Is Assisted Living Tax Deductible Irs One way for you or your parent to save money is by deducting eligible assisted living expenses on taxes Use this guide to learn about what you can deduct and how to calculate these figures The Internal Revenue Service allows for

Yes you can claim your parent s eligible assisted living expenses on your federal tax return provided that certain conditions are met According to the IRS you can deduct the Yes if you are itemizing your return you can deduct some most or all of the assisted living costs How much depends on why you are there If you are itemizing your

Is Assisted Living Tax Deductible Irs

Is Assisted Living Tax Deductible Irs

https://i.ytimg.com/vi/iUFD8ywzo7s/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgTyhBMA8=&rs=AOn4CLBW4HazxkJs85gl3alEDjVLpsJKOw

Is Assisted Living Tax Deductible Understanding The Tax Benefits Of

https://i.ytimg.com/vi/Bp2WjrcZx2g/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGD8gYihlMA8=&rs=AOn4CLA0i_-SJqTio374BMp3Y-9JBzrkww

Is Assisted Living Tax Deductible CountyOffice YouTube

https://i.ytimg.com/vi/T_DQd3yo0DA/maxresdefault.jpg

The good news is that some or all of the costs of Assisted Living and Alzheimer s care may be tax deductible These are the basic rules concerning the tax deductibility of Assisted Living and Alzheimer s care expenses The IRS considers assisted living as a form of tax deductible long term care when certain conditions are met When those conditions are met the costs of select medical expenses are tax deductible Specifically if an

Assisted living facility costs can be tax deductible but there are certain guidelines and requirements that must be met The Internal Revenue Service IRS provides detailed information on what medical expenses are deductible Are Assisted Living Expenses Tax Deductible The deductibility of assisted living expenses depends on whether the services provided qualify as medical care under IRS guidelines Medical Nursing Home Special Care Expense s

More picture related to Is Assisted Living Tax Deductible Irs

2017 Christmas Activities Lakeside Manor Alzheimers Care

http://lakesidemanor.org/wp-content/uploads/2017/12/IMG_9796-compressor.jpg

Tax Worksheets 2022

https://www.pdffiller.com/preview/391/382/391382225/large.png

Resources Trousdale Living Communities

https://trousdalelc.org/wp-content/uploads/2023/03/Is-assisted-living-tax-deductible-1-1080x628.jpg

You won t be able to deduct assisted living expenses if you claim the standard deduction on your tax return Itemizing deductions involves adding up qualified medical expenses and then deducting the amount that exceeds Q What portion of assisted living is tax deductible As long as the resident meets the IRS qualifications see above all assisted living expenses including non medical costs like housing and meals are tax deductible

Not all costs associated with assisted living are tax deductible Generally the Internal Revenue Service IRS allows deductions for medical expenses including some costs When you or your loved one require assistance with at least two daily living activities DLAs such as bathing dressing or eating you may be eligible for certain tax deductions on your medical

Assisted Living Tax Deduction 2024 Abbey Annetta

https://img.prod.aplaceformom.com/main/uploads/va/2016/05/Important-534x800.jpg

Realtor Tax Deduction List

https://www.pdffiller.com/preview/100/302/100302714/large.png

https://www.payingforseniorcare.com › g…

One way for you or your parent to save money is by deducting eligible assisted living expenses on taxes Use this guide to learn about what you can deduct and how to calculate these figures The Internal Revenue Service allows for

https://www.aplaceformom.com › caregiver-resources › ...

Yes you can claim your parent s eligible assisted living expenses on your federal tax return provided that certain conditions are met According to the IRS you can deduct the

Is Assisted Living Tax Deductible

Assisted Living Tax Deduction 2024 Abbey Annetta

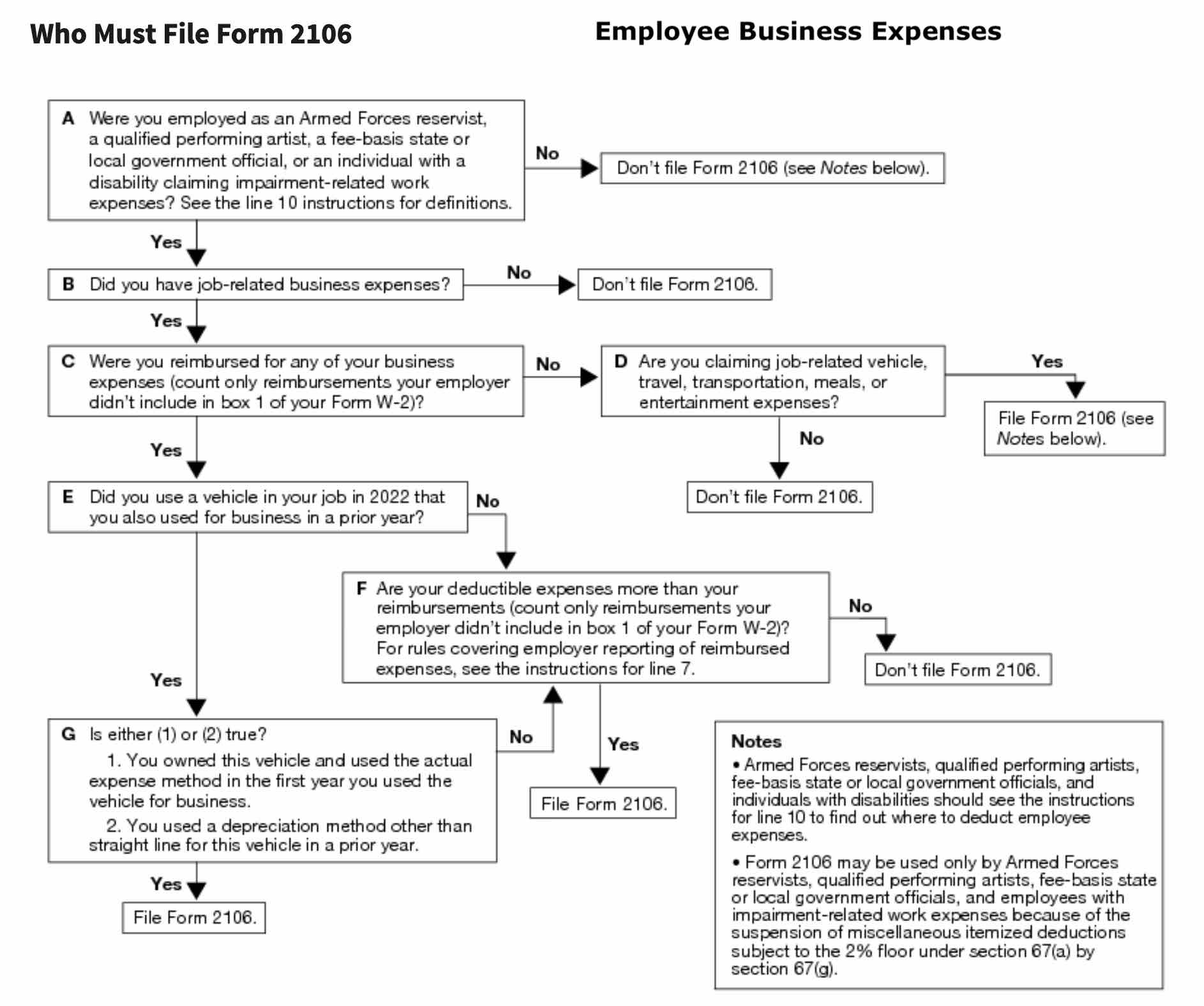

Can You Deduct Unreimbursed Employee Expenses In 2022

Are Assisted Living Expenses Tax Deductible Medical Expense Info

Overlooking The ASSISTED LIVING TAX DEDUCTION Can Be Costly March 20

Is Assisted Living Tax deductible

Is Assisted Living Tax deductible

5 Genius Ways To Pay For Assisted Living

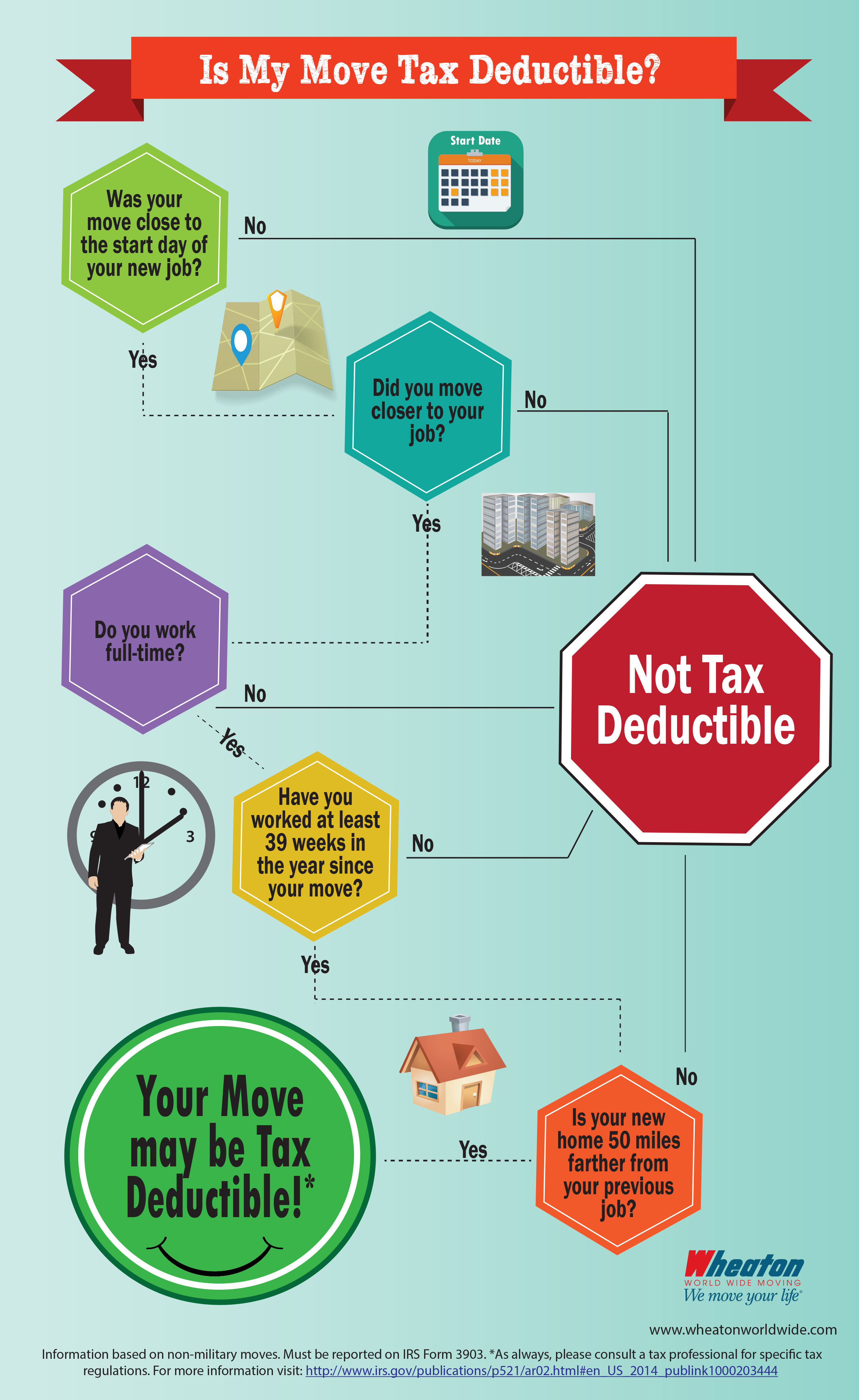

Infographic Is My Move Tax Deductible Wheaton

Is Assisted Living Tax Deductible

Is Assisted Living Tax Deductible Irs - Many expenses are tax deductible and in many cases some or all of your assisted living costs may also get you a tax break We have put together some guidelines that will help seniors or