Here are some of the main considerations you should keep in mind to plan ahead reduce your taxes and minimize your risk of audit

Tax Planning Destiny Capital

https://destinycapital.com/wp-content/uploads/2023/05/[email protected]

Tax Planning Tips Suncoast CPA Group

https://suncoastcpagroup.com/wp-content/uploads/2022/08/tax-planning.jpg

https://www.stessa.com/blog/real-estate-tax-strategies-for-2022/

To place a property into service you must meet two requirements 1 the property must be ready for use and 2 the property must be available for use Generally your rental is ready for use when the city or locality of your rental property will conservatively issue a Certificate of Occupancy

https://www.realtor.com/guides/homeowners-guide-to-taxes/how-to-calculate-property-tax/

Your area s property tax levy can be found on your local tax assessor or municipality website and it s typically represented as a percentage like 4 To estimate your real estate taxes you

Use Tax Planner Software To Offer Tax Planning Corvee

Tax Planning Destiny Capital

Tax Planning Under The New Tax Bill Redwood Grove Wealth Management

2009 Tax Planning

Grow And Optimize Your Medium Or Large Tax Firm Corvee

Tax Planning Services For Retirement Savers

Tax Planning Services For Retirement Savers

Certified Concierge Tax Accountant Tax Planning Masterclass

Tax Planning Financial Planning Kinetic Financial United States

Tax Planning Retirement Daily On TheStreet Finance And Retirement Advice Analysis And More

Tax Planning For House Property - Tax planning is a crucial aspect of successful real estate investment It involves understanding and applying tax laws regulations and strategies to minimize tax liabilities and maximize returns on investments The primary objectives of tax planning for real estate include reducing taxable income taking advantage of tax credits and